LOS Integrations

Streamline verifications in your loan origination system.

Leverage Truv’s out-of-the-box LOS integrations to close loans faster.

Direct-to-source verifications.

Direct-to-source verifications.

Cost savings.

Faster processing.

Automated verifications.

Compliance.

Cost savings

60-80% cost reduction.

Lenders leverage Truv’s direct-to-source data to minimize the cost of databases and manual processes.

Get Started

reduce buybacks

Authorized reports for DU® and LPA®.

Truv VOIE reports are approved by Fannie Mae and Freddie Mac to use with DU and LPA.

Faster Processing

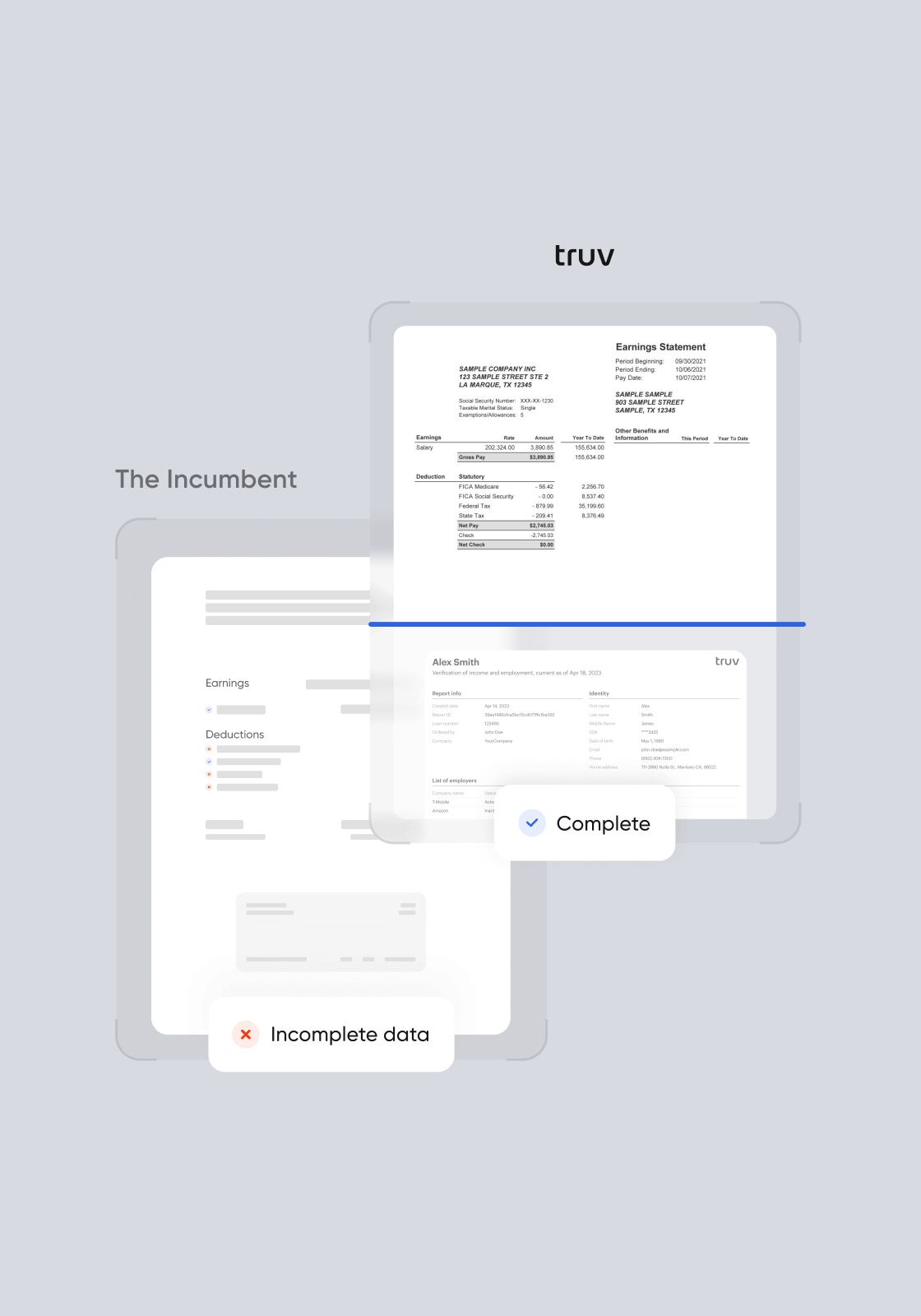

Streamline documentation collection.

Access the Truv report, paystubs, W-2s and 1099s, straight from the source.

Get Started

CUSTOMIZED BRANDING

Branded borrower communications.

Personalize the emails and sms notifications sent to borrowers to increase conversion.

Get Started

SIMPLE IMPLEMENTATION

Go live in days with no code.

Simple configurations allow you to leverage a range of customizable features.

Get Started

Explore Truv’s loan

origination system integrations.

Explore Truv’s loan origination system integrations.

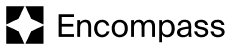

Direct-to-source income, employment, and asset verifications in Encompass.

Improve your verification process with direct-to-source, real-time data in BlueSage Solutions.

Streamline income and employment verifications with real-time data in Vesta Software.

Automate income and employment verifications to close loans faster in Byte Software.

Simplify your verification workflow with direct-to-source data in Dark Matter Empower.

All-in-one platform

for verifications.

All-in-one platform for verifications.

Products & Solutions

Payroll Income & Employment

Highest conversion rate and data fill rates in the industry.

Paystubs & W-2s

Best-in-class OCR and fraud detection for pay documents.

Bank Assets

Highest oAuth rate and insights into bank assets & cash flows.

Mortgage Lending

Accelerate loan closing & reduce buy backs.

Platform

Austin Coleman

SVP Mortgage Lending at America First Credit Union