Tenant Screening

Avoid income fraud with online tenant screening.

Access tenant screening with Truv’s waterfall — bank, payroll and document upload.

Easily verify income and employment

in minutes.

Easily verify income and employment in minutes.

Maximize conversion.

Accelerate approvals.

Reduce risks.

Why partner with Truv?

Why partner

with Truv?

Bridge

Verify borrowers instantly.

User experience optimized for high conversion and minimum friction.

Learn more

Quality

Use real-time,

accurate data.

Data and documents sourced directly from the source.

Learn more

Assets

Verify using bank accounts.

With over 13K+ financial institutions & AI- driven deposit detection.

Learn moreWaterfall

Use one platform for all verifications.

Every method you need to verify 100% of borrowers.

Learn moreGrowth

Reduce vacancy days.

Best conversion rate in the industry. Proven by A/B tests. Higher NPS for customers who used Truv.

Get Started

Trusted Data

Avoid income fraud.

Trusted data and documents directly from the source. Best-in-class fraud detection for paystubs.

Get StartedIncreased Efficiency

Reduce manual verifications.

Less dependency on manual labor and fixed expenses. 100% solution to verifications via Waterfall.

Get Started

All-in-one platform

for verifications.

All-in-one platform for verifications.

Tenant screening

verification process FAQs.

Tenant screening verification process FAQs.

Tenant screening is a comprehensive process used by landlords, property managers, and real estate investors to evaluate potential renters before signing a lease agreement. The primary goal is to minimize risk and find reliable, responsible tenants who will: pay rent on time. To verify an tenant’s financial status, tenant screeners use Truv for real-time income and employment verifications.

A tenant screener performs background checks on tenant applicants, which typically include criminal records, credit history, employment verification, and rental history. Truv's digital process empowers applicants to complete income and employment verifications in less than a minute, minimize the need for document collection.

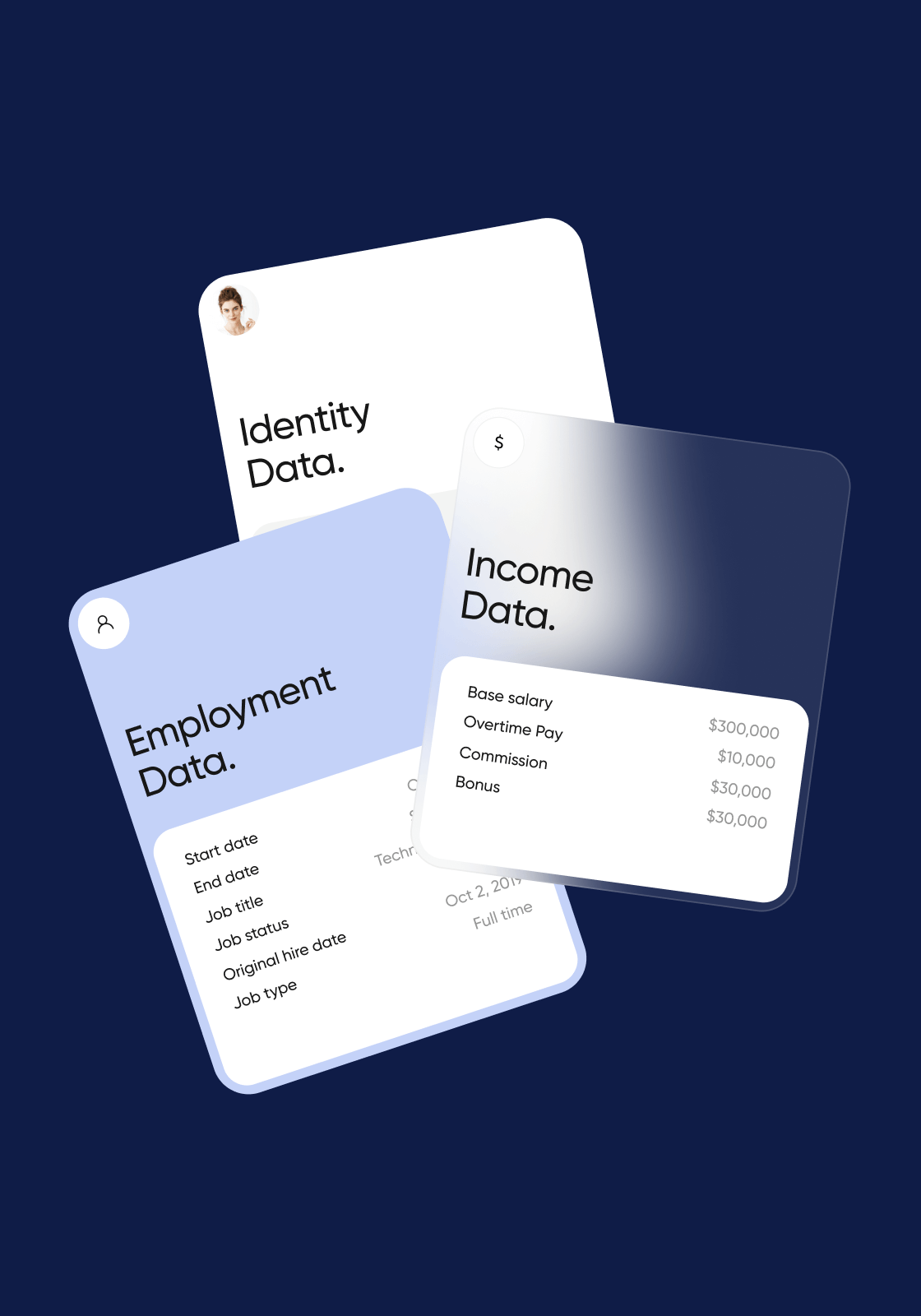

Truv offers comprehensive verification services for tenant screening, including payroll income verification, payroll employment verification, AI-driven document processing, bank income verification, and Smart Routing, a solution that combines bank and payroll data sources in a conversion-optimized experience.

Truv provides an all-in-one verification platform that enables property managers and tenant screeners to instantly verify income and employment with direct-to-source, real-time data. Our waterfall approach combines payroll verification, bank data analysis, and document verification in one seamless process.

Truv combats rental application fraud through supplying tenant screeners with:

- Direct-source payroll data verification;

- Direct-to-source bank data;

- Advanced OCR and 99.99% fraud detection for submitted documents (W2s & paytsubs);

- Real-time verification of employment status.

Our platform is designed for rapid implementation with minimal technical requirements. The system can be integrated into existing tenant screening workflows through our API or direct integrations. Most properties can begin verifying applicants within days of implementation, with full training and support provided by our dedicated team.

We maintain the highest level of security standards, protecting sensitive applicant information with industry-leading encryption protocols, including Advanced Encryption Standard (AES-256) & Transport Layer Security (TLS) keep personal information safe. Our platform is built to help you maintain regulatory requirements while streamlining the application process through safe connections to payroll providers & banks.

Joshua Yowell

Director of Operations at BetterNOI