Consumer Lending

Automated income verification for faster loan approvals.

Make informed decisions with Truv’s cashflow and payroll data.

Understand borrower’s cash flow and set

up loan repayment via bank or paycheck.

Understand borrower’s cash flow and set up loan repayment via bank or paycheck.

Maximize conversion.

Accelerate approvals.

Reduce risks.

Why partner with Truv?

Why partner

with Truv?

Bridge

Verify borrowers instantly.

User experience optimized for high conversion and minimum friction.

Learn more

Quality

Use real-time, accurate data.

Direct to source data. Approved by Freddie Mac and Fannie Mae.

Learn more

Assets

Verify using bank accounts.

With over 13K+ financial institutions & AI- driven deposit detection.

Learn more

Scoring Attributes.

Understand borrower risk.

View cashflow and 2,000 scoring attributes to control risk.

Learn moreGrowth

Fund more loans.

Best conversion rate in the industry. Proven by A/B tests. Higher NPS for customers who used Truv.

Get Started

Trusted Data

Reduce risk of income fraud.

Trusted data and documents directly from the source. Repayment directly from borrowers paycheck.

Get StartedIncreased Efficiency

Reduce manual verifications.

Less dependency on manual labor and fixed expenses.

Get Started

All-in-one platform

for verifications.

All-in-one platform for verifications.

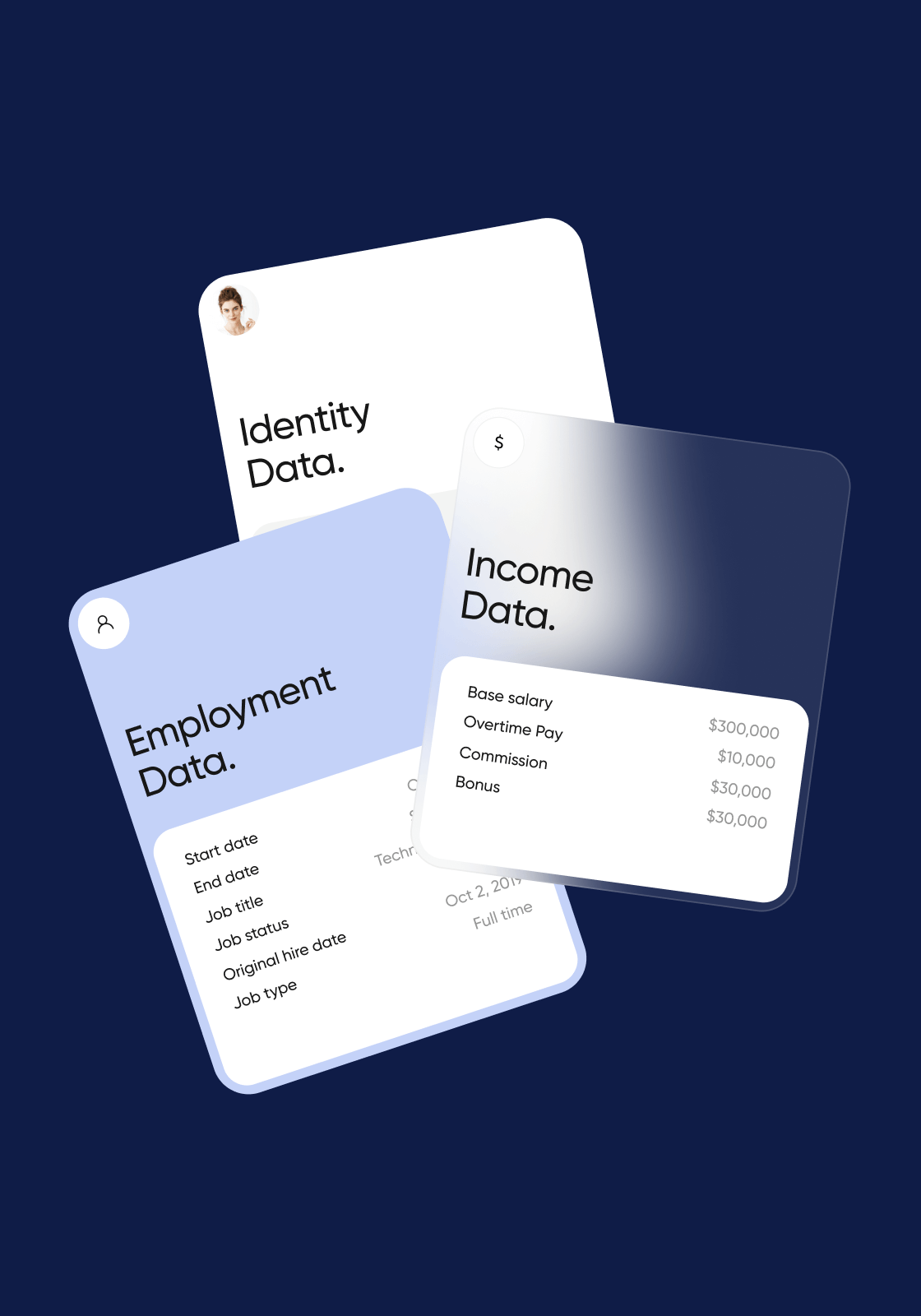

Income & Employment Verification

Payroll Income & Employment

Highest conversion rate and data fill rates in the industry.

Bank Income

Highest oAuth rate and insights into transactions.

Paystubs & W-2s

Best-in-class OCR and fraud detection for pay documents.

Scoring Attributes

Attributes

Increase risk model accuracy with transaction data.

Smart Routing

Smart Routing

Dynamically present payroll or bank verification.

Platform

Automated income

verification FAQs.

Automated income verification FAQs.

Consumer lending is a financial service where banks, credit unions, and other financial institutions provide various types of loans directly to individual consumers, including personal loans, installment loans, credit cards, mortgage loans, and more.

Truv offers comprehensive verification services for consumer lending, including income verification, employment verification, document processing, loan repayment, and Smart Routing. Our all-in-one platform has the ability to combine multiple data sources into one experience to optimize conversion and streamline the verification process for lenders.

Truv’s verification solution dramatically accelerates loan decisions by automating the income and employment verification process. Our waterfall approach automatically selects the fastest verification method for each borrower, whether through instant payroll connectivity, bank data, or document verification. This means your borrowers can complete applications in minutes rather than days, leading to higher conversion rates and improved customer satisfaction.

For borrowers like gig workers, freelancers, or those with multiple income sources, our bank income verification provides a complete view of their financial health. The system analyzes up to 24 months of transaction history to verify income patterns, helping you confidently serve borrowers who might be declined by traditional verification methods. This comprehensive cash flow analysis helps you make informed lending decisions while maintaining risk standards.

Consumer lenders using Truv report significantly faster loan closing times and higher application completion rates. Our platform is specifically designed to handle the speed requirements of consumer lending, with most verifications completed in under 30 seconds. The system integrates seamlessly with major loan origination systems and can be customized to match your specific underwriting criteria and risk tolerance.

Consumer lenders using Truv experience a range of benefits HFS, for example, saw a +15% increase in fraud detection, 65% conversion rate, and 10-15% improvement in operational efficiency. The platform’s ability to instantly verify income and employment translates to more loans funded with less overhead.

In the consumer lending space where speed is crucial, Truv provides real-time AI-driven fraud detection at a 99.99% effective rate. Our system automatically flags suspicious patterns in submitted information, restores tampered fields, notifies you of fraudulent activity, and verifies income and employment status in real-time, directly from the source. This multi-layered approach helps protect against common consumer lending fraud schemes while maintaining rapid verification speeds.

Our waterfall verification process is optimized for consumer lending’s need for speed and flexibility. When a borrower begins the verification process, our system instantly determines the fastest available verification method based on their employment status and available data sources. If the primary method isn’t available, the system automatically cascades to alternative methods without requiring human intervention, ensuring maximum conversion with minimum friction.

We understand the sensitive nature of consumer lending data and maintain bank-level security standards throughout our verification process. All borrower data is encrypted using industry-leading protocols, and our platform complies with all relevant consumer lending regulations. The combination of the Advanced Encryption Standard (AES-256) & Transport Layer Security (TLS) keep personal information safe.

Liz Messerly

Lending Operations Manager, American First Credit Union