From day one, Truv’s operating principle has been centered on our client success. we work closely with our clients from pre-close to post-close to learn exactly how we should tailor our products – for your ease-of-use, the end user experience, and last but not least, optimal performance. Review our recap of product developments for the month of May and check out upcoming events for the Truv Team in June.

Truv Platform Updates

Encompass Improvements

When mortgage lenders leverage Truv for faster, easier and cost-effective verifications of income and employment, not only do loan officers gain more time back to focus on new relationships with borrowers, but they also provide borrowers in the midst of the loan approval process with a frictionless experience. To enhance how lenders can leverage Truv within the Encompass® interface, we made more exciting improvements over the last month.

- eFolder Support: To make it easier to locate specific returned documents from Truv verifications, lenders can now customize which eFolder each Truv document type should be returned to (supports the following document types – Paystub, W2, 1099, Invoice, Employer report, Borrower report). Refer to our eFolder Document Customization guide for setup instructions.

- CC Feature: For order status update notifications, order managers – loan officers, loan officer assistants, and processors – have the ability to pre-set up to 15 email recipients to receive updates on the order, with the option to remove or add recipients at any stage in the loan file.

- Default CC Configuration: The cc feature can be customized for the loan officer or processor to receive all order status notifications by default, ensuring real-time order updates are tracked to keep the loan moving to closing.

- Auto-Populate Templates Based on Company Name: For larger lenders who might have multiple Joint Ventures or sub-companies, we added the ability to pre-select a Truv template in Encompass® based on the Company Name (Field 1264). This saves LOs time by eliminating the need to manually select the right template based on their company for each Truv order.

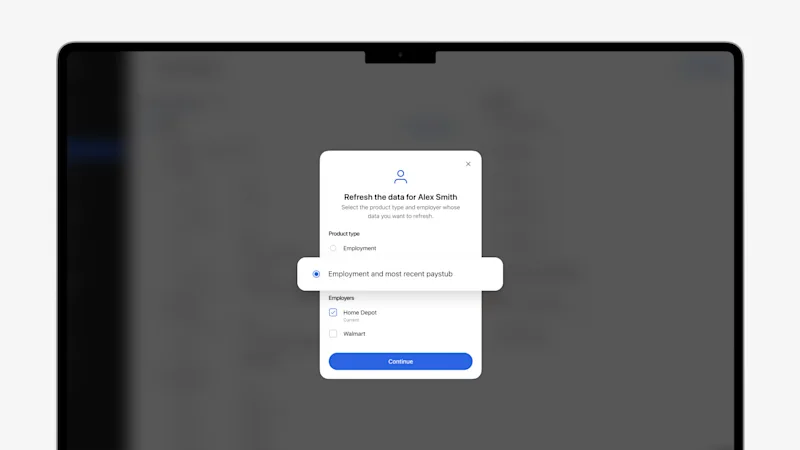

Truv Dashboard and Order Updates

- Employment & Latest Paystub Refresh: For Verification of Income and Employment orders, our clients now have the ability to refresh the order and request a Verification of Employment with the borrower’s most recent paystub.

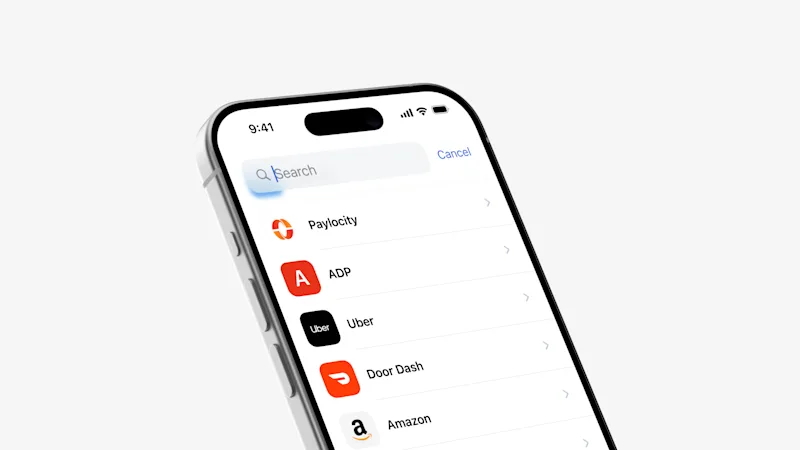

Truv Bridge Updates

- Combined Search: Expanding search parameters for borrowers to verify income and employment faster than before is now supported by Truv Bridge’s capability to search providers in addition to employers.

If you’re ready to see Truv in action or learn about how Truv could work for you, reach out to the team today.

Upcoming Events

Total Expert Accelerate

Truv is looking forward to Total Expert’s Accelerate 2024 in Minneapolis from June 23-27. If your team is attending, the Truv Team would love to connect with you to chat all things consumer-permissioned data, industry trends or answer any questions you may have!

Stay tuned for more events, webinars, and podcasts, to come.

Customers Come First

Have any feedback for the Truv team? Let us know what Truv can do to best serve you. Your success is our success. We want to hear from you!