Doc Upload

AI-driven document processing.

Mitigate fraud and seamlessly verify income.

One platform

5 reasons

to select Truv.

Detect fake documents

99.9% fraudulent detected.

Verify document authenticity, preventing fraud attempts.

Get Started

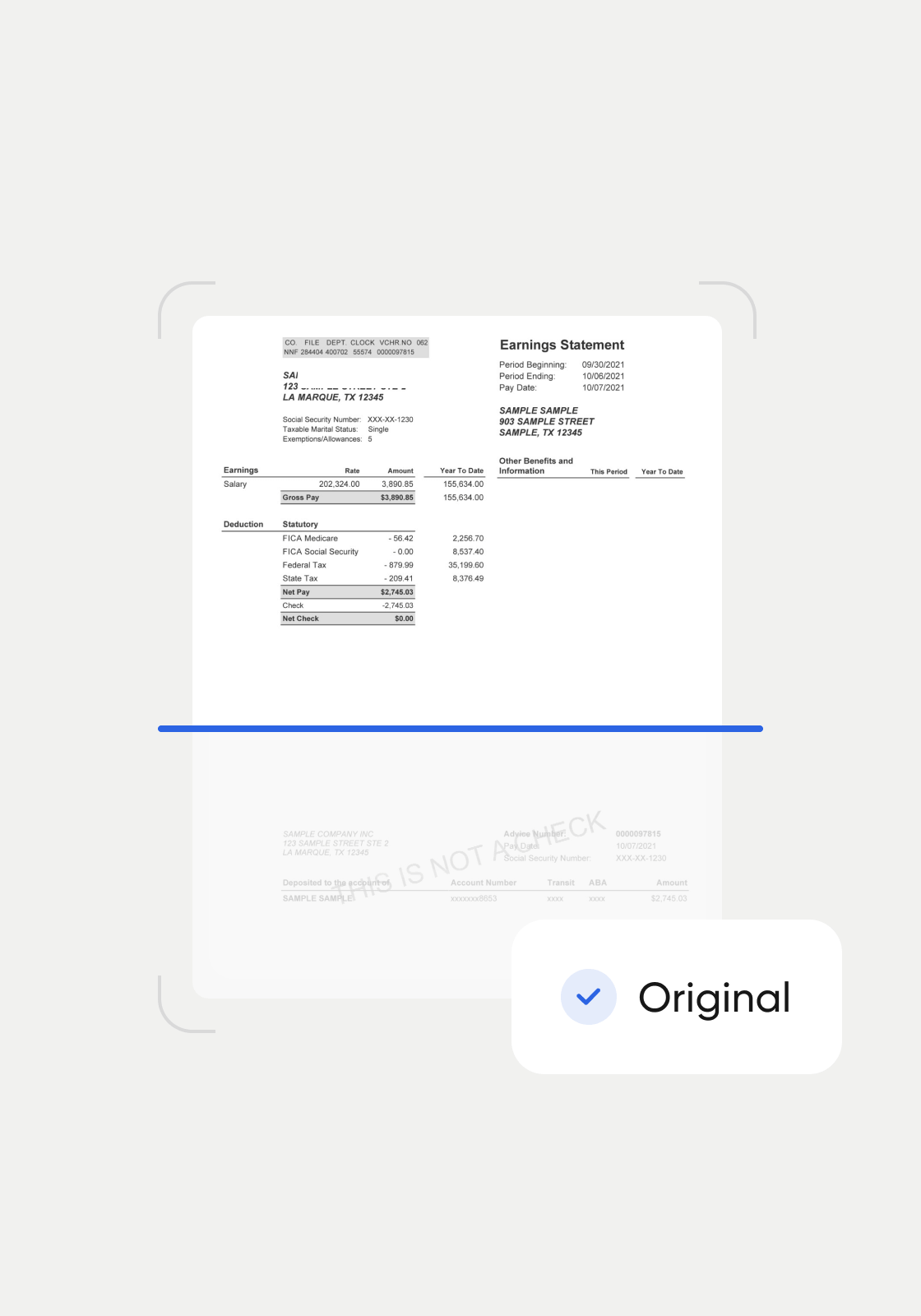

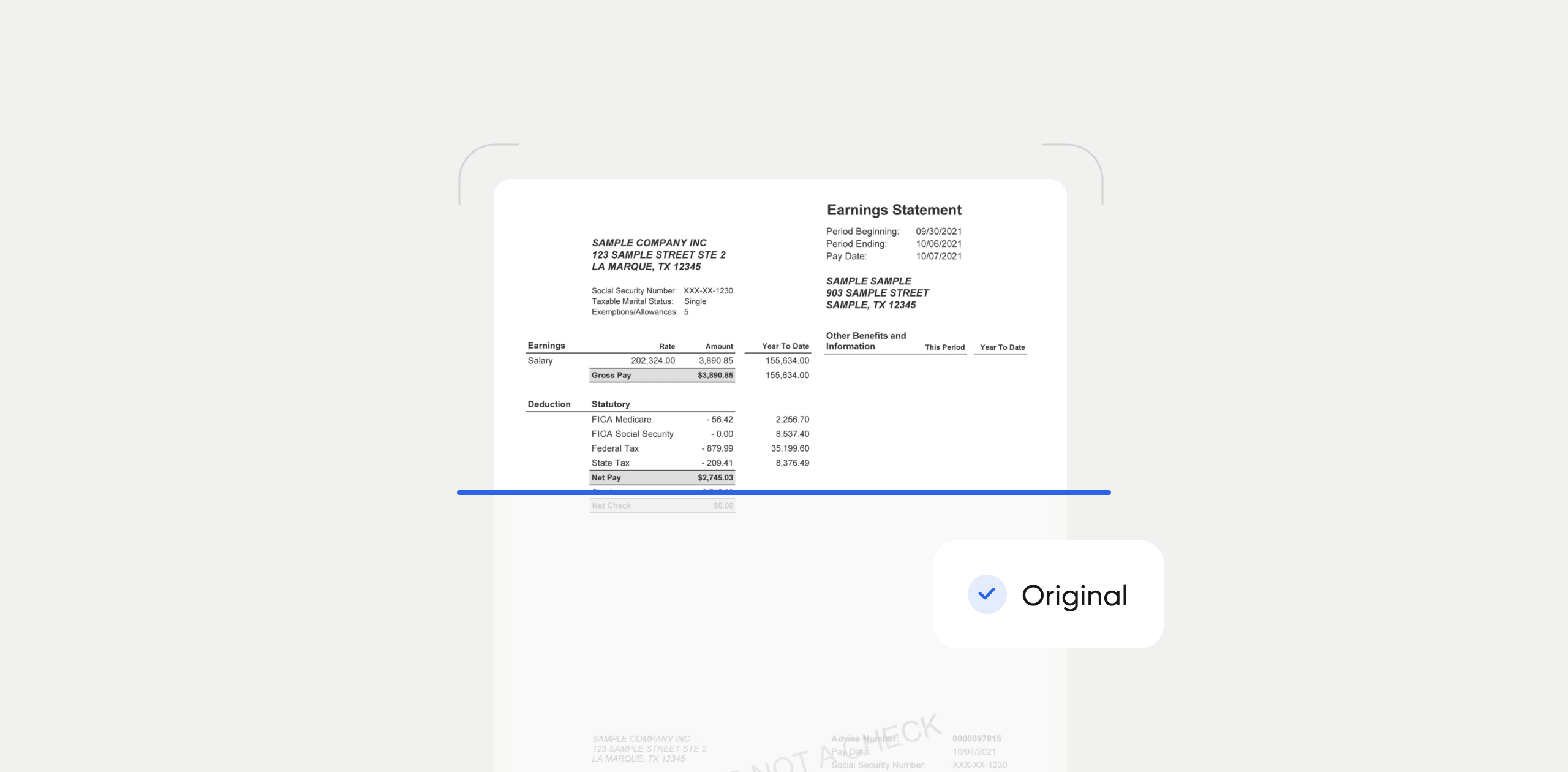

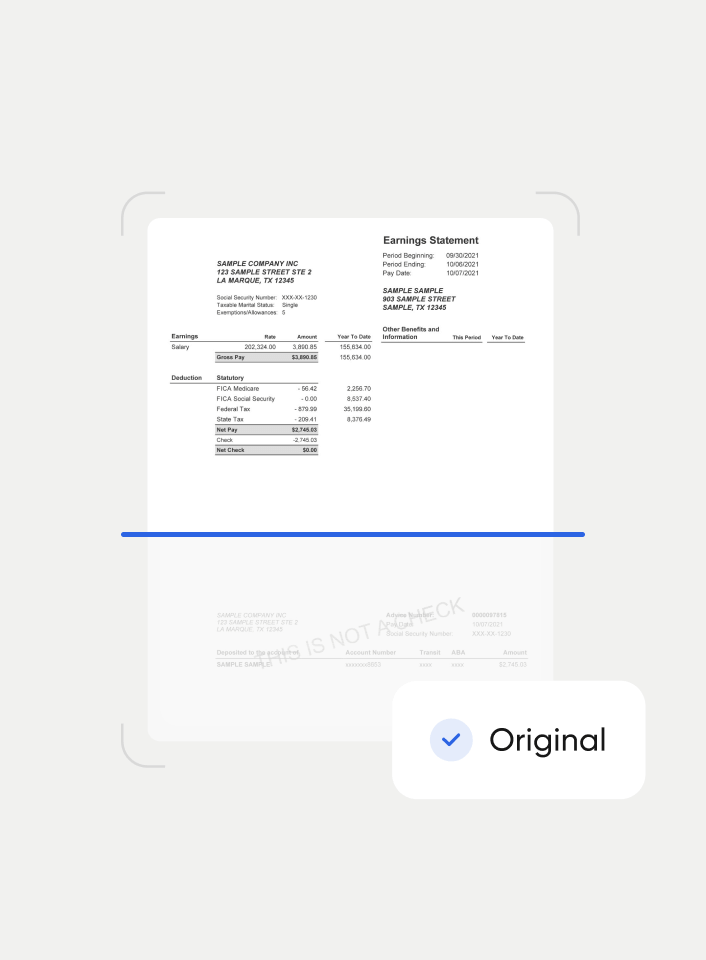

Fraud-checked Documents

Docs tampering detection.

Using a vast database, auto detect and restore altered fields.

Get Started

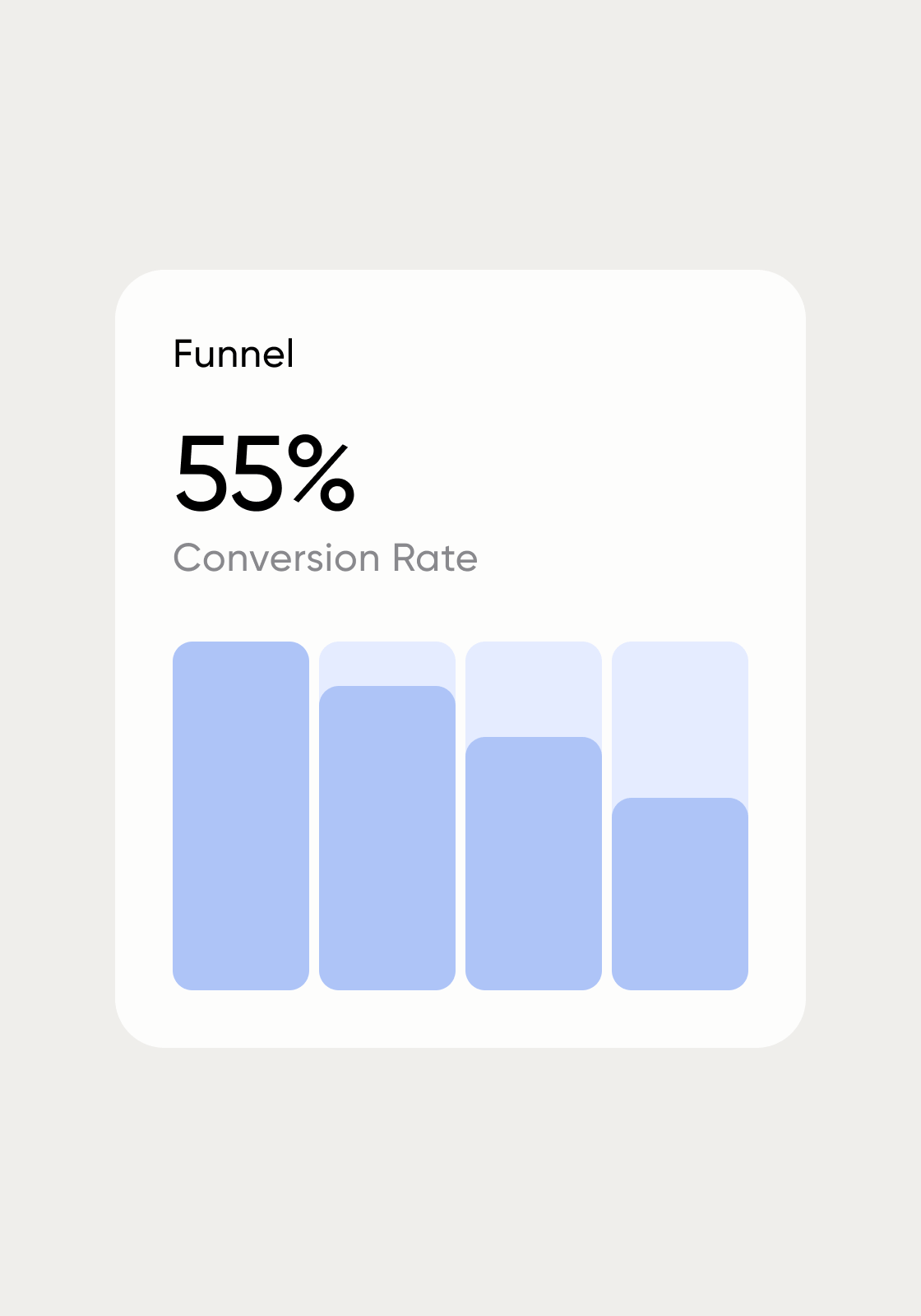

Growth

Speed and conversion.

Fast turnaround times and high conversion in document collection workflow.

Get Started

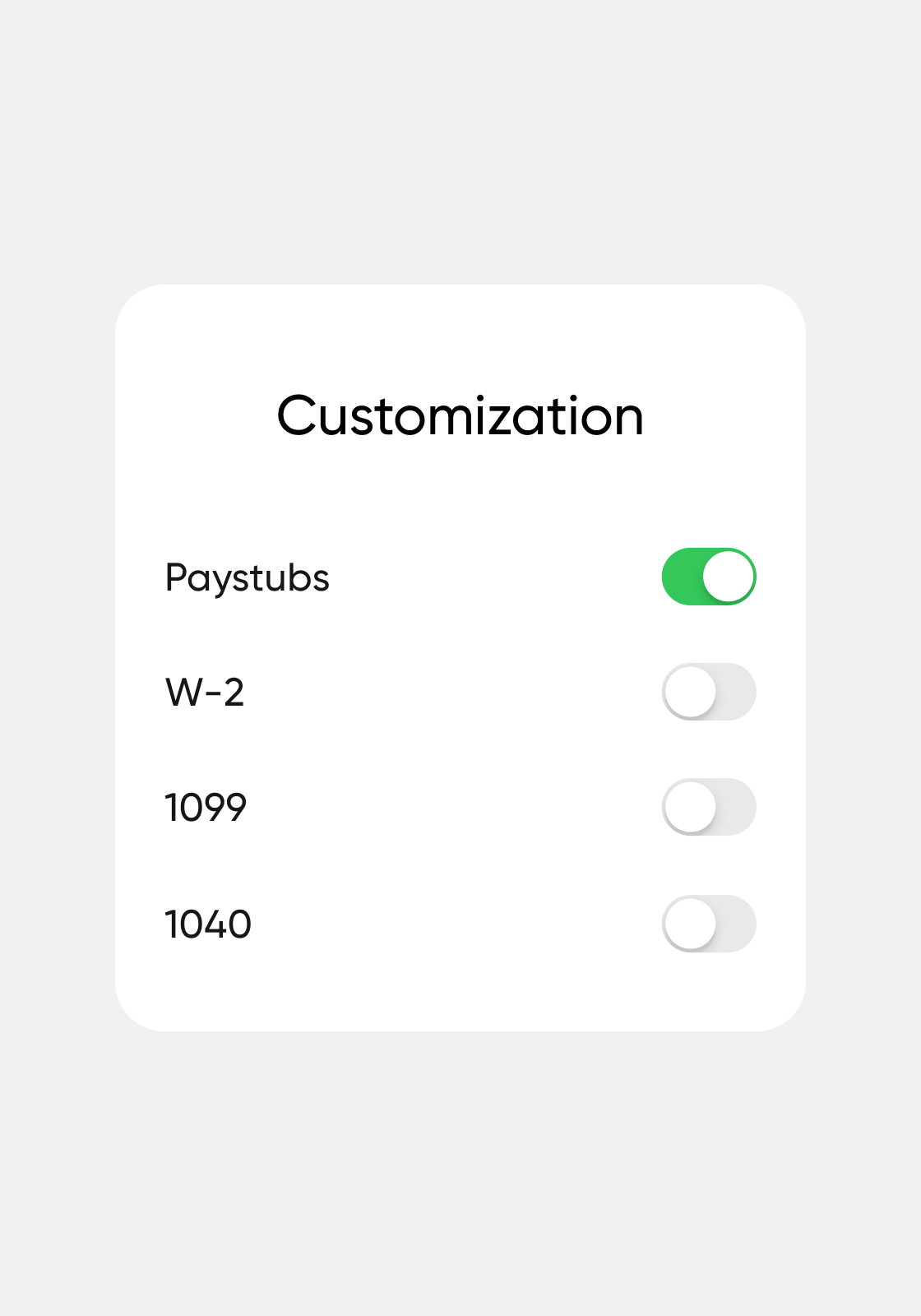

Customization

Unlimited customizations.

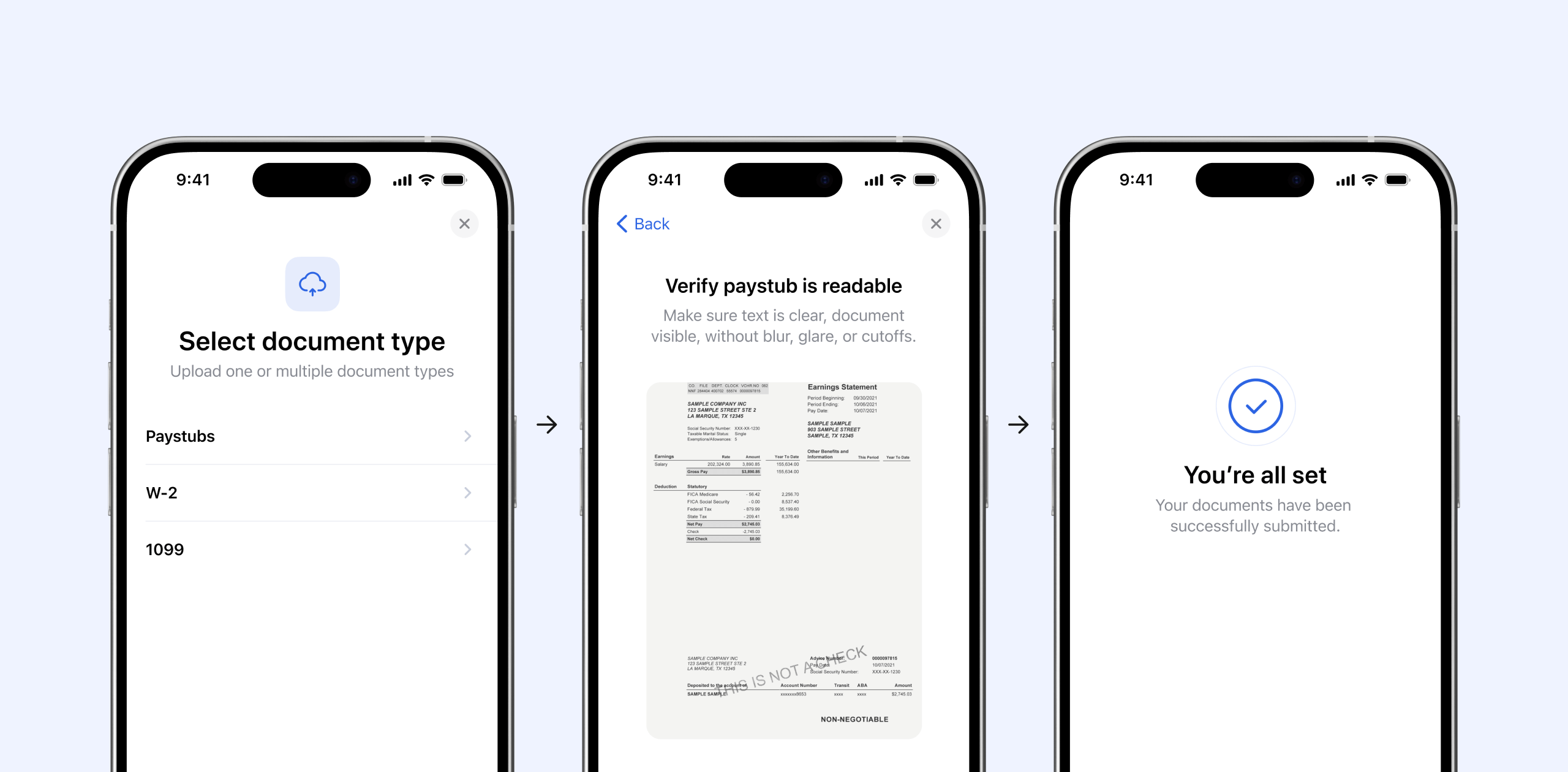

Customize the required docs and language for the perfect user experience.

Learn more

All-in-one platform

for verifications.

All-in-one platform for verifications.

Mortgage Lending

Accelerate loan closing & reduce buy backs.

Home Equity Lending

Truv instantly verifies income, employment & insurance.

Consumer Lending

Approve more loans. Reduce repayment risk.

Auto Lending

Instantly waive income stipulations.

Tenant Screening

Avoid income fraud. Accelerate approvals.

Background Screening

Fast and affordable employment verifications.

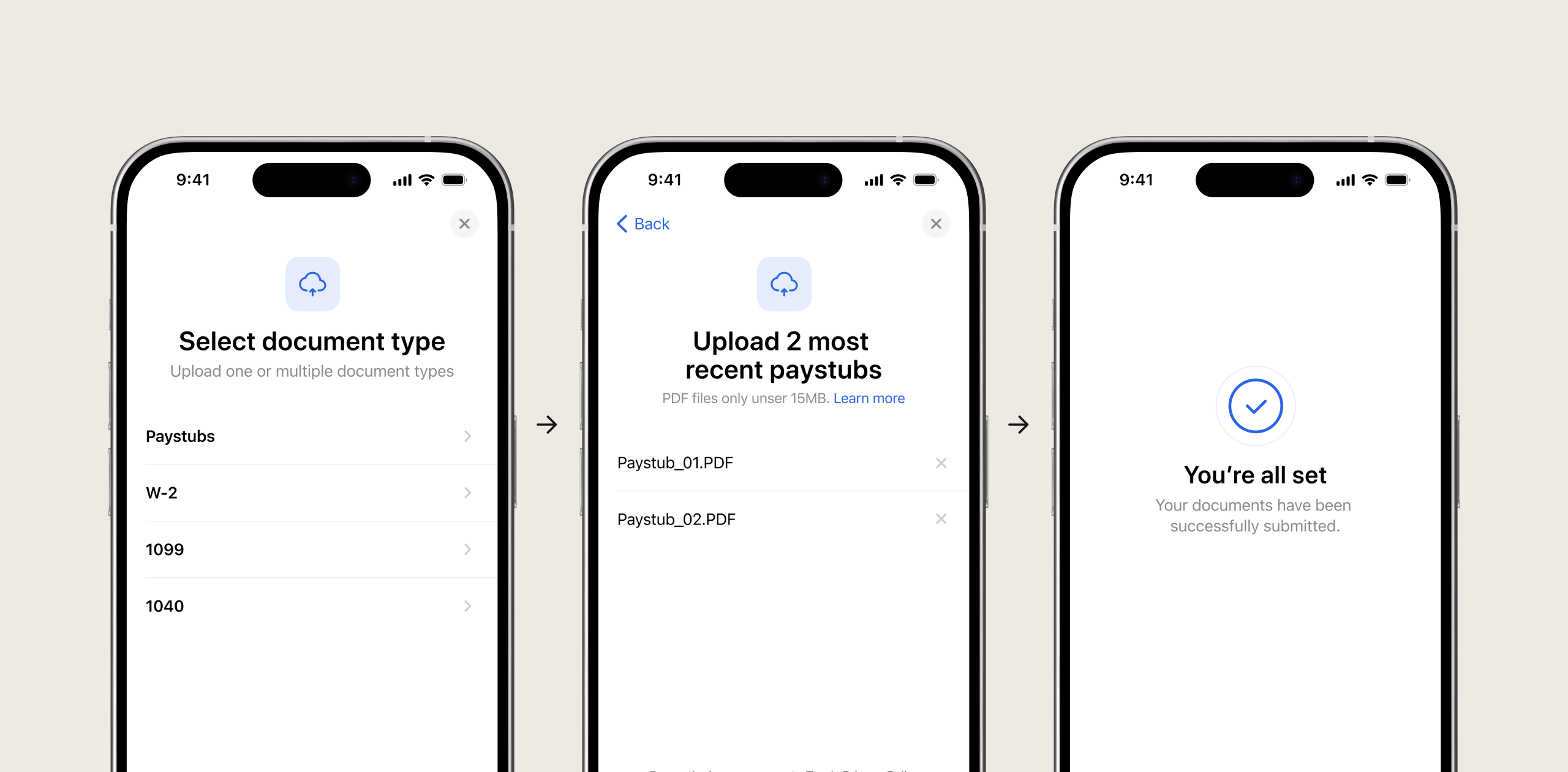

How it works.

How it works.

Document Upload FAQs.

Document Upload FAQs.

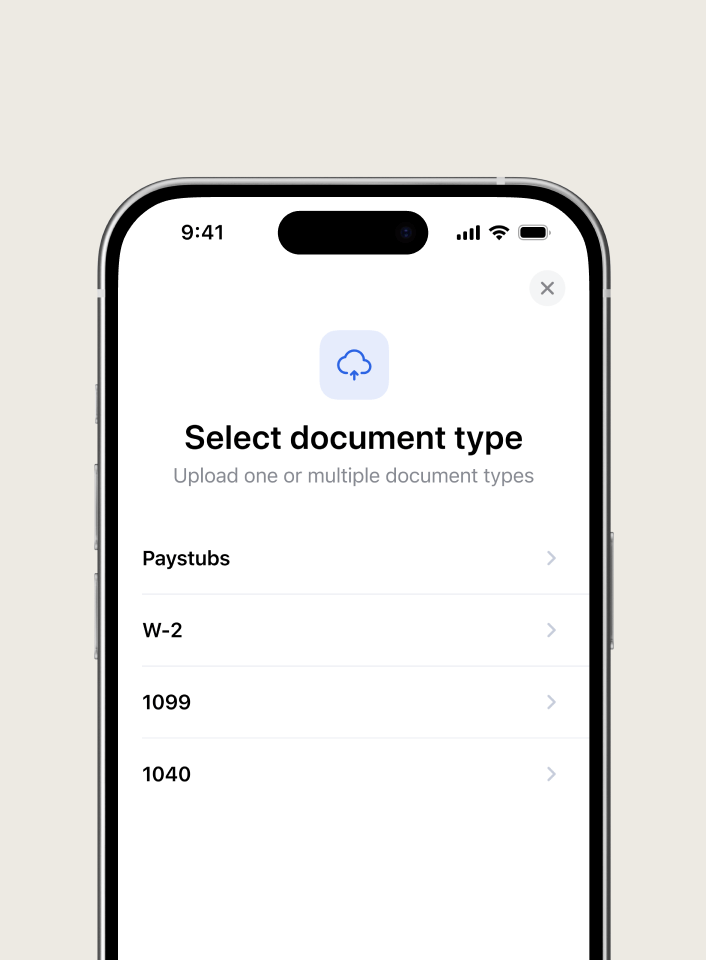

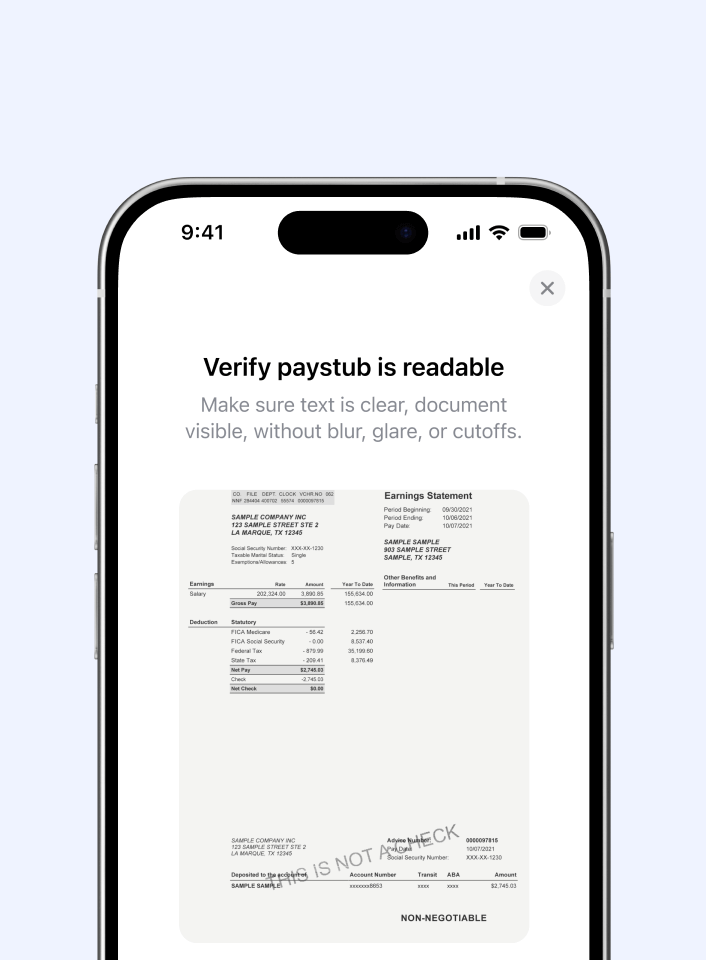

Designed as a fallback solution to consumer-permissioned income and employment verification, Truv’s Document Upload solution offers a streamlined experience for consumers to upload documents within the Truv interface. Also available through API integration, this solution empowers developers and businesses to incorporate document upload and verification capabilities directly into their platforms or applications, creating seamless and automated verification processes.

AI-based document processing typically refers to using artificial intelligence technologies to automate the extraction, analysis, and processing of information from various document types, including Optical Character Recognition (OCR), to convert images of text into machine-readable text to expedite the review process and minimize fraud.

As an integrated provider with Freddie Mac’s AIM Check API, Truv can deliver instant and automated assessment of paystub and W-2 data for lenders to use for their calculations of qualified income.

Truv is one of three providers to have a GSE certification for a Document Upload solution. While Truv specializes in direct-to-source data connections, our Document Upload feature provides a flexible alternative within a single interface for consumers. By offering both options, Truv provides a comprehensive verification waterfall, adaptable to various consumer needs, while maintaining the highest standards of compliance and reliability.

The platform supports document verification for PDFs, JPEGs, PNGs, and other file formats. It includes tampered element detection and field restoration to ensure document authenticity and integrity.

Truv provides full visibility into the verification process, returning both parsed data and the original borrower-uploaded documents. This comprehensive approach ensures thorough document review and analysis.

With a 99.9% fraud detection rate, Truv’s solution is designed to identify and flag potentially fraudulent or tampered documents across various file formats, providing an extra layer of security in the verification process.

Charlie Cafazza

Co-Founder at ClearChecks