Direct Deposit Switch

Drive primacy for your organization.

Increase direct deposits by up to 65% with Truv’s direct deposit switch products.

Drive deposit growth and personalize

your member experience.

Drive deposit growth and personalize your member experience.

Maximize primacy.

Go Live quickly.

Find best customers.

Why partner with Truv?

Why partner

with Truv?

Bridge

Instantly switch direct deposit.

User experience optimized for high conversion and minimum friction.

Learn more

Dashboard

Delight customers in branch.

Flexible and customizable experience to reach customers anywhere.

Learn more

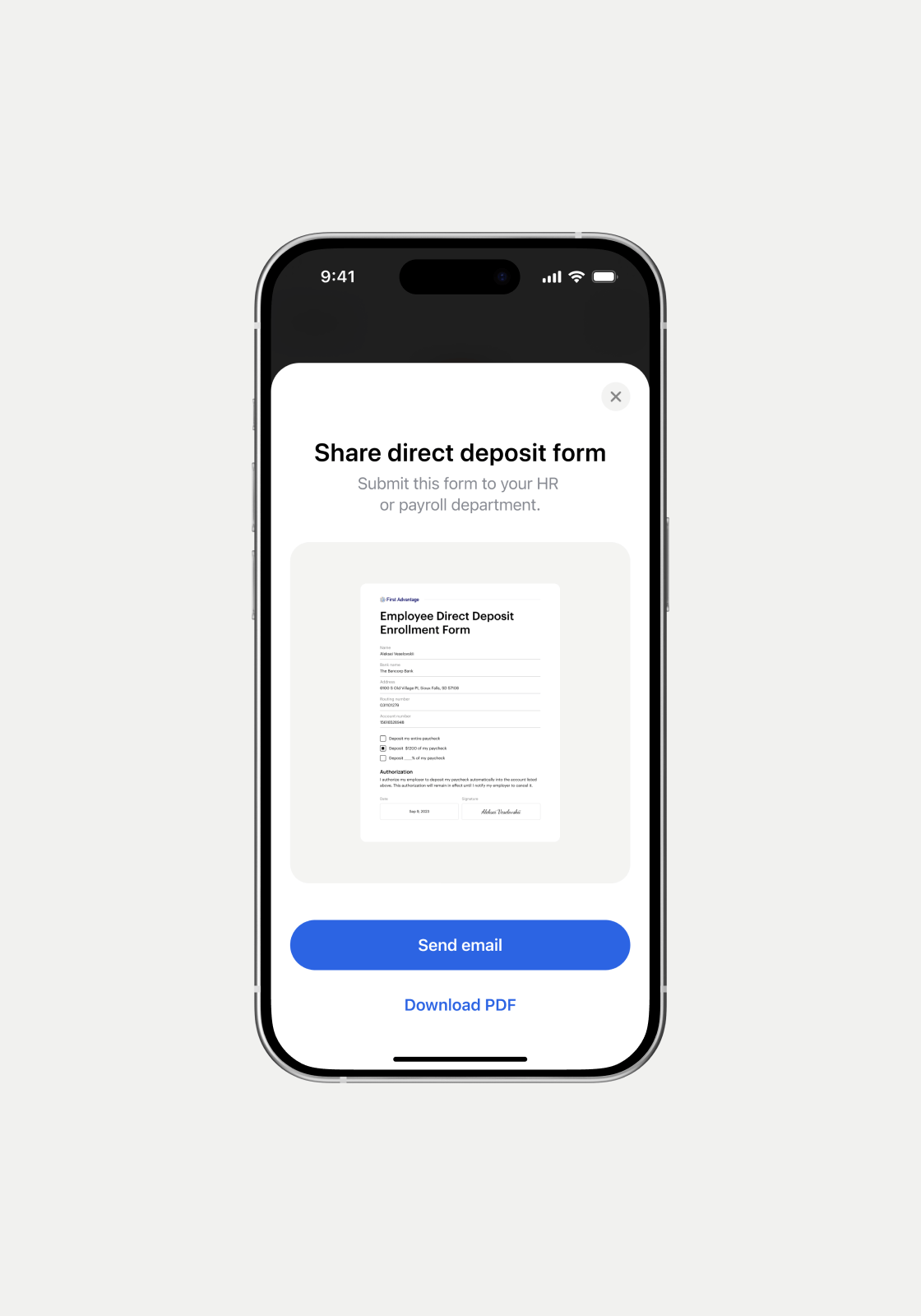

Waterfall

Switch all customers.

Switch direct deposit digitally or by sending HR a signed deposit form.

Learn more

Integrations

Implement Truv in days.

All DDS Platform integrations and dedicated success team.

Learn more

Direct Deposit Switching

Solution FAQs.

Direct Deposit Switching Solution FAQs.

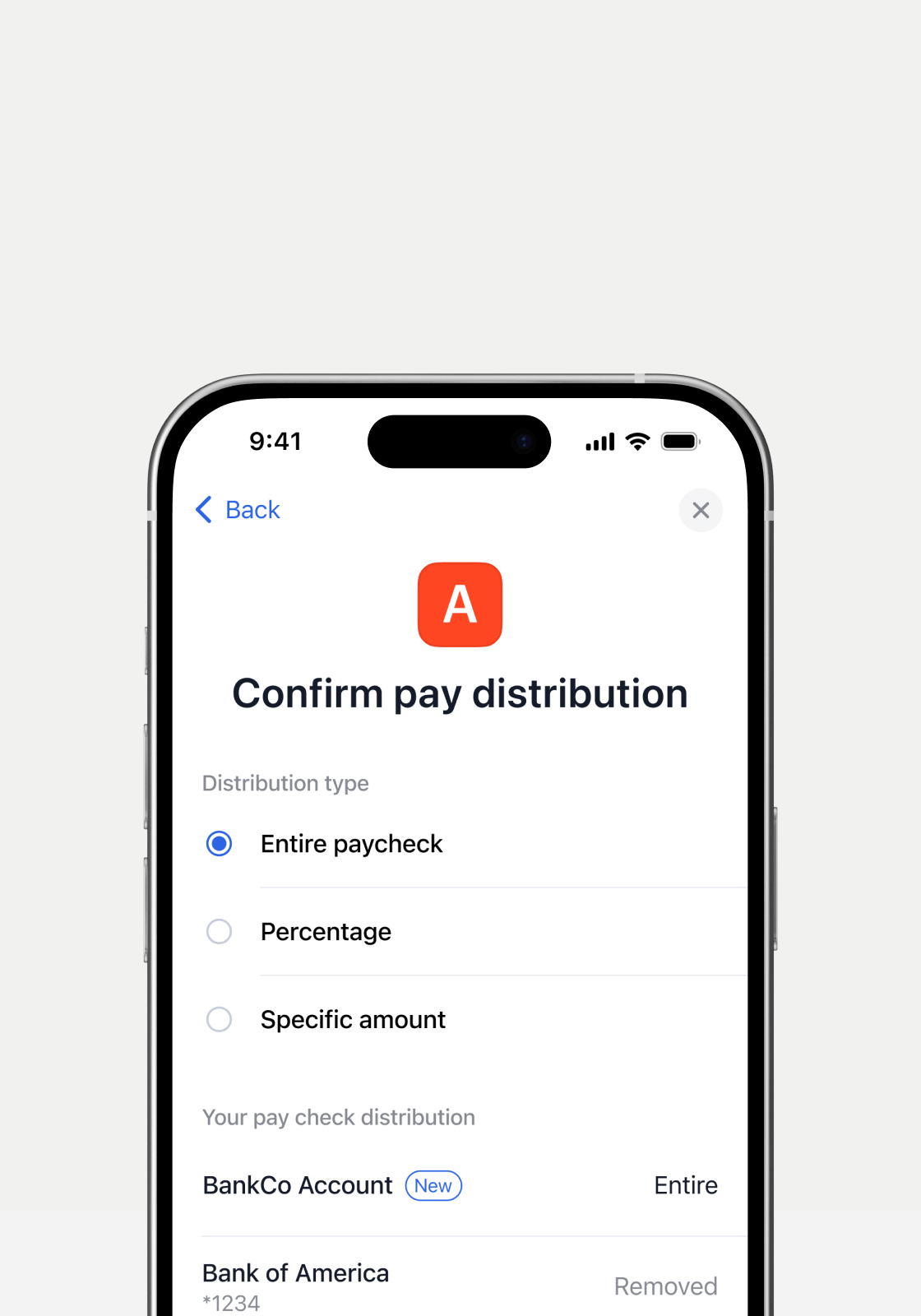

Truv’s Direct deposit switching is the process consumers complete a few steps to change where recurring payments (typically a paycheck) are automatically deposited, redirecting the income from one financial account to another.

Truv’s solution empowers banks to increase new member acquisition, grow existing relationships, reduce costs, and increase operational efficiency.

Truv provides multiple implementation paths (online, in-branch, new/existing members), supports various authentication methods, and offers fallback options like HR forms to ensure high conversion rates.

Truv can be embedded and white-labeled into your services to enable your customers to switch instantly.

Truv recommends driving engagement with members through email and push notifications. By engaging members directly via familiar, built-in channel, banks encourage seamless DDS with tailored messaging.

Truv empowers consumers to make a switch in just a few clicks. Consumers can connect their payroll information digitally and make distribution selections in 60 seconds, eliminating paperwork, manual review, and in-branch processes.

Truv’s solution connects consumers to their payroll providers and/or employers. To initiate a switch, consumers should know their payroll provider and login credentials.

Truv’s verification platform seamlessly integrates into both digital and in-branch experiences, expediting account opening for new members while enhancing online banking services for existing ones. Whether through embedded flows, text messages, emails, or QR codes, Truv provides flexible verification options, providing a modern, user-friendly experience that meets member expectations for digital banking convenience.

Truv’s platform integrations include Candescent (formerly Terafina) and Alkami to our impressive roster alongside Jack Henry Banno, Clutch, Q2 and MX. These partnerships are transforming how banks and credit unions drive deposit growth, account primacy, and customer acquisition while boosting engagement and retention.

Sergio Terentev

Founder & CEO, B9