Fannie Mae

Get relief from reps and warrants with Truv.

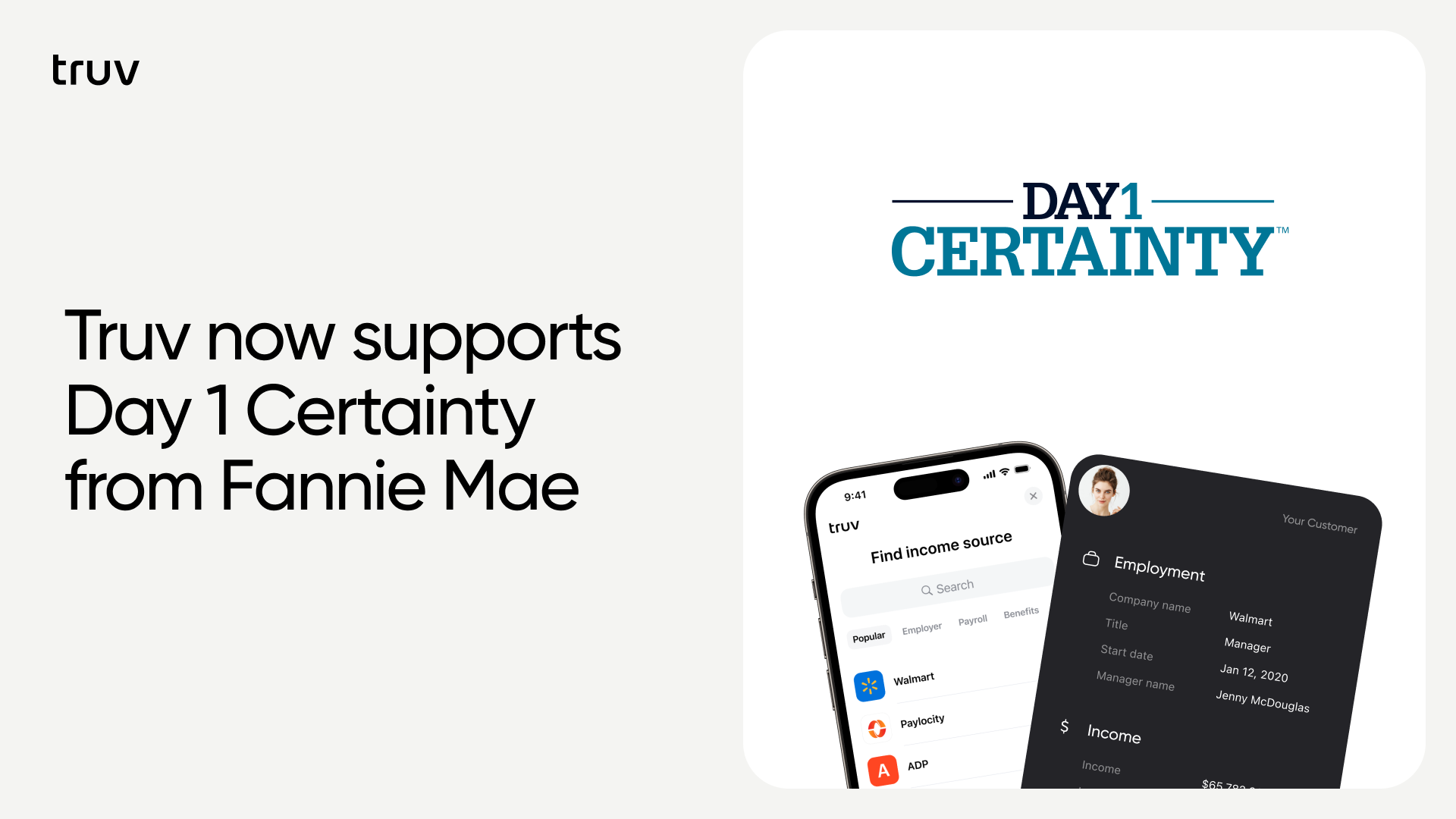

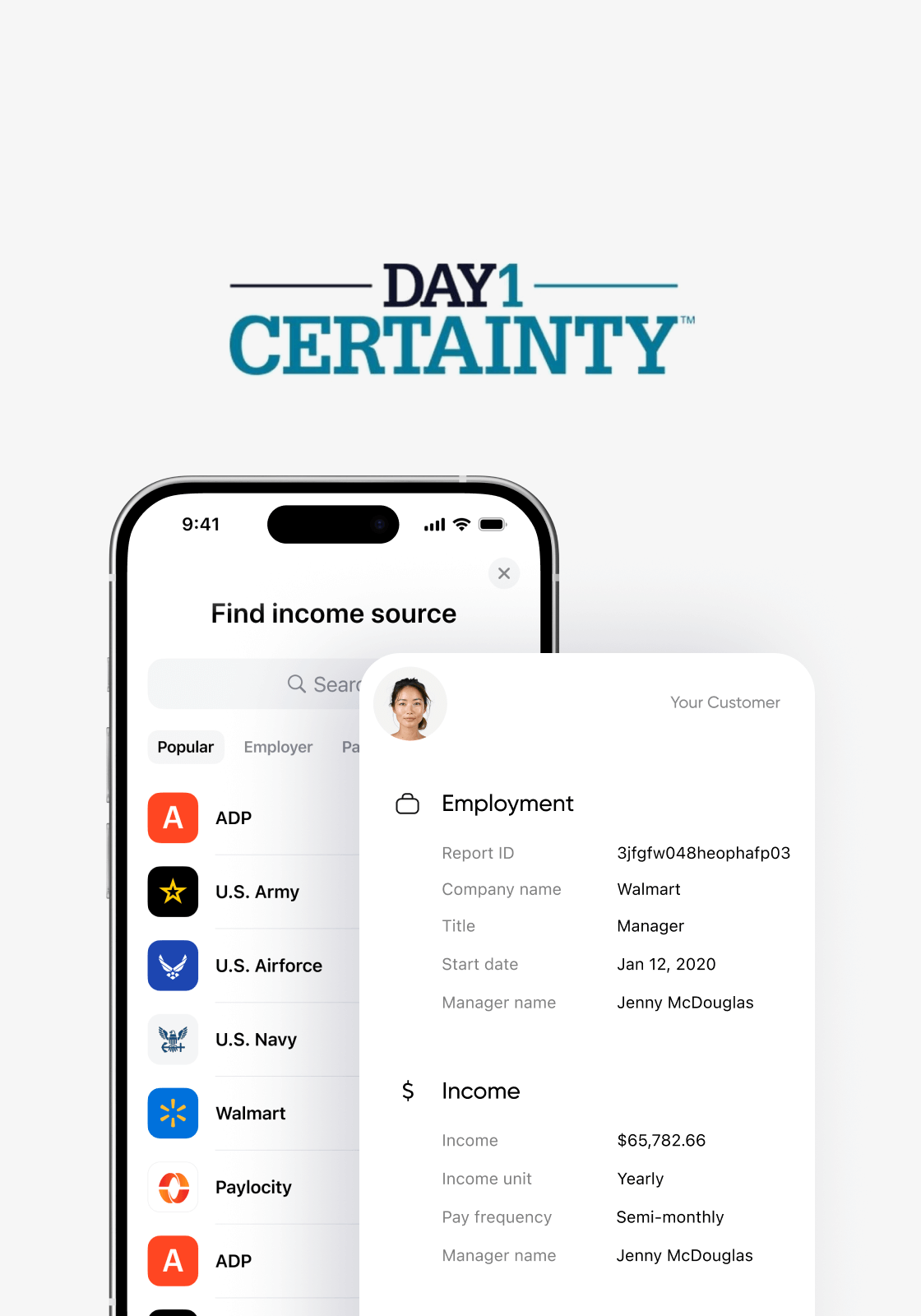

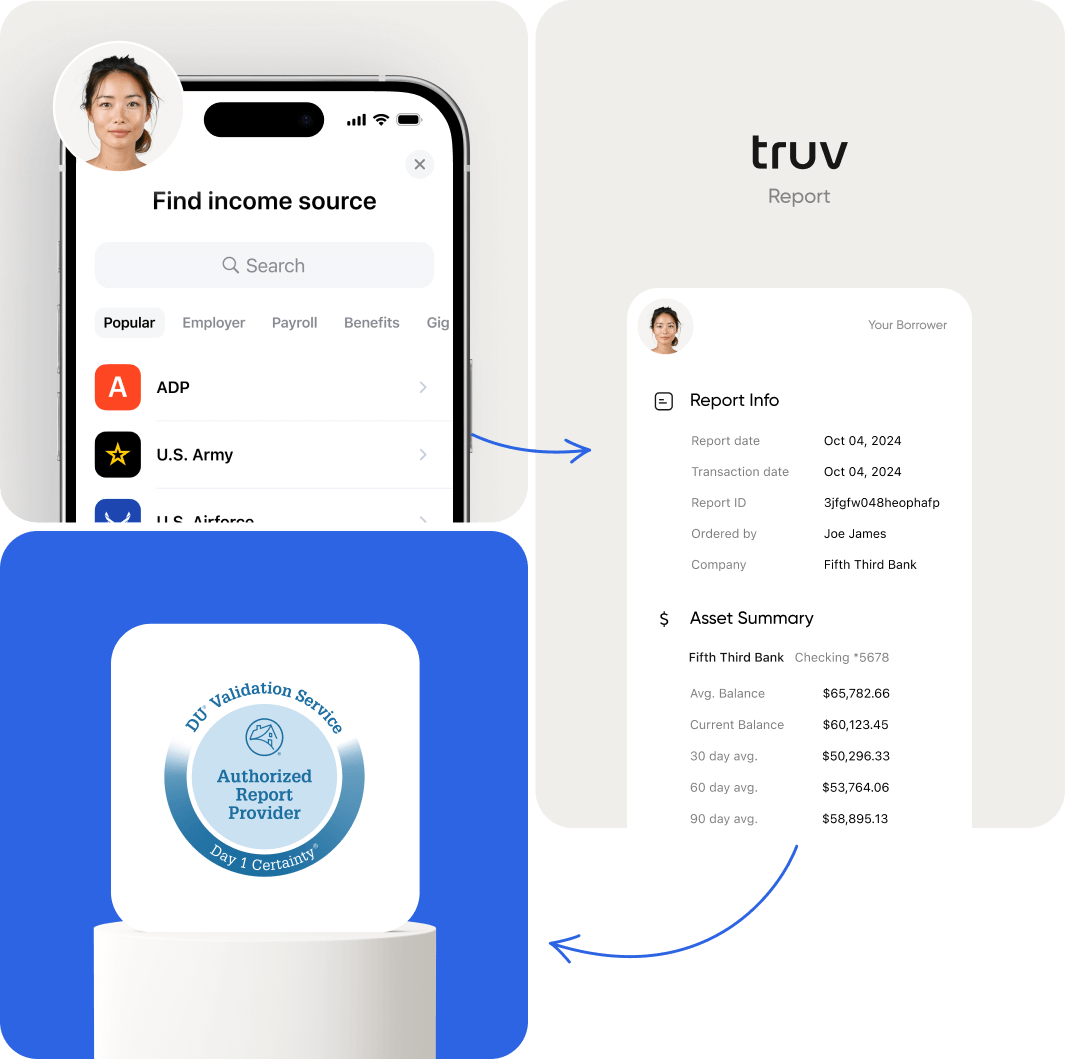

Truv is an authorized report supplier for lenders using Fannie Mae’s Desktop Underwriter® (DU®).

Payroll income and employment verification.

Payroll income and employment verification.

Verify borrower income and employment

using Truv reports with DU.

Verify borrower income and employment using Truv reports with DU.

Reduce operational costs.

Accelerate loan processing.

Lower buyback risks.

Improve lending productivity.

DU-Approved Reports

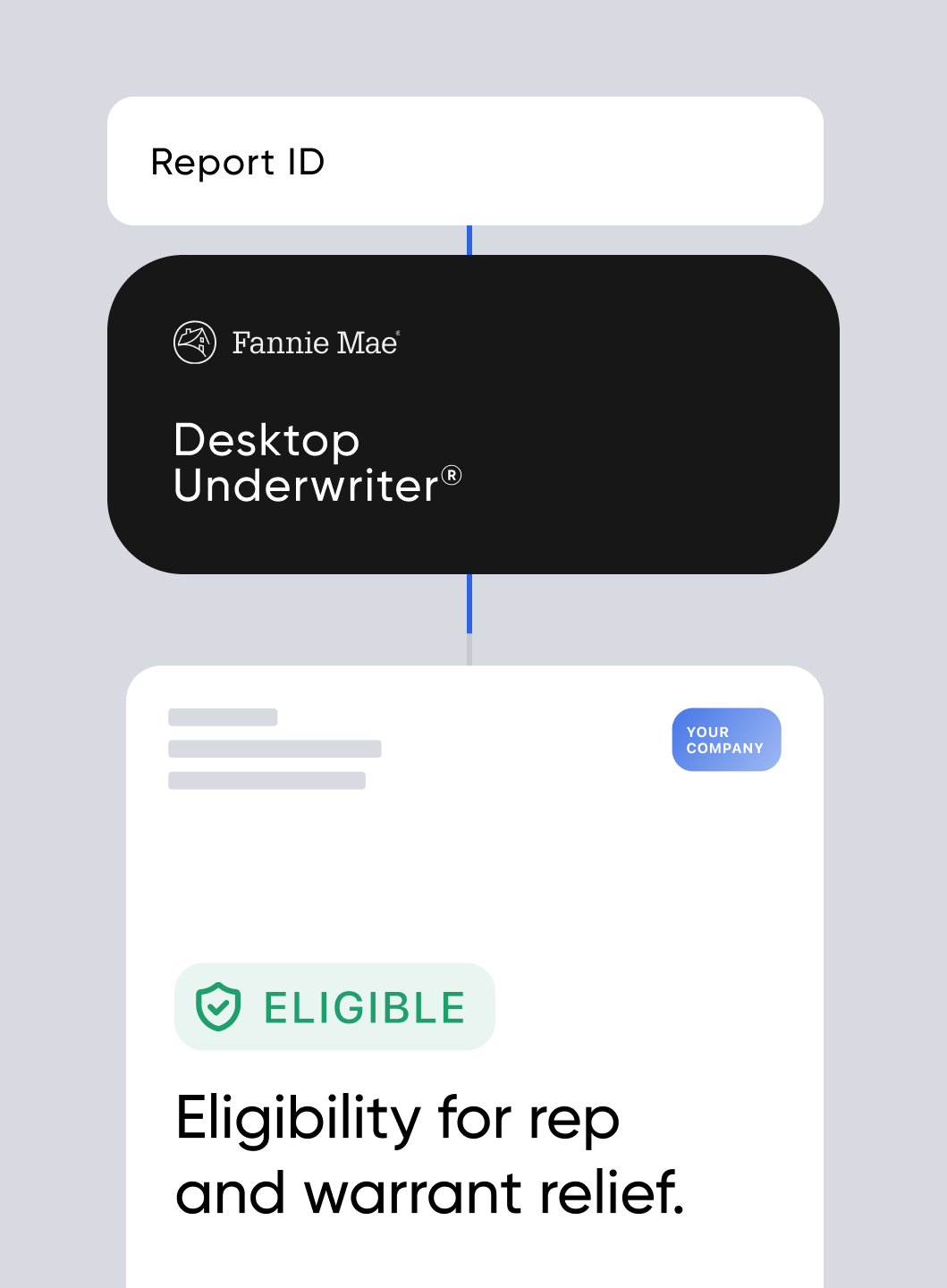

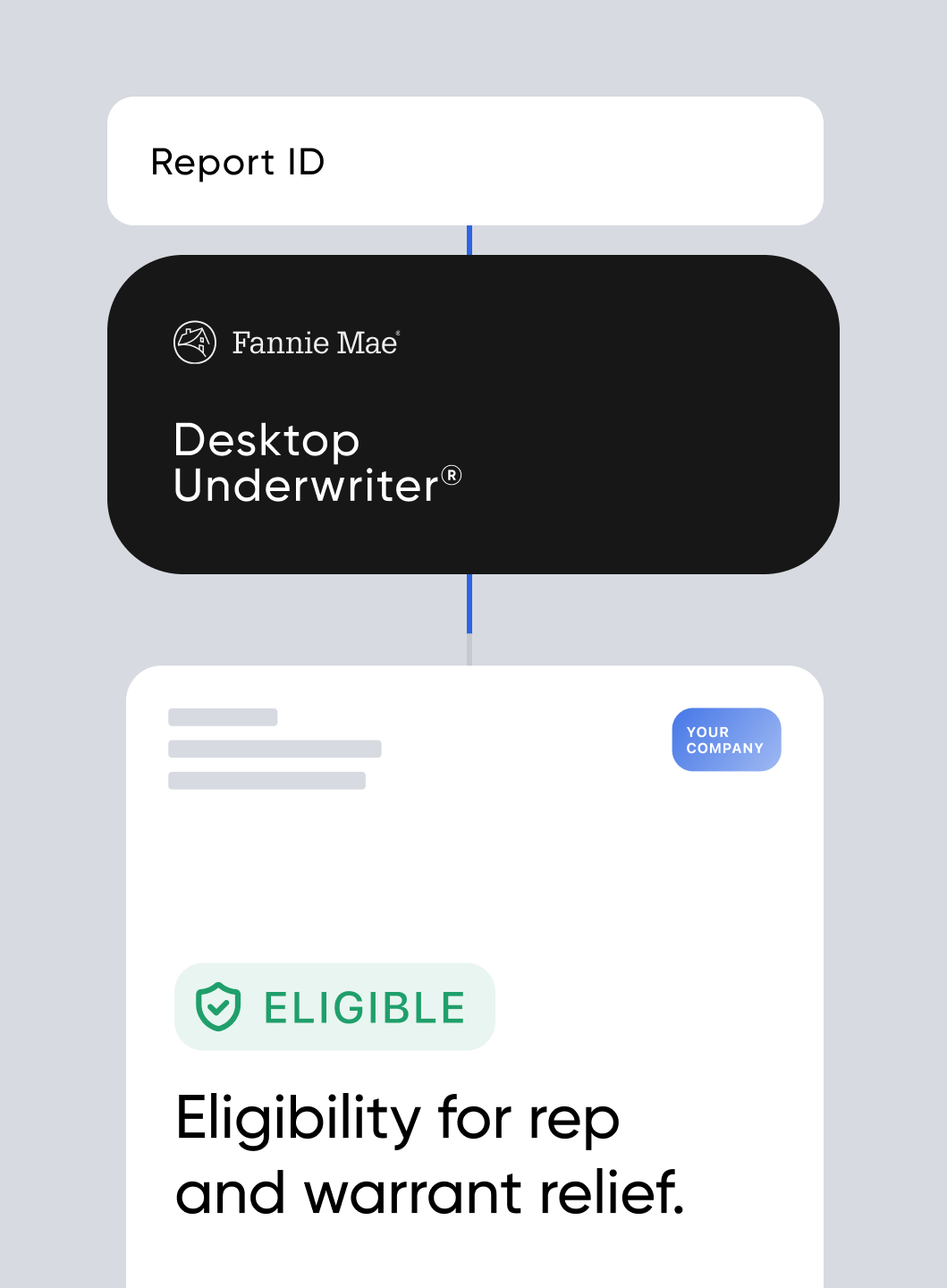

Rep and warrant relief.

Receive DU on the validated loan components when using income & employment data from Truv.

Get Started

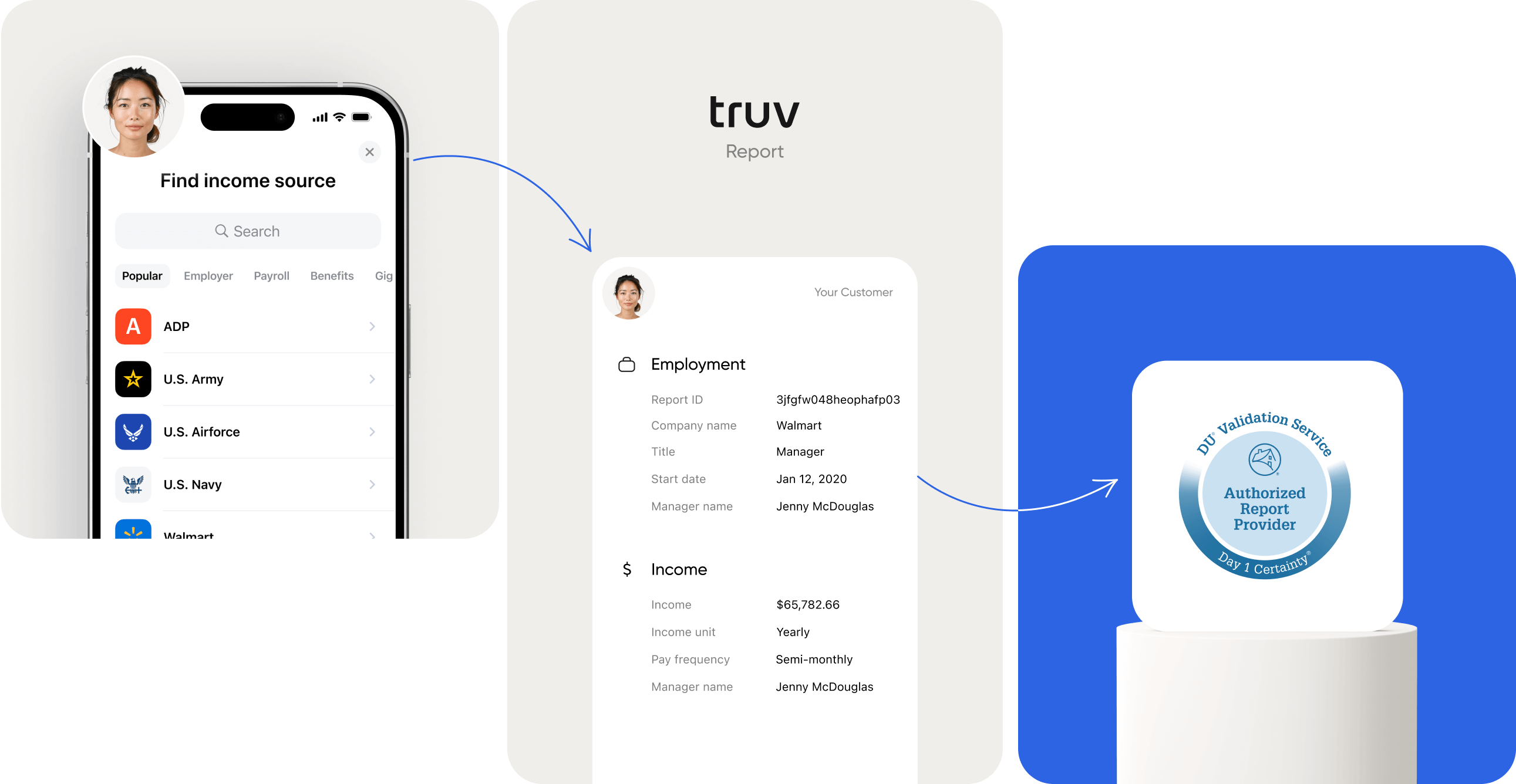

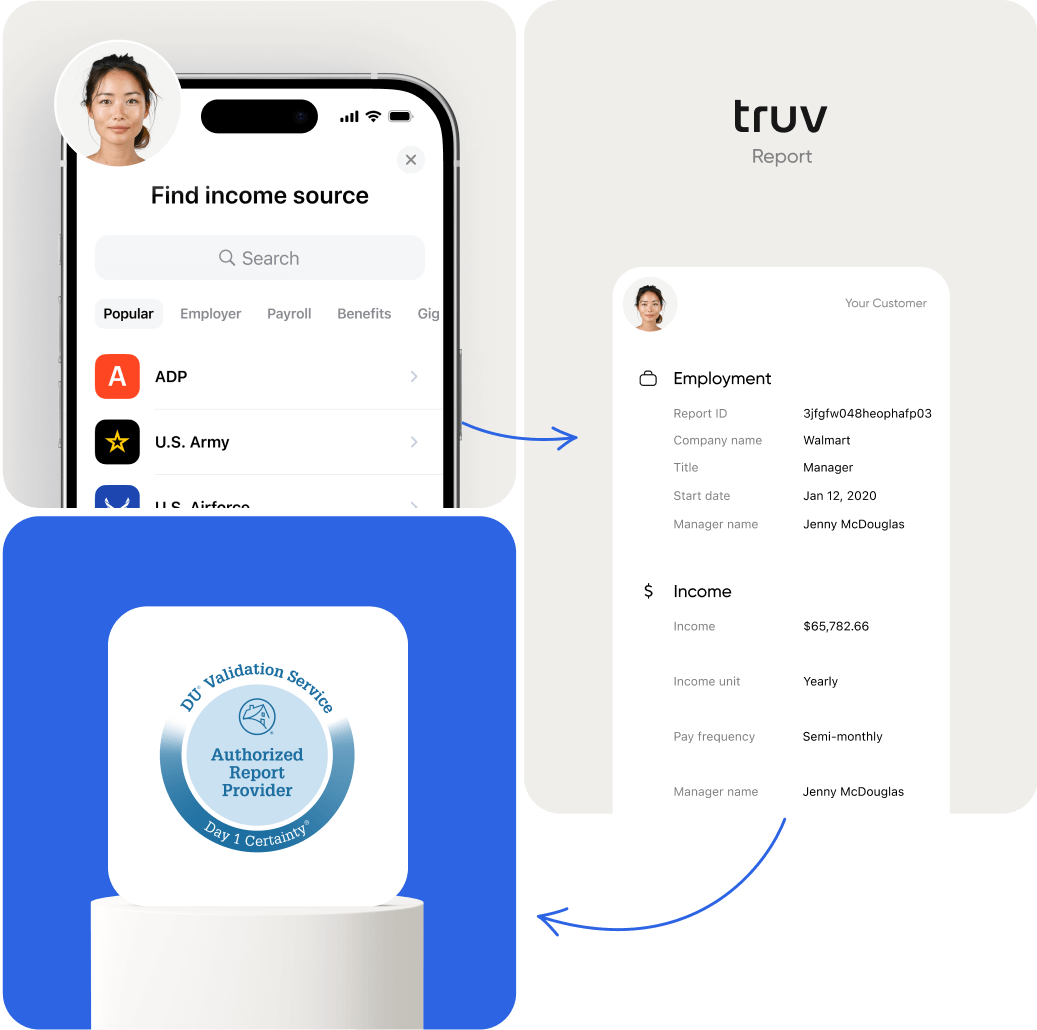

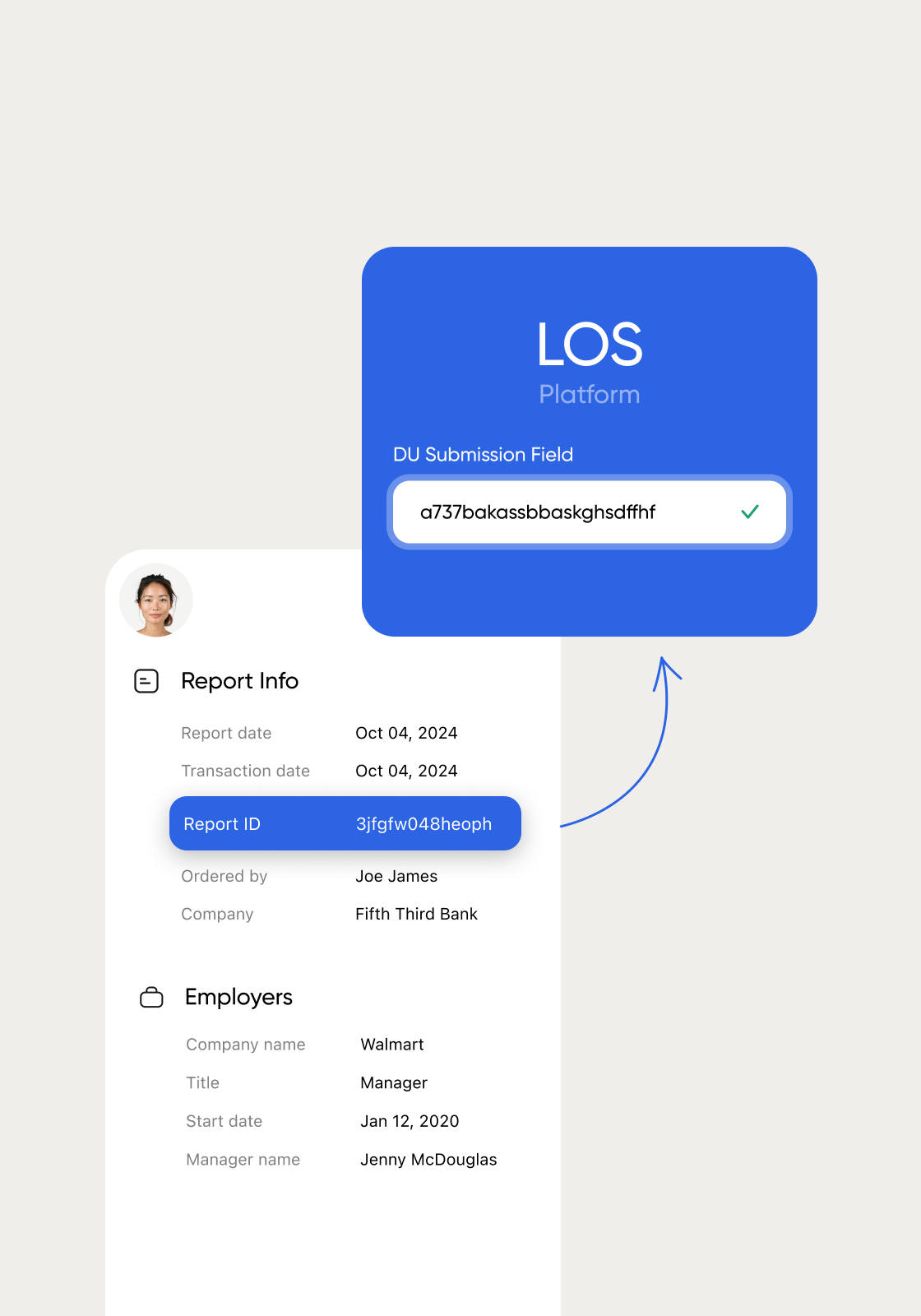

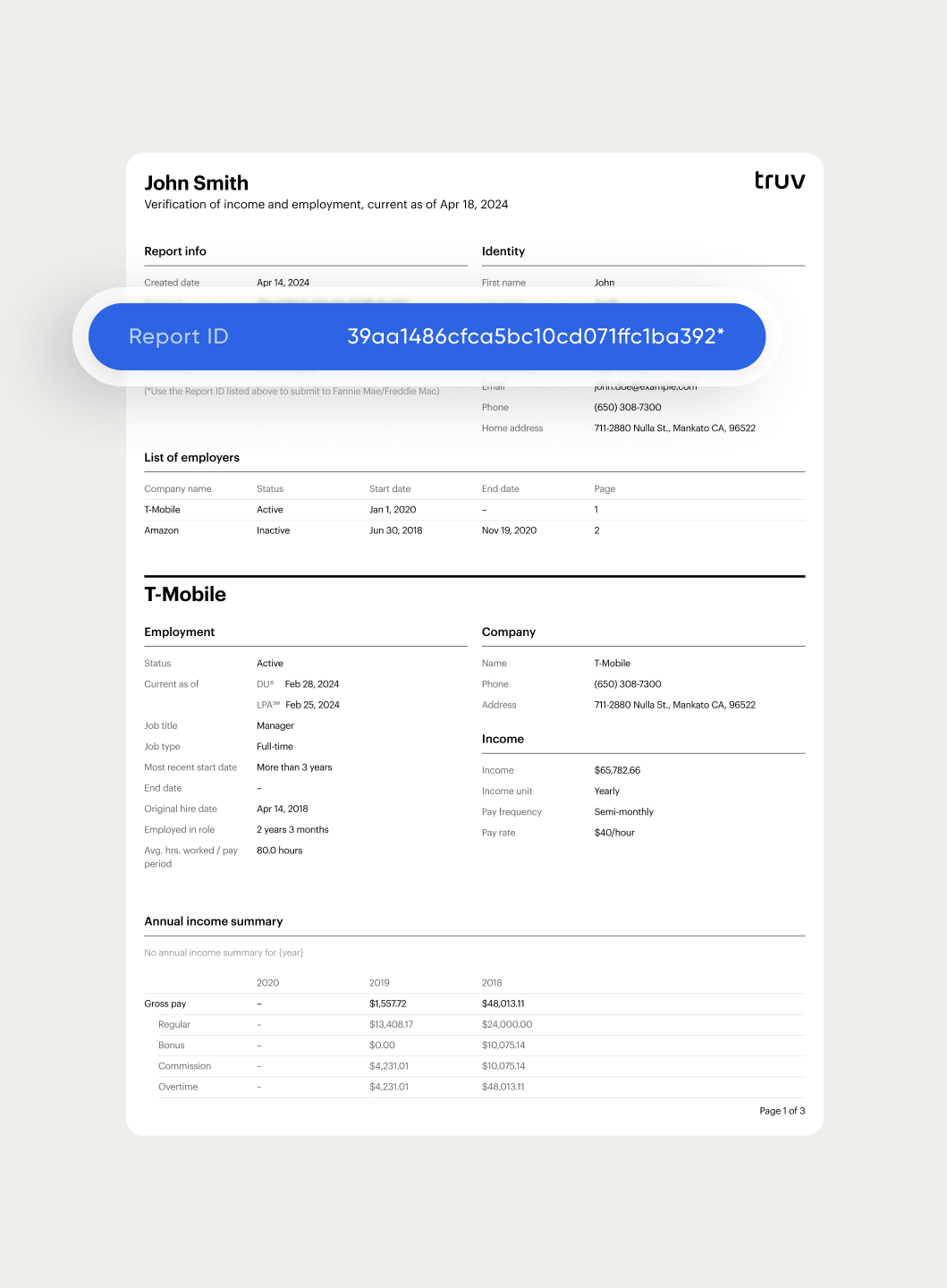

Fannie Mae DU

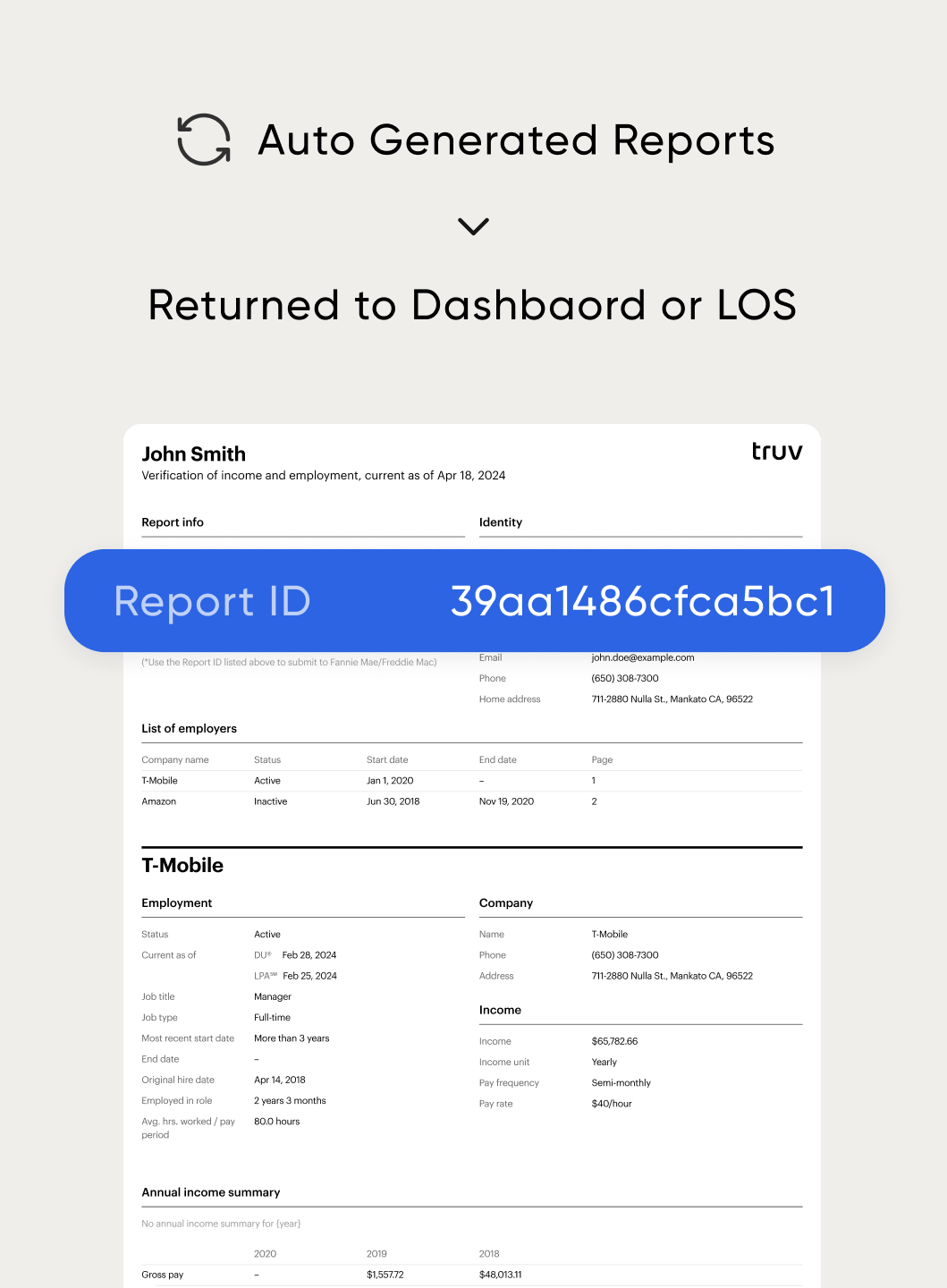

Report ID for submission to DU.

Report ID auto-generates and auto-populates in your LOS for seamless submission to DU.

Get Started

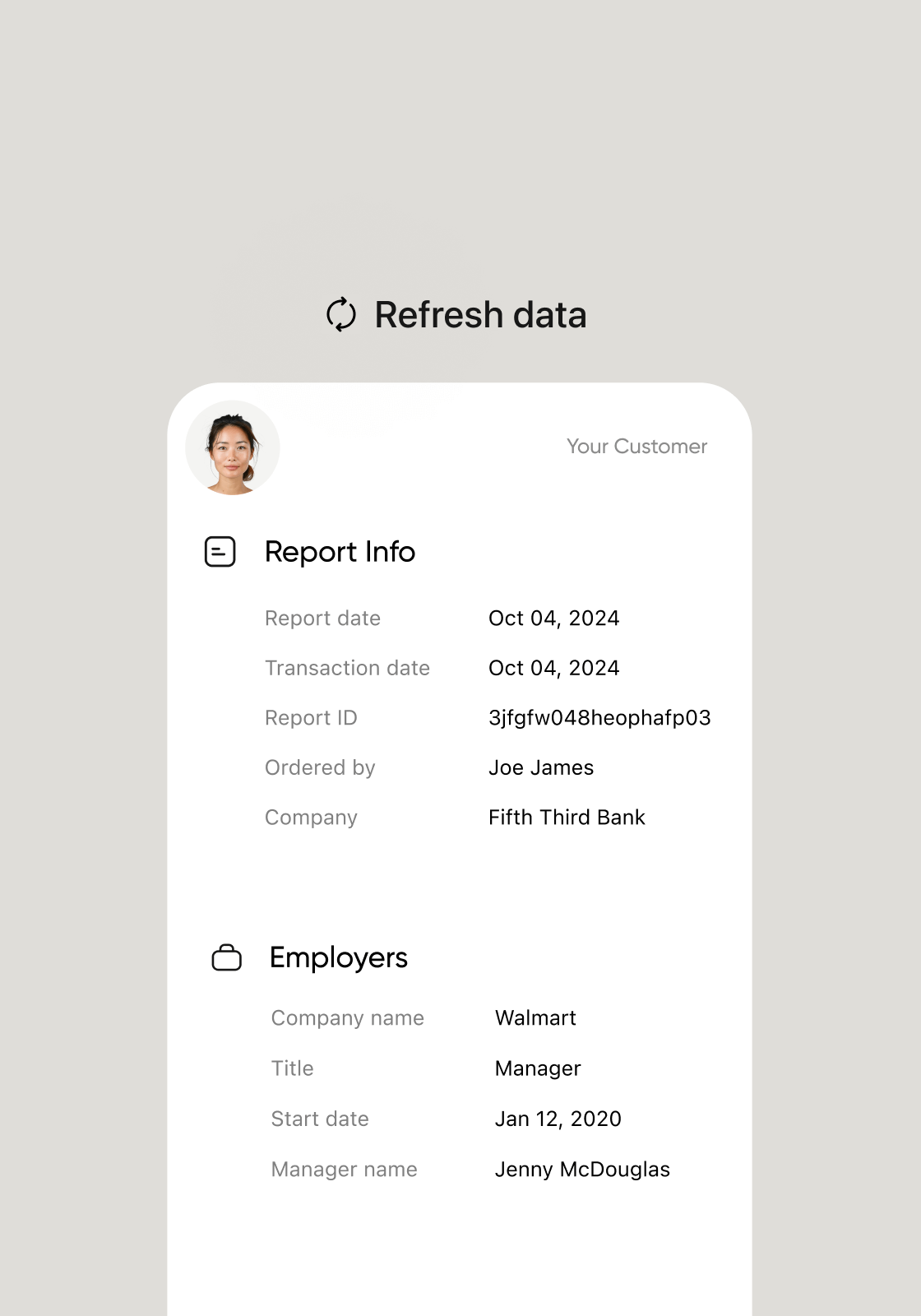

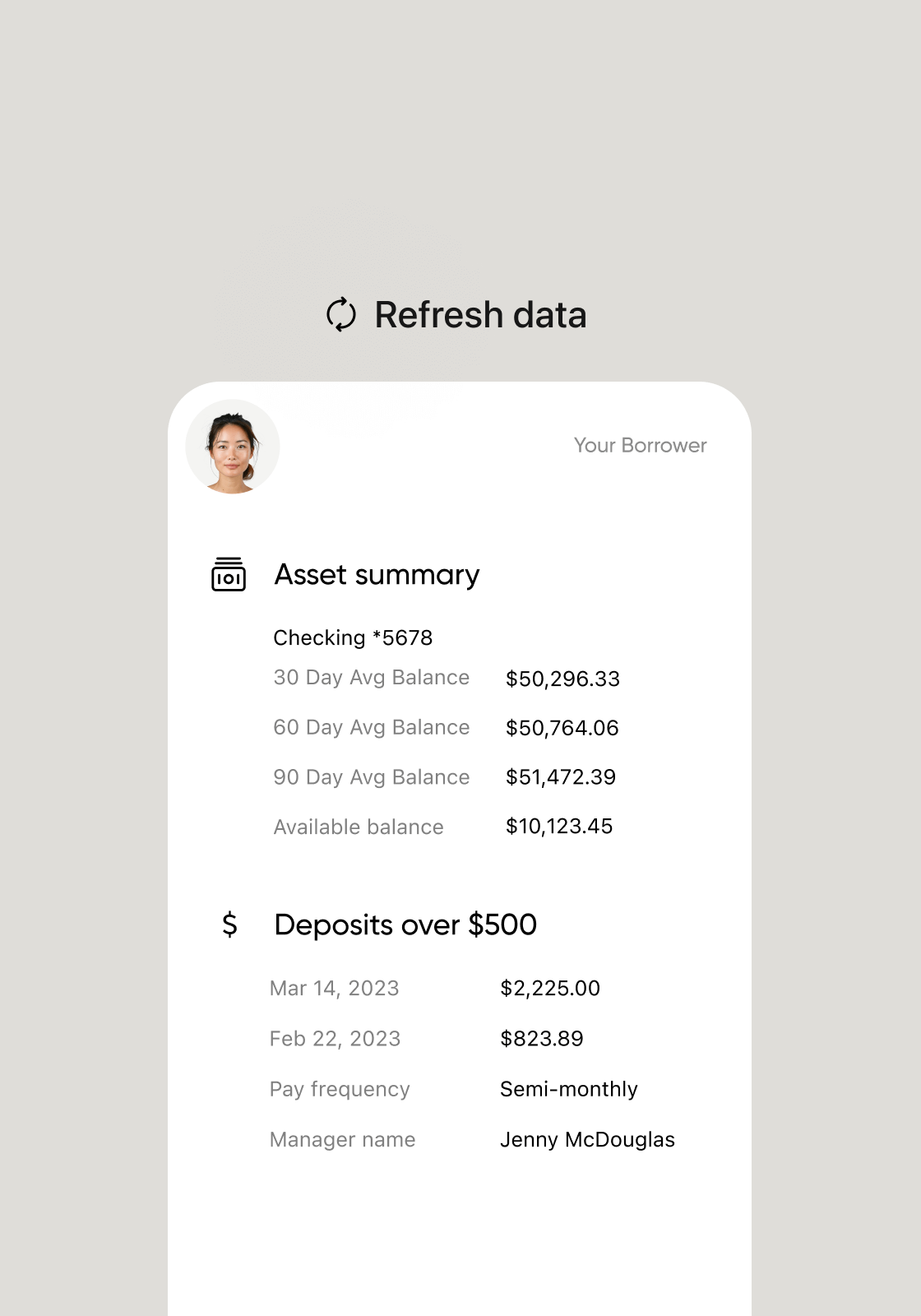

DU-eligible Reverifications

Reverification Report ID.

A Report ID auto-generates for reverification reports eligible for DU.

Get Started

Faster Loan Cycles

Accelerated lending speed.

Lenders have seen a reduction in loan cycle times by 3+ days with automated VOIE.

Get Started

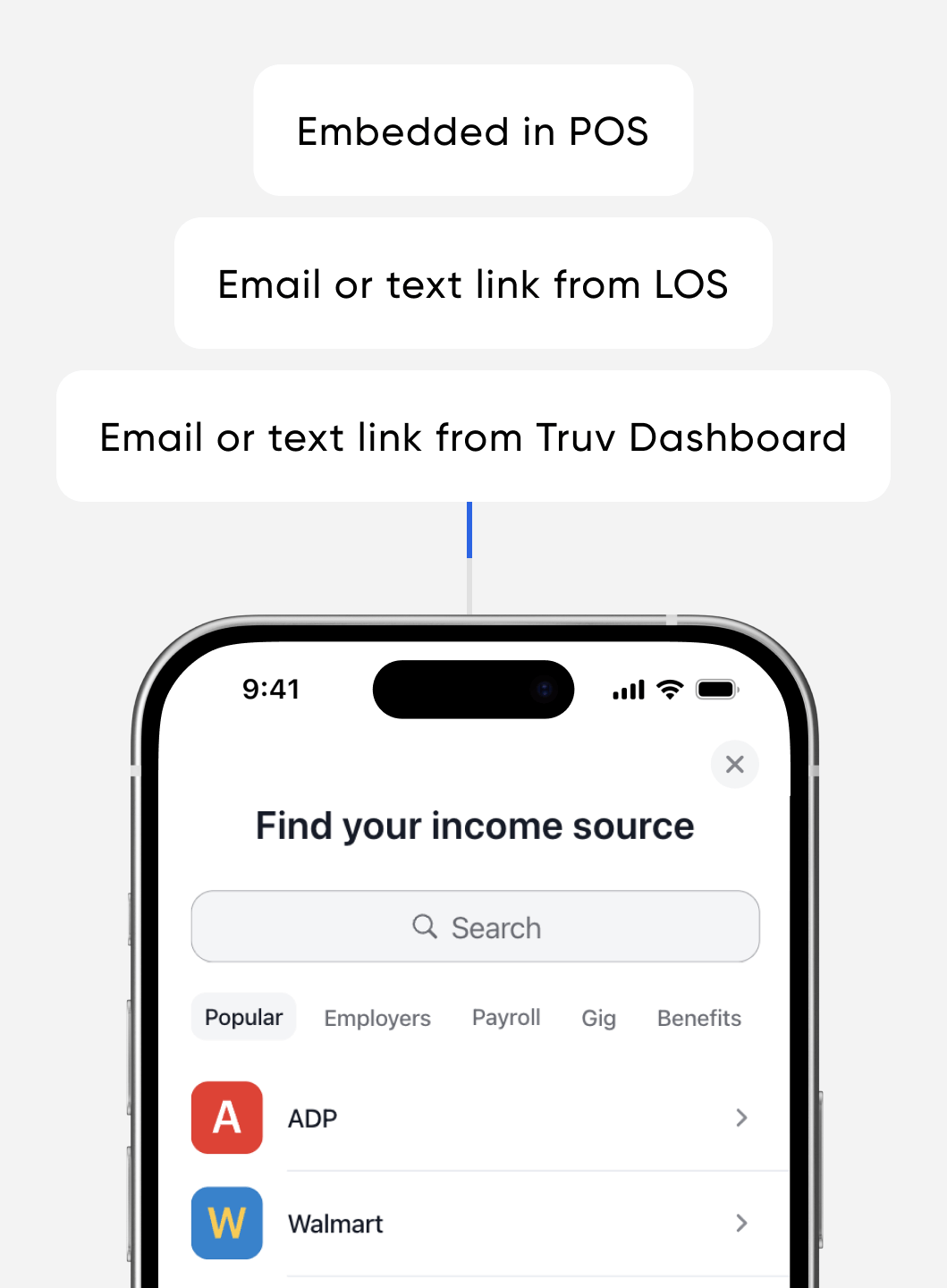

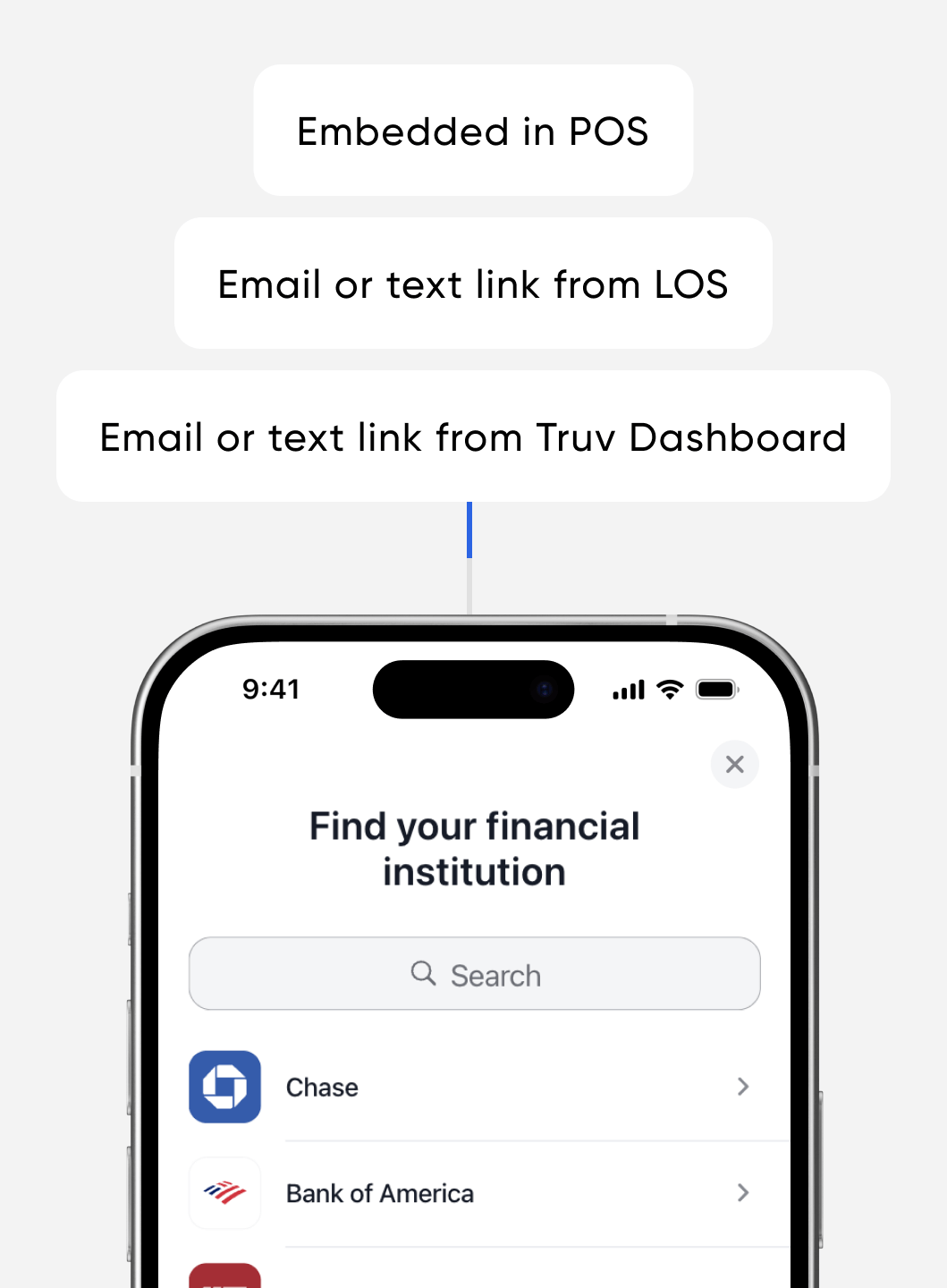

How it works.

How it works.

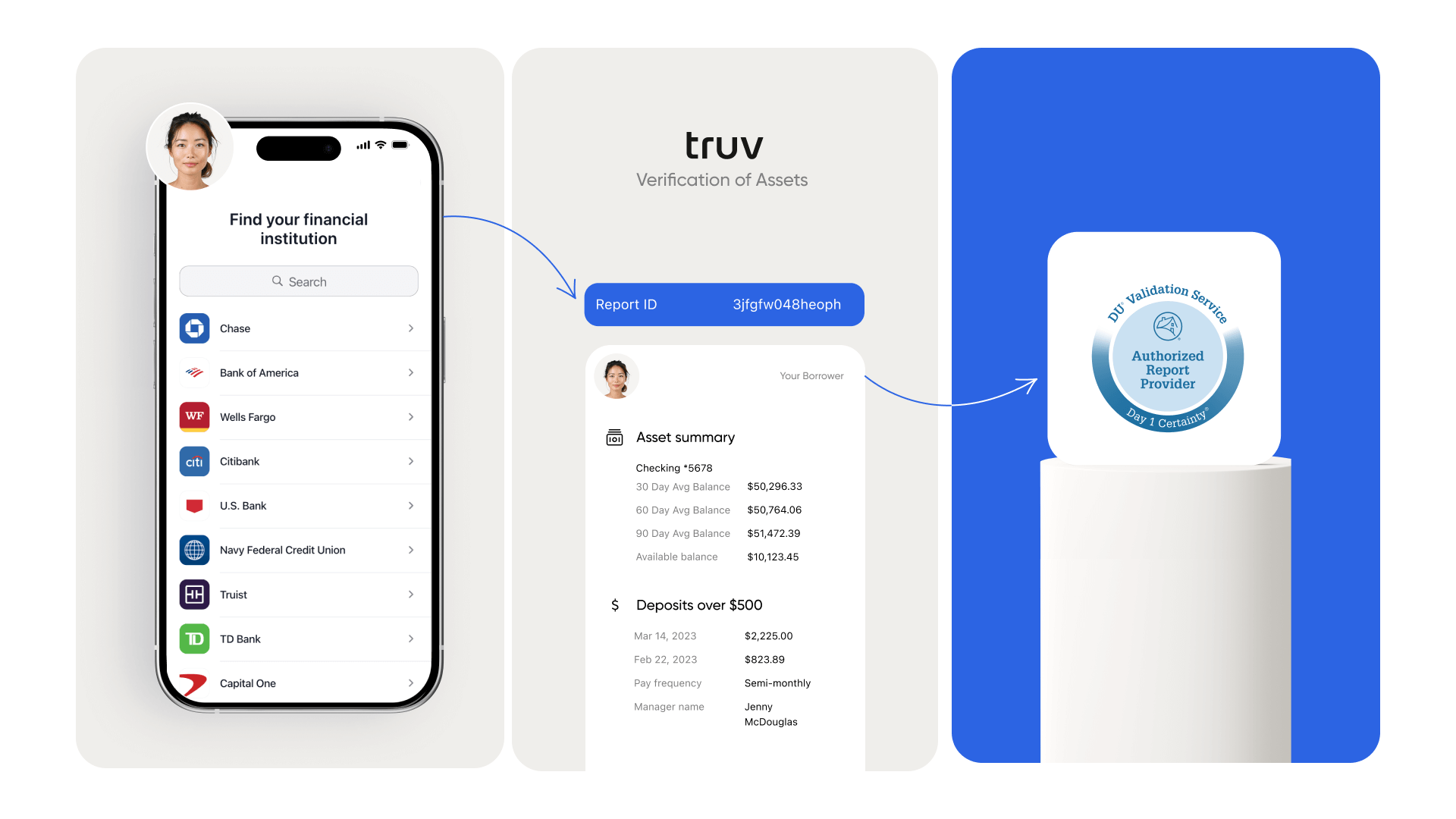

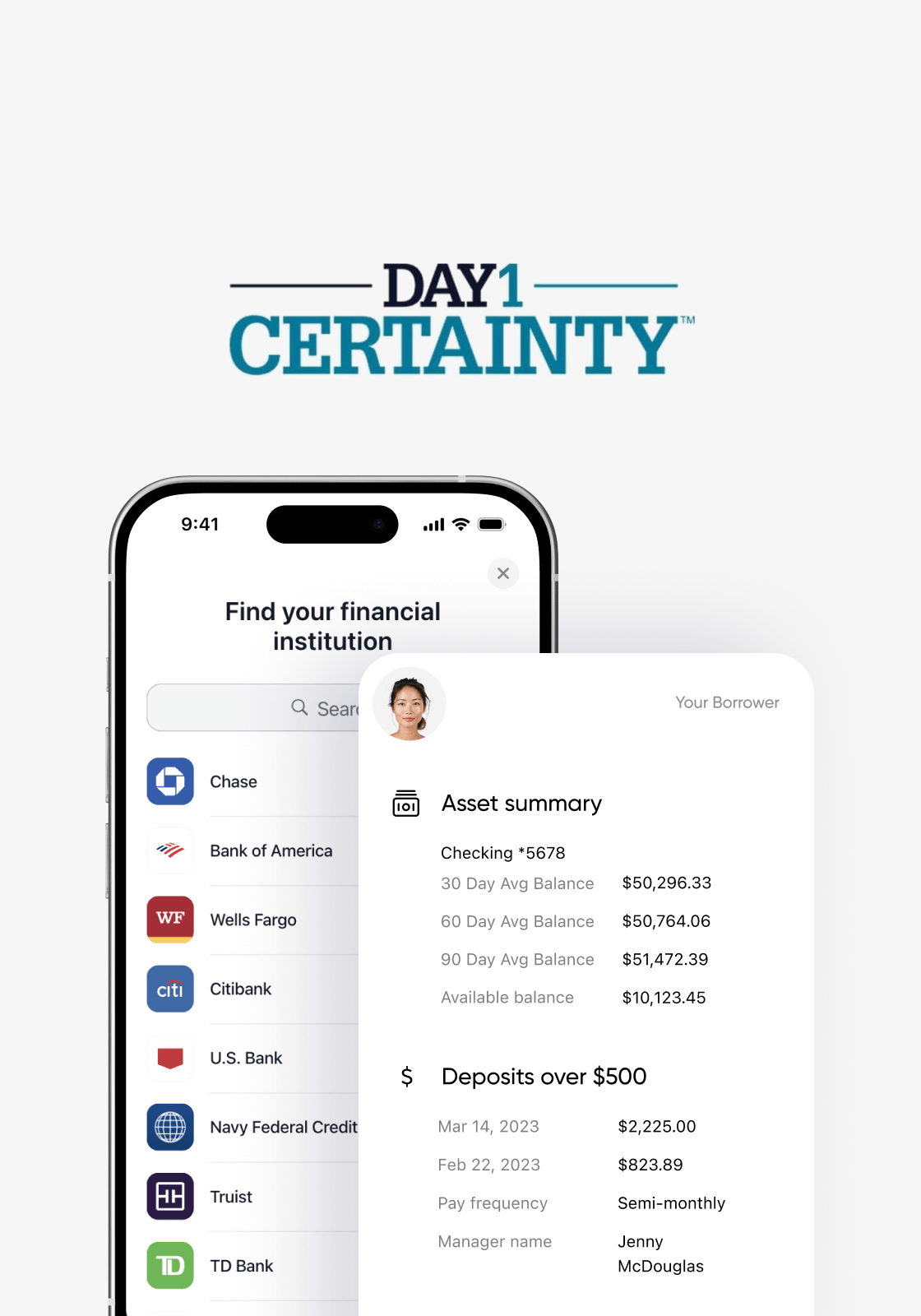

Asset verification.

Asset verification.

Verify borrower assets

using Truv reports with DU.

Verify borrower assets using Truv reports with DU.

Reduce operational costs.

Streamline large deposit verification.

Improve operational efficiency.

Enhance the borrower experience.

DU-Approved Reports

Rep and warrant relief.

DU on the validated loan components when using asset data from Truv.

Get Started

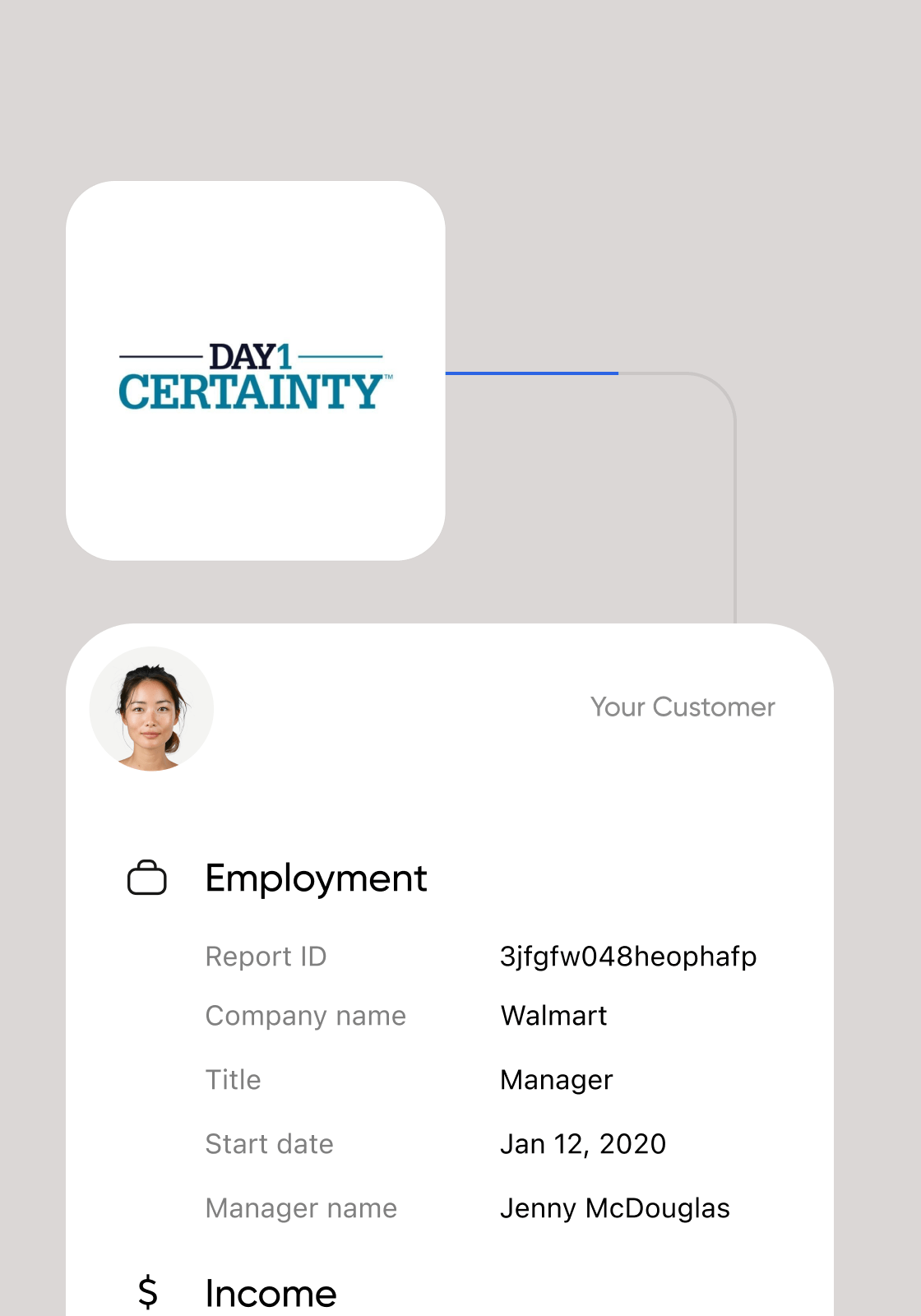

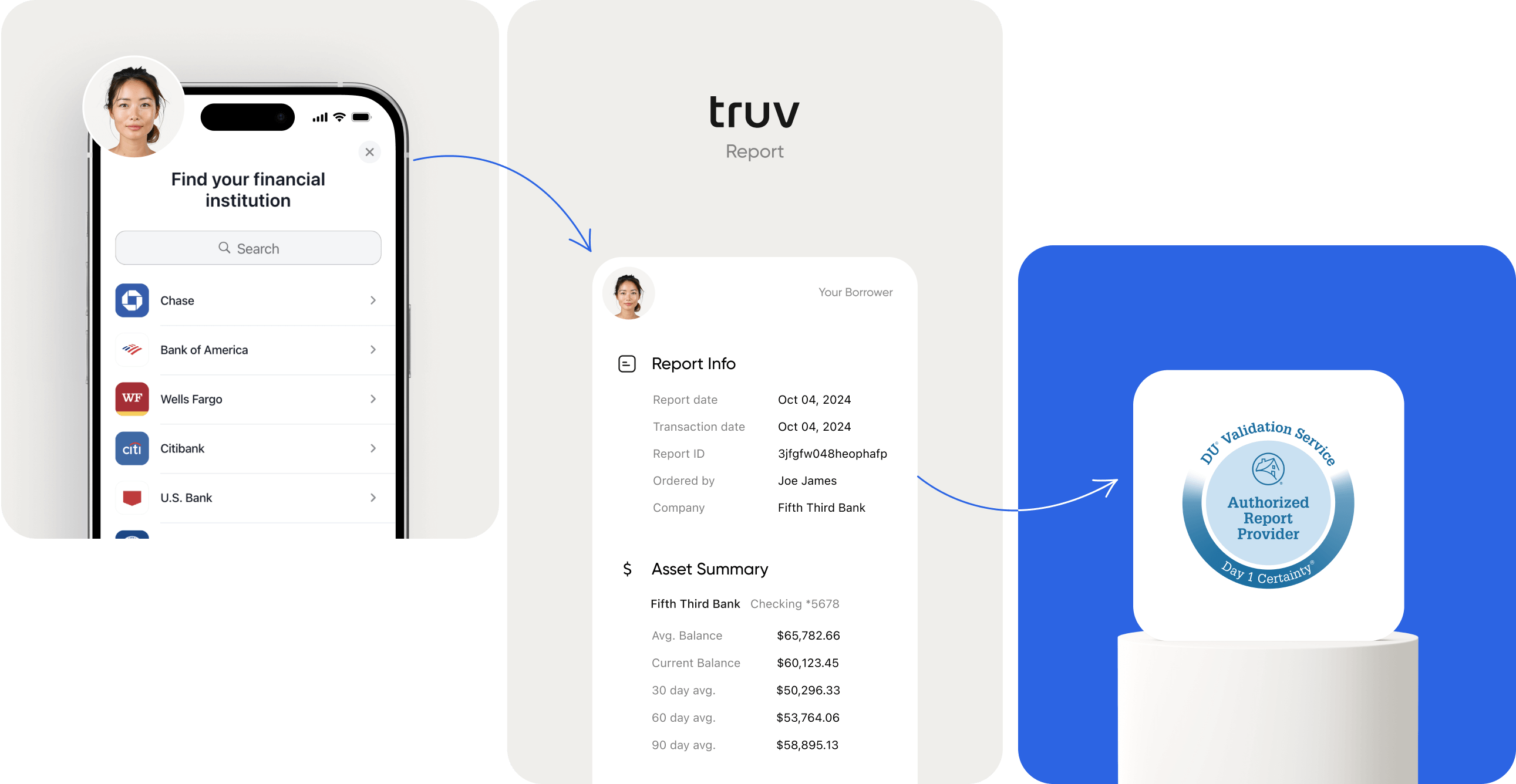

Validation with One Report

1 report, 3 validations.

Submit a single asset report to DU for validation of income, employment, and assets.

Get Started

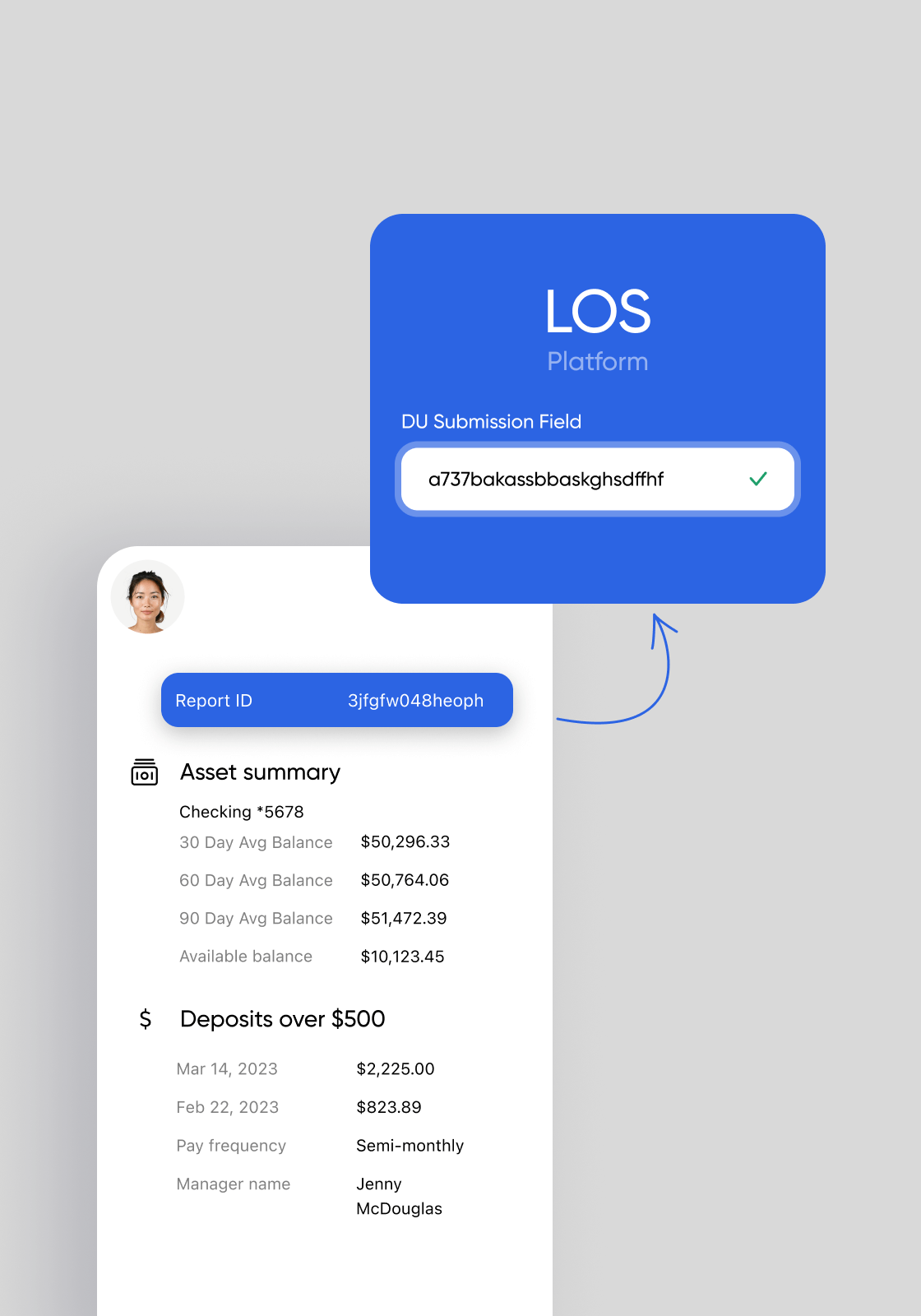

Fannie Mae DU

Report ID for submission to DU.

Report ID auto-generates and auto-populates in your LOS for seamless submission to DU.

Get Started

DU-eligible Reverifications

Reverification Report ID.

A Report ID auto-generates for reverifications and becomes eligible for DU.

Get Started

How it works.

How it works.

All-in-one platform

for verifications.

All-in-one platform for verifications.

Products & Solutions

Payroll Income & Employment

Highest conversion rate and data fill rates in the industry.

Paystubs & W-2s

Best-in-class OCR and fraud detection for pay documents.

Bank Assets

Highest oAuth rate and insights into bank assets & cash flows.

Mortgage Lending

Accelerate loan closing & reduce buy backs.

Platform

Peter Skarnulis

VP of Single-Family Digital Management Solution, Fannie Mae