A Turning Point: The Leap Towards Alternative Data

On February 16, 2017, Richard Cordray, the then-director of the Consumer Financial Protection Bureau (CFPB), delivered a powerful statement:

‘Alternative data from unconventional sources may help consumers who are stuck outside the system build a credit history to access mainstream credit sources. We want to learn more about whether this non-traditional approach can offer opportunities to millions of Americans who are credit invisible and how to minimize any risks in how this information is used.’

The idea was simple but potent: By considering alternative payment history from payday loans and title loans, we could clear the murkiness around the credit behavior of underserved consumers and enable their access to credit.

Blurring Boundaries: Merging Mainstream and Alternative Credit

In the wake of the CFPB’s endorsement of alternative data, the three largest mainstream credit bureaus embraced this approach, each acquiring an alternative credit bureau that tracks non-traditional lending behavior:

- November 14, 2017 – TransUnion acquires FactorTrust

- March 19, 2018 – Experian acquires Clarity Services

- July 16, 2018 – Equifax acquires DataX

These acquisitions marked a pivotal shift. Previously, mainstream credit bureaus did not consider alternative loan history, and payday lenders promoted their loans as not affecting credit scores. Now, the once impenetrable wall separating these two worlds had crumbled.

This shift gained further momentum on December 3, 2019, when major financial regulators issued a joint statement supporting the use of alternative data in credit underwriting. However, the question arises: Has the integration of alternative lending histories genuinely improved financial inclusion, or has it inadvertently done the opposite?

Unveiling Hidden Signals: The Dual Impact of Alternative Data

While it may seem that incorporating alternative loan repayment histories could make a consumer appear less risky, the reality is more nuanced. Such data not only indicates a consumer’s willingness to repay but also signals they are under financial distress.

How does this play out in the real world? An analysis by one of the traditional credit bureaus reveals that subprime consumers using payday and alternative loans face a 50+% higher loss rate on their bank loans than their counterparts who don’t. This increased risk is hard for a traditional bank lender to absorb, and as a result, they might serve only around 10% of underserved consumers, excluding the rest.

Truv Provides the True Picture

One form of alternative credit data that often harms underserved consumers is alternative payment history. Truv uses Financial Behavior Attributes to analyze raw banking data to measure both traditional and alternative lending payment behavior as well as overall financial health. This allows us to create a more accurate view of the impact of alternative loan usage.

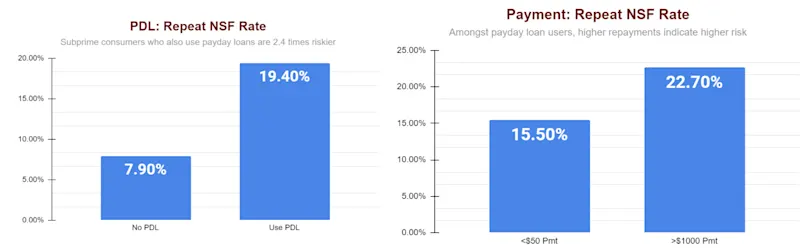

We drew a sample of subprime consumers from our credit database and segmented them by whether they use payday or other alternative loans. We then looked at their repeat NSF rate in the following two month period to assess the differences in risk levels. NSFs are a generalized form of payment default and is a good proxy for overall risk. At first glance, our data also shows that subprime consumers that use payday loans are riskier.

But we didn’t stop there. Using our Financial Behaviors attributes we were able to build a risk model for the payday loan population which takes into account a complete profile of their financial behavior. This model paints a very different picture of the underserved consumer population.

Our model identifies 6x more low risk consumers than alternative models because 60% of payday loan consumers have repeat NSF rates that are lower than subprime consumers who do not use payday loans. Using our Financial Behaviors attributes, we’ve developed a risk model that provides a more comprehensive profile of consumer financial behavior.

Advancing Financial Inclusion

While alternative data can be a powerful tool for improving financial inclusion, it also carries the potential for unintended consequences if used improperly. We need to couple alternative loan payment history with data that measures financial health and recovery to get a balanced and accurate consumer view.

At Truv, we provide attributes and models that offer a complete consumer view, equipping lenders with the tools they need to grow their lending businesses in underserved markets responsibly and profitably. By utilizing a balanced approach, we can make significant strides towards the goal of financial inclusion.