Bank

Verify income with bank transaction data.

Mitigate fraud and seamlessly verify income with Truv bank products.

Predictable income streams.

Extracted directly from transaction data to ensure accuracy.

Get Started

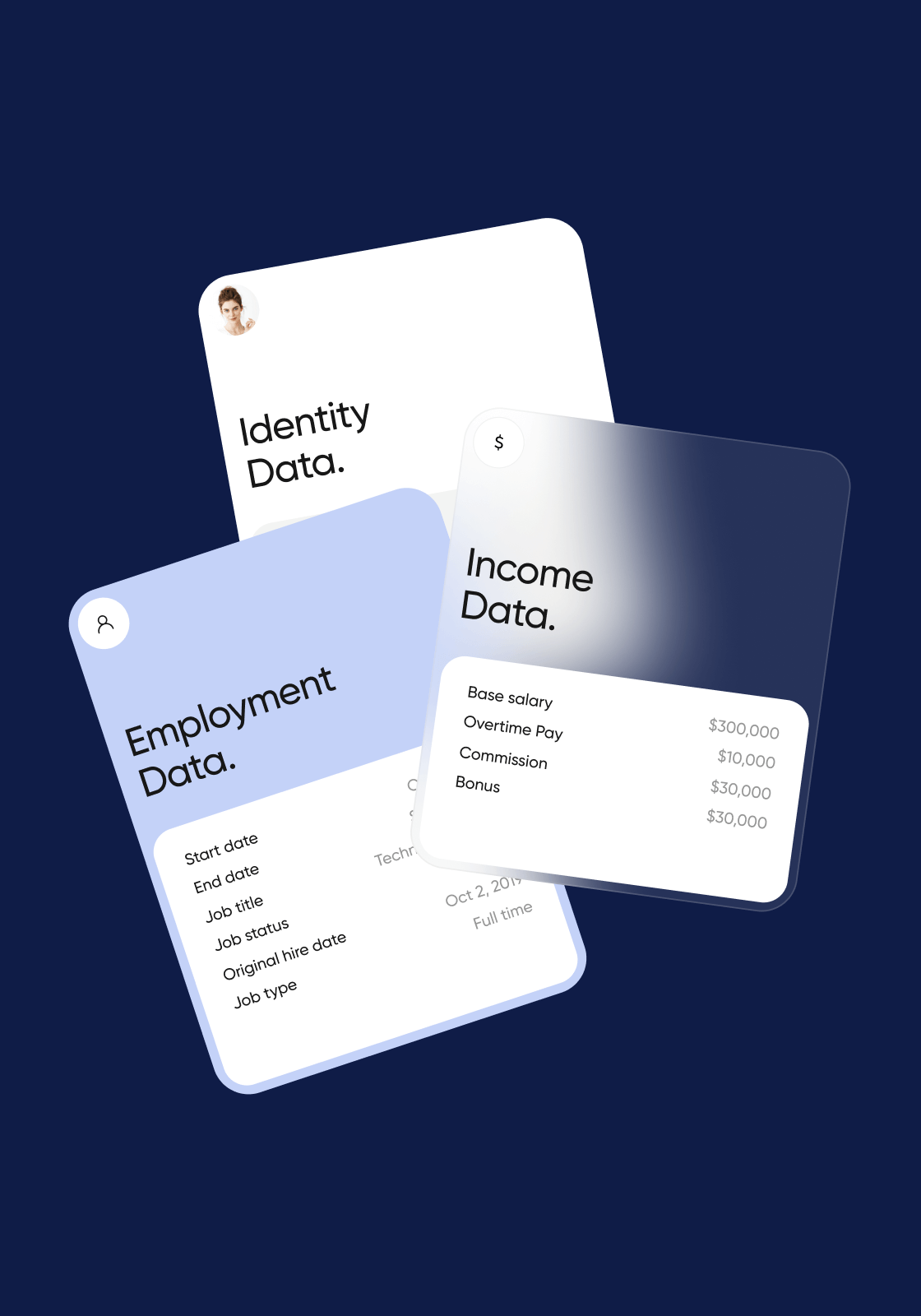

Cleansed and standardized fields.

Convert cryptic transaction descriptions into cleansed and ready-to-use data.

Get Started

Flexible integration options.

Deploy as a standalone solution or as a part of an overall verification waterfall.

Get Started

All-in-one platform

for verifications.

All-in-one platform for verifications.

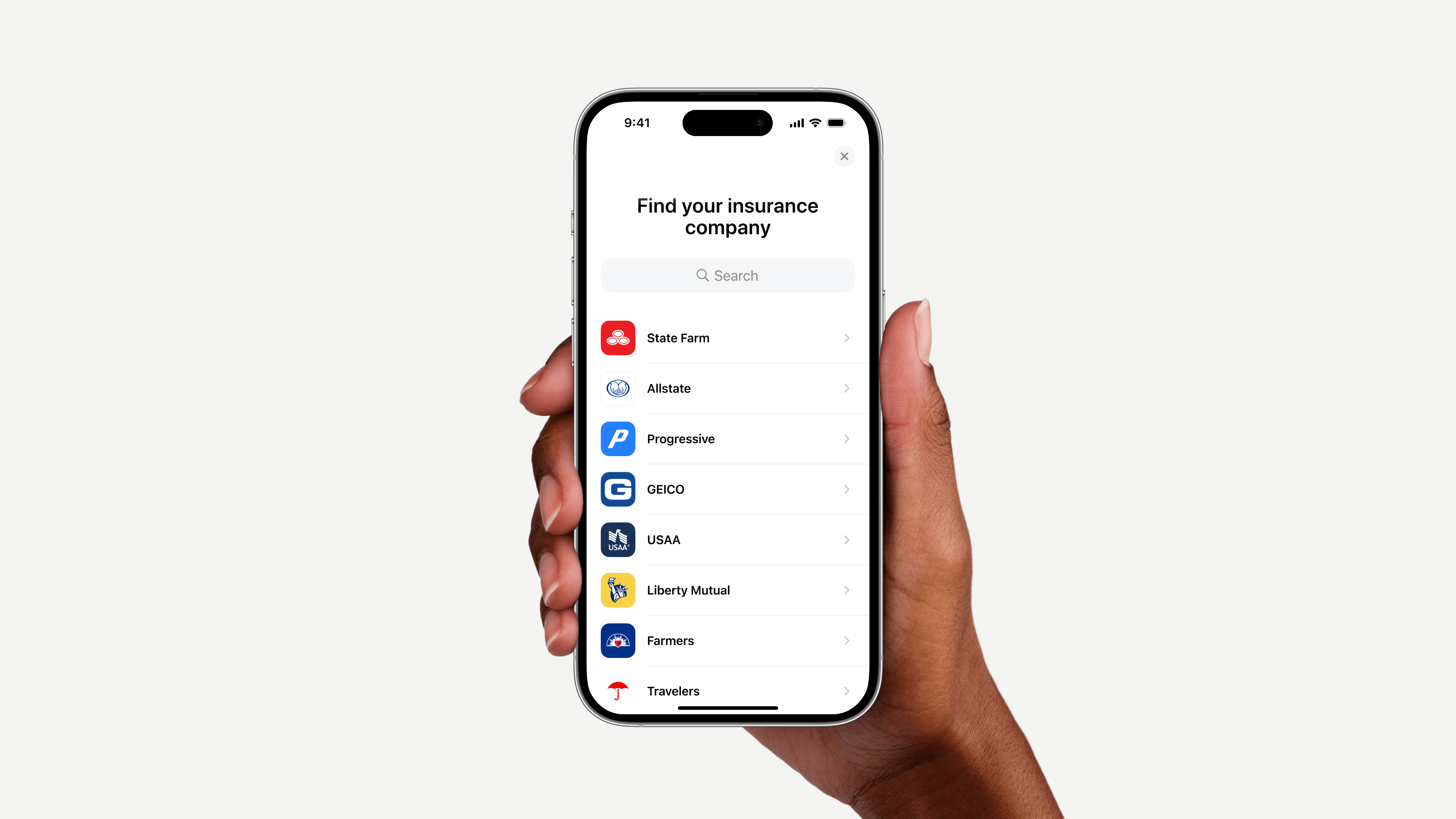

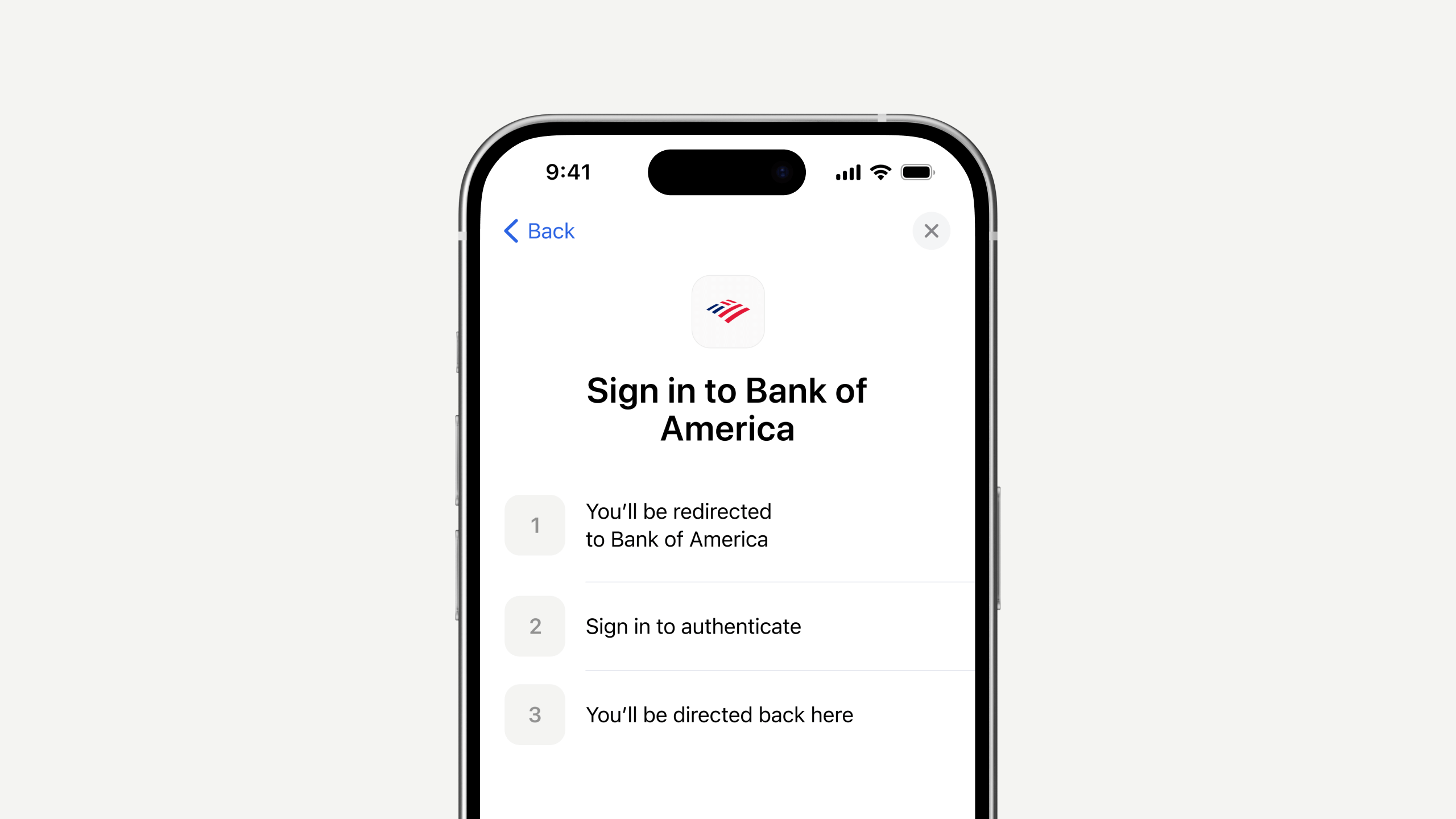

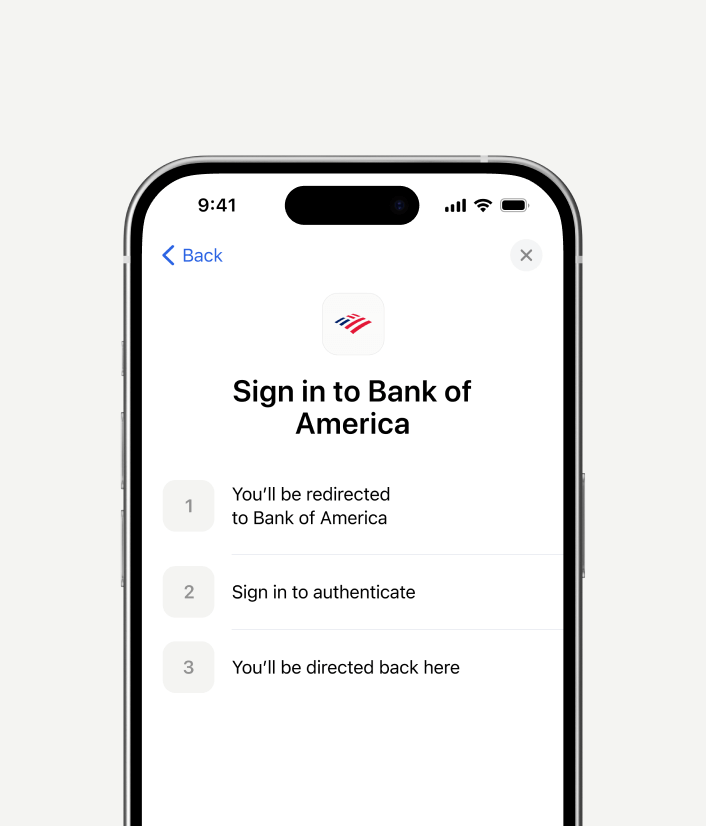

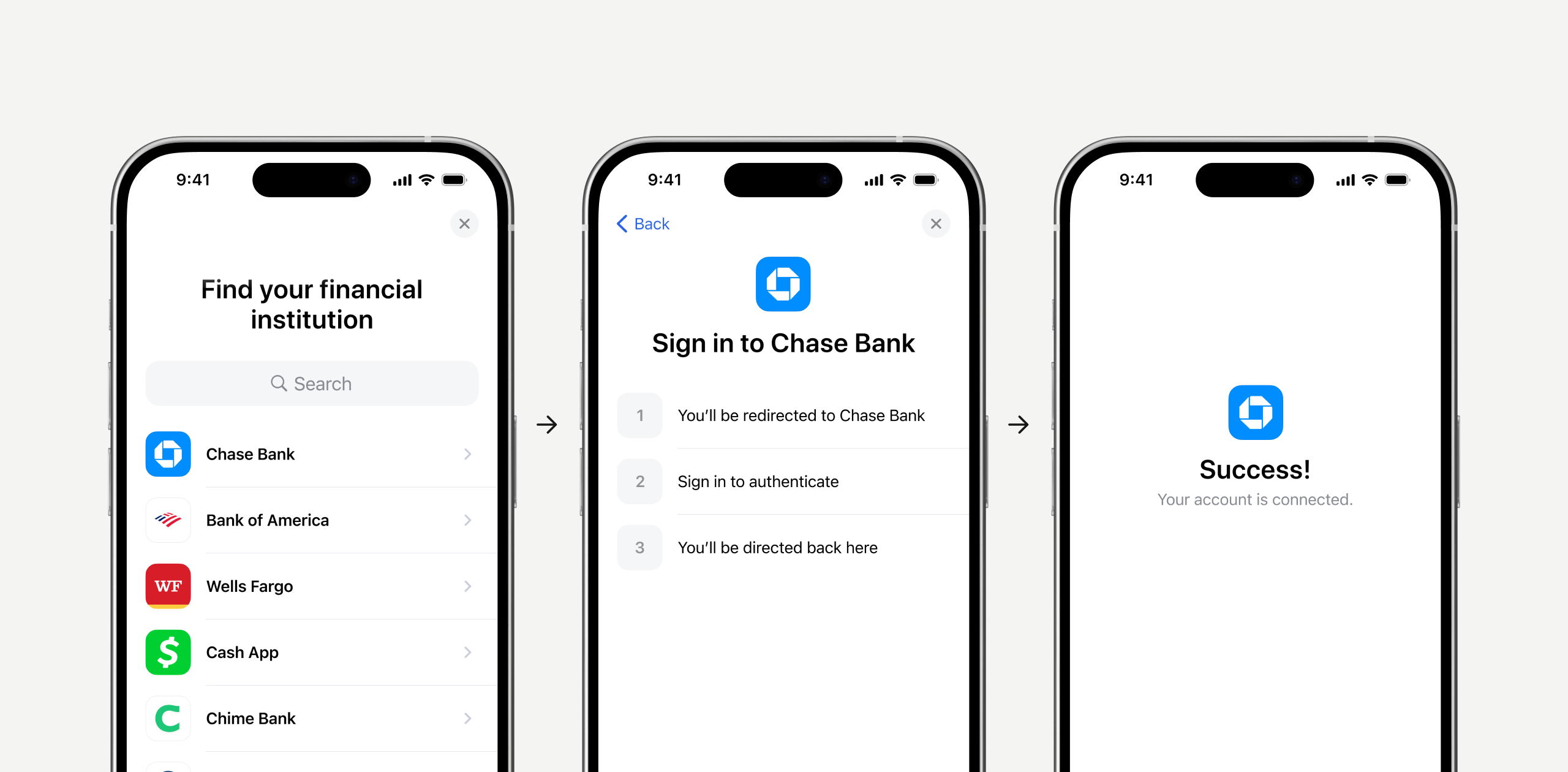

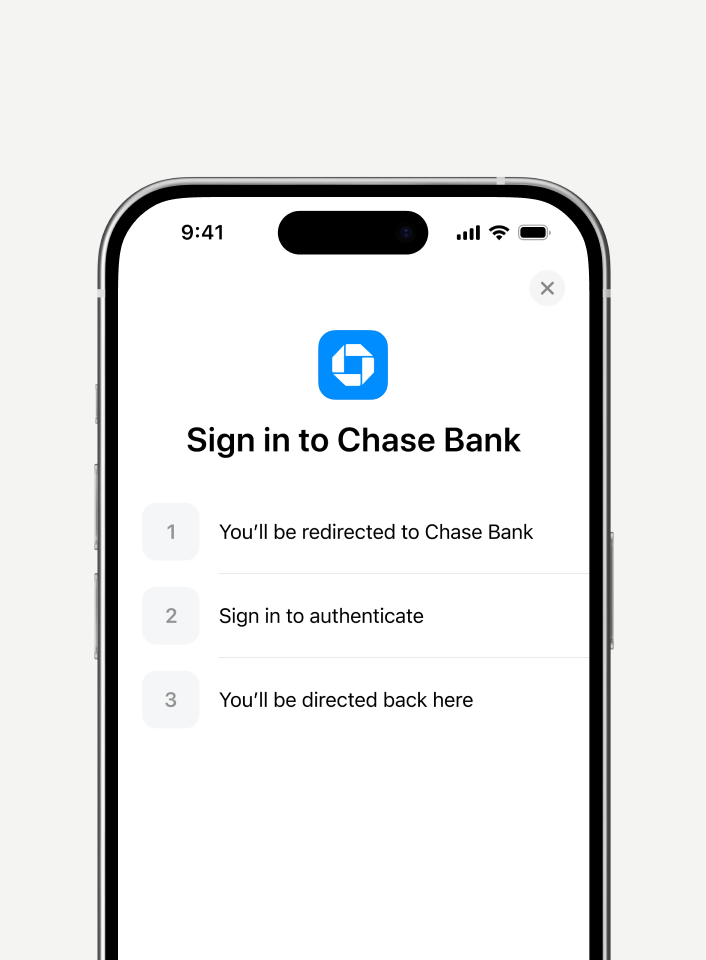

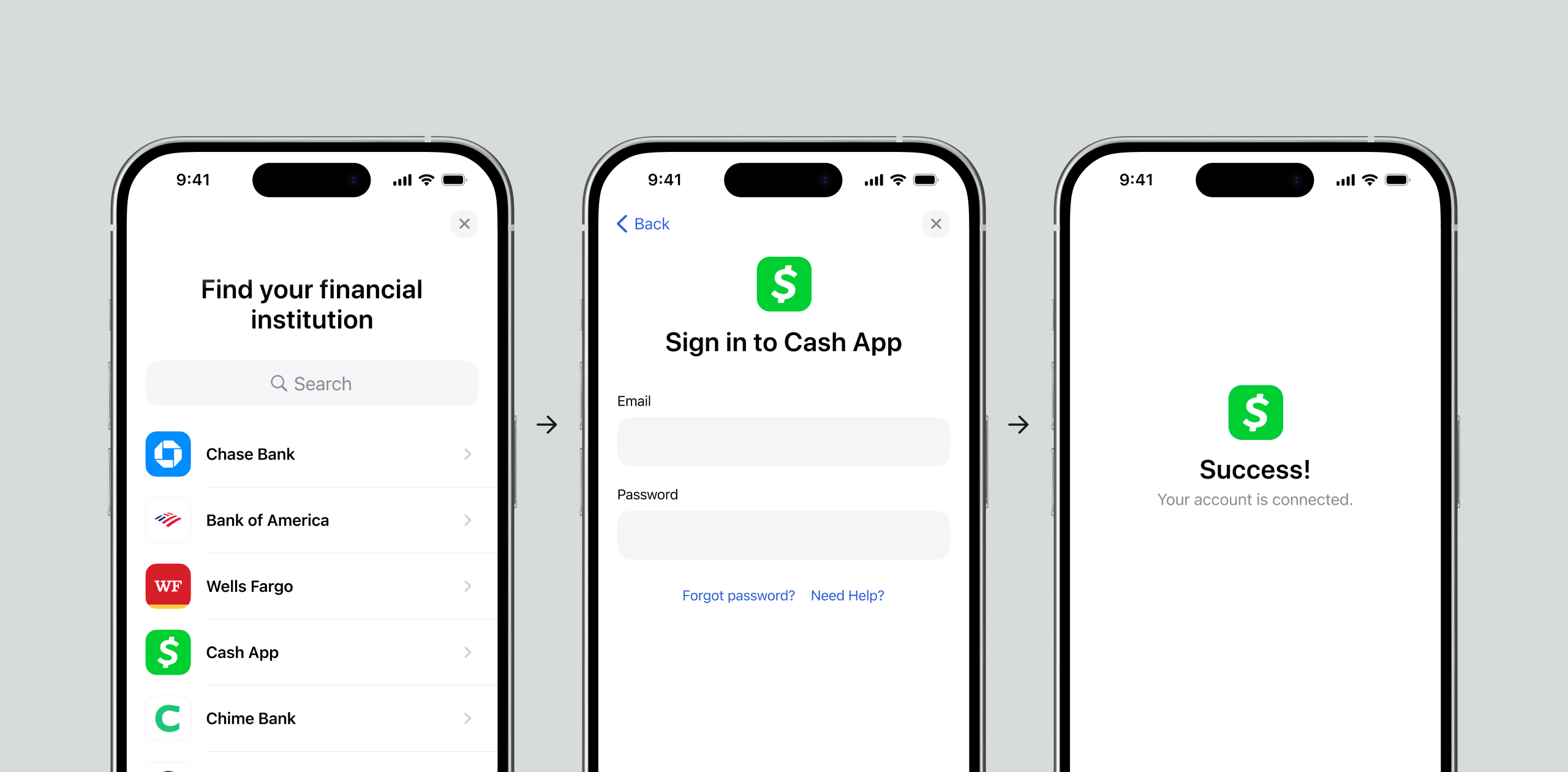

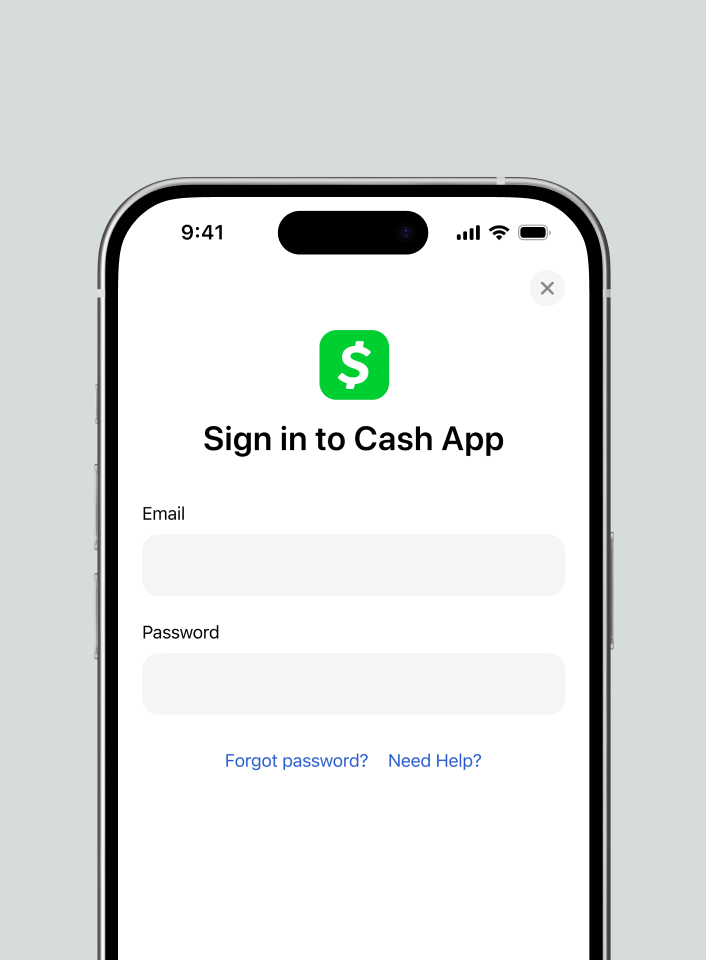

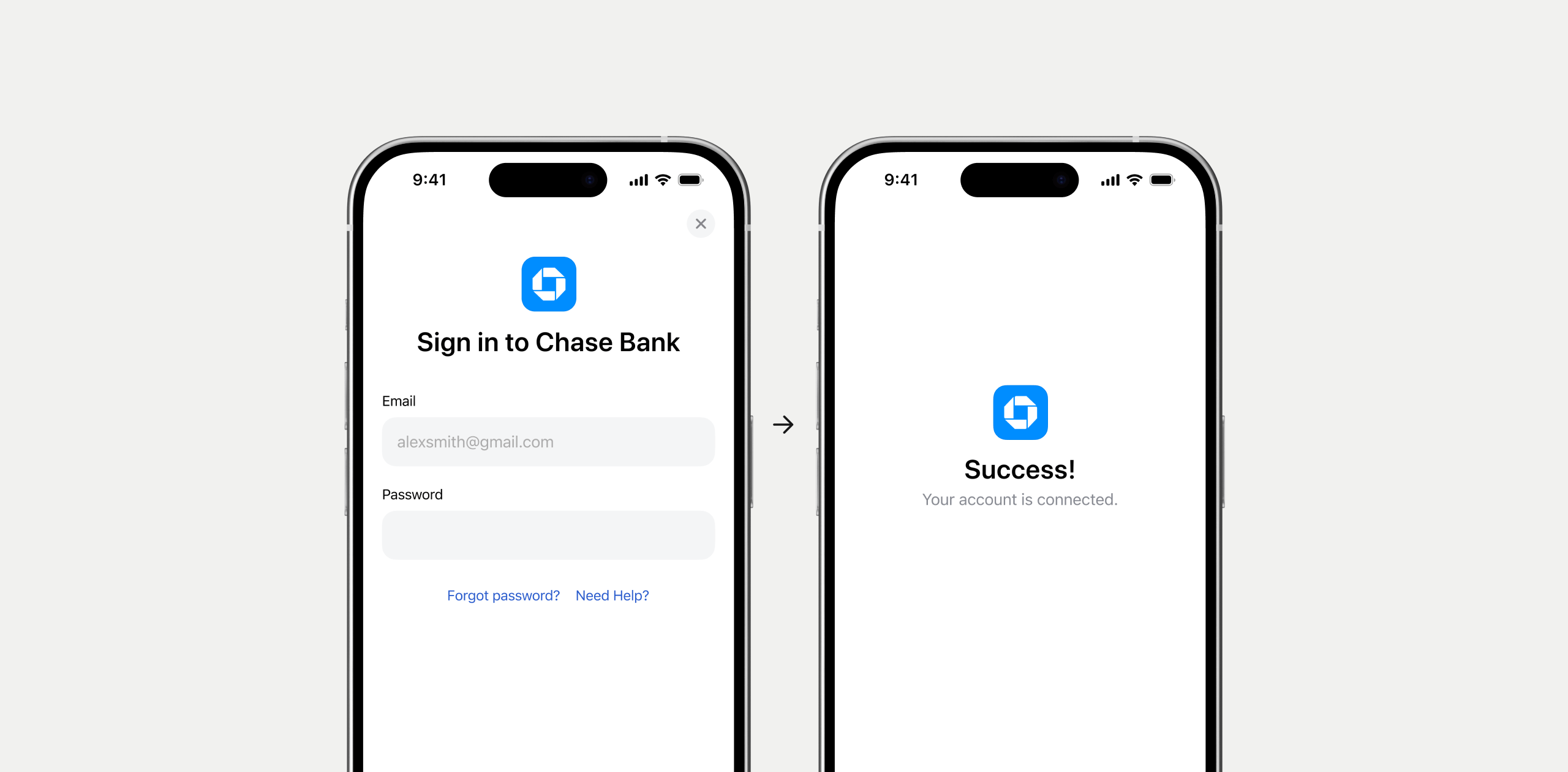

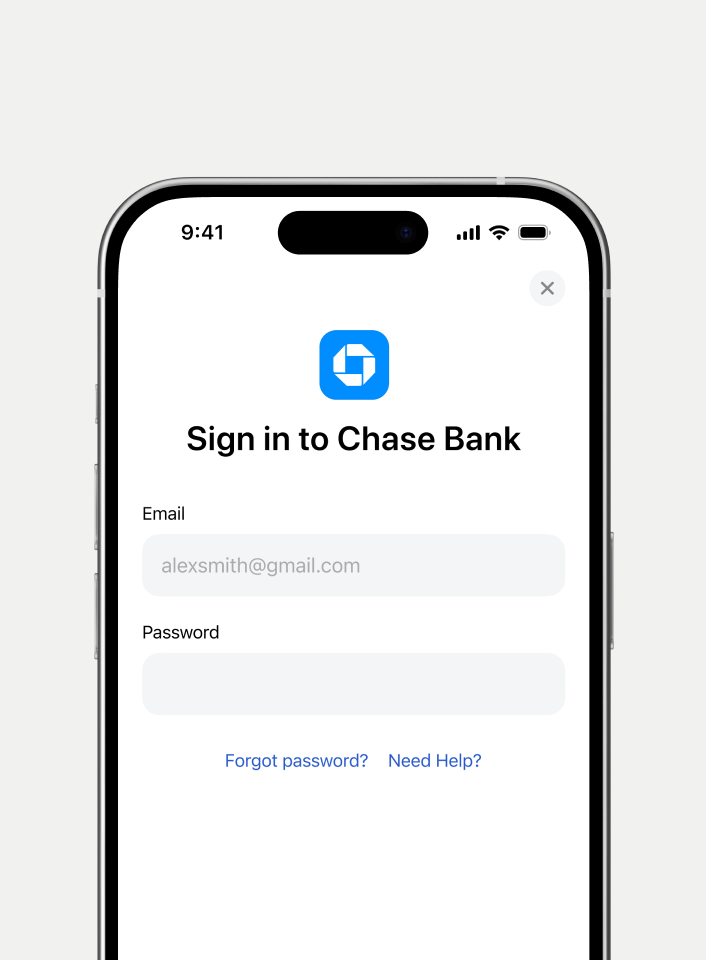

How it works.

How it works.

Verifications by

bank accounts FAQs.

Verifications by bank accounts FAQs.

Consumer lenders, auto lenders, and home equity lenders.

Through real-time transaction data interpretation, Truv enables faster loan underwriting by providing immediate, cleansed financial insights directly from bank accounts.

Truv covers over 13,000+ financial accounts.

The platform is enterprise-grade, SOC2 Type II compliant, and one of the few consumer-permissioned FCRA compliant vendors in the industry.

By providing real-time transaction data interpretations, Truv helps lenders confidently underwrite loans, reach more qualified applicants, and reduce time spent on manual data cleansing.

Truv safeguards consumer data through multiple security and privacy measures, including operating as a credit reporting agency (CRA) and adhering to Fair Credit Reporting Act (FCRA) standards, implementing SOC2 Type II compliance protocols, utilizing application-level encryption to protect sensitive information, maintaining compliance with privacy regulations, and performing continuous security monitoring to identify and address threats in real time. This approach eliminates the need for consumers to email sensitive financial documents directly to lenders or landlords, reducing the risk of data breaches and unauthorized access to personal information.

Sergio Terentev

Founder & CEO, B9