Unlock the power of open finance.

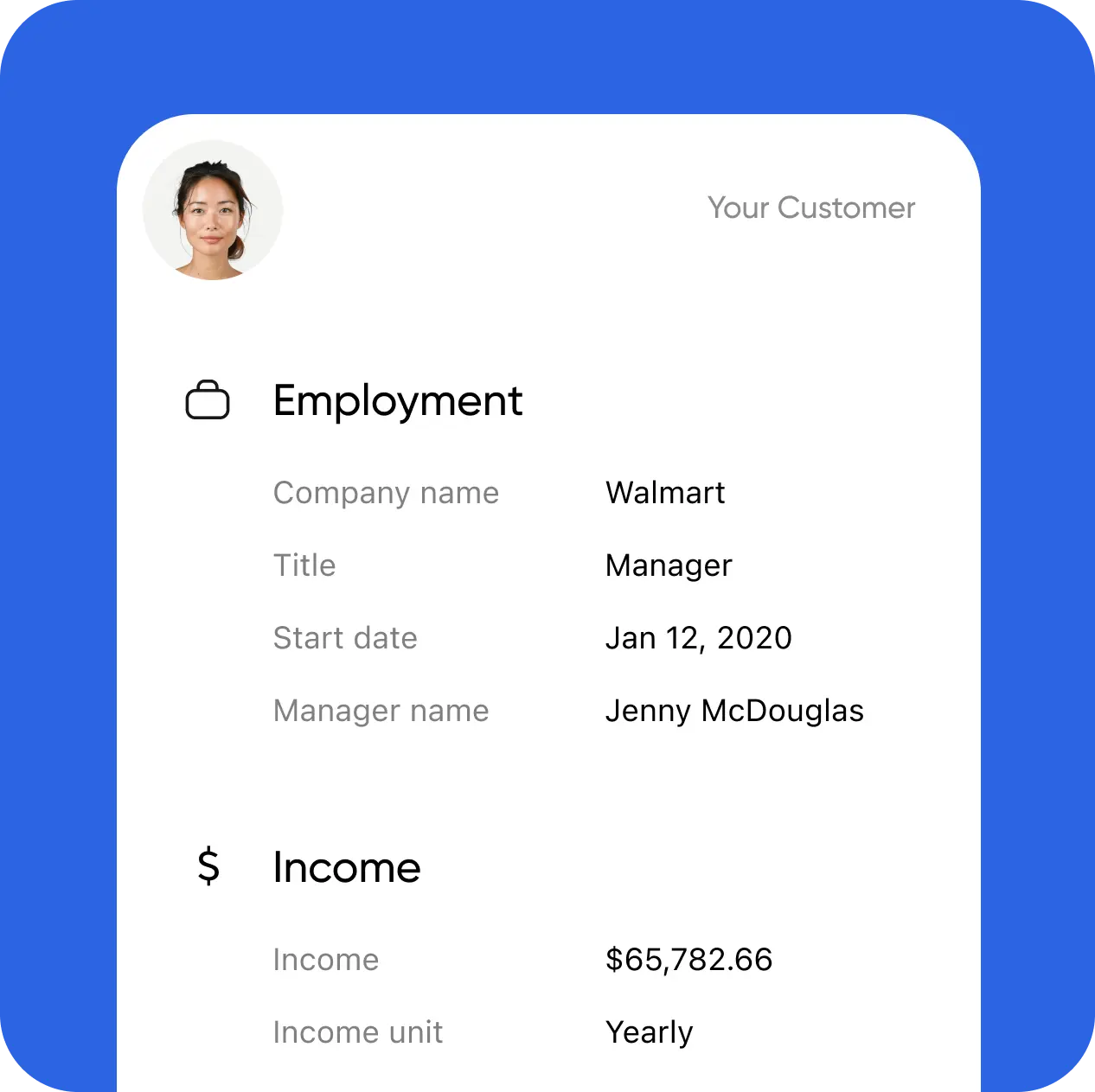

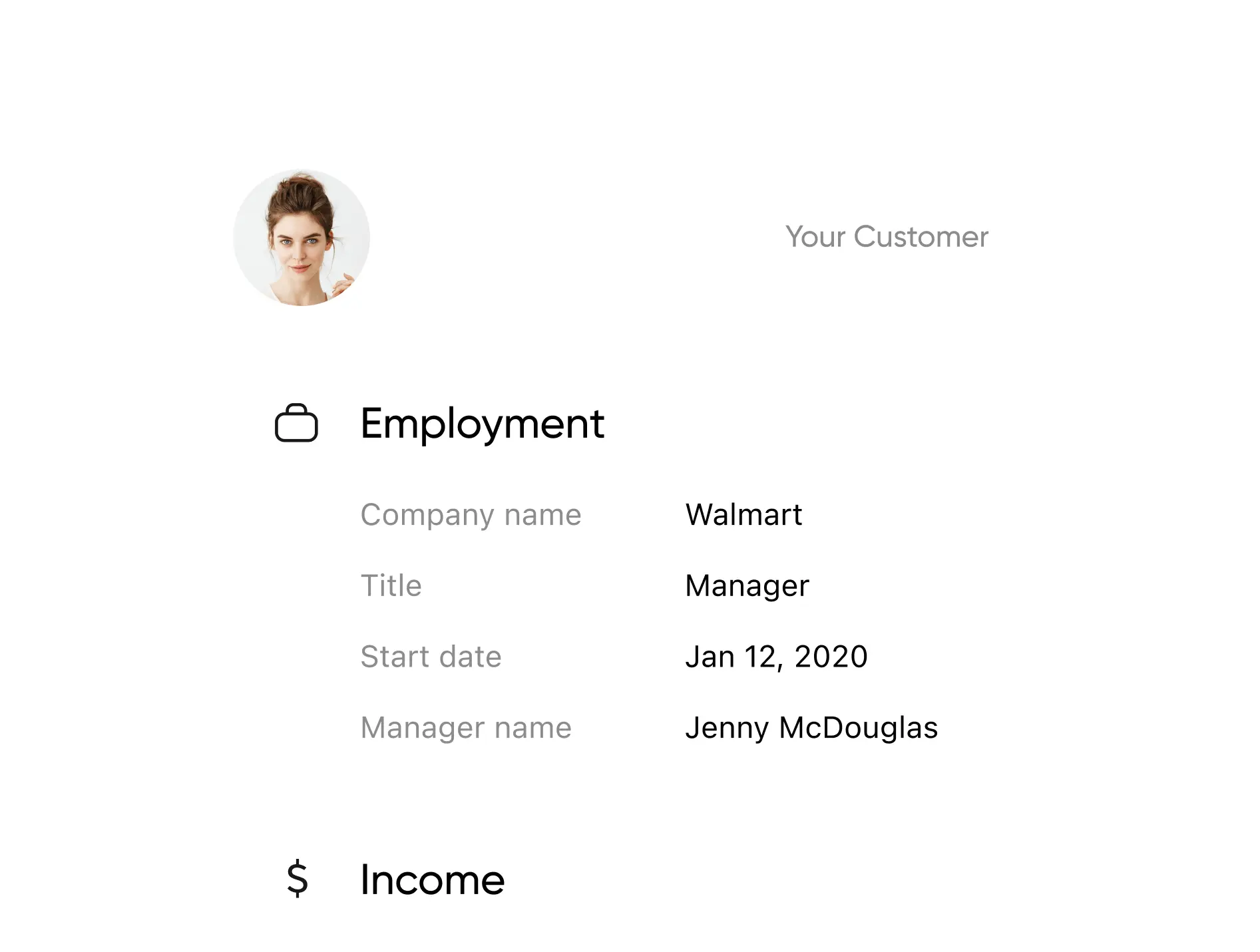

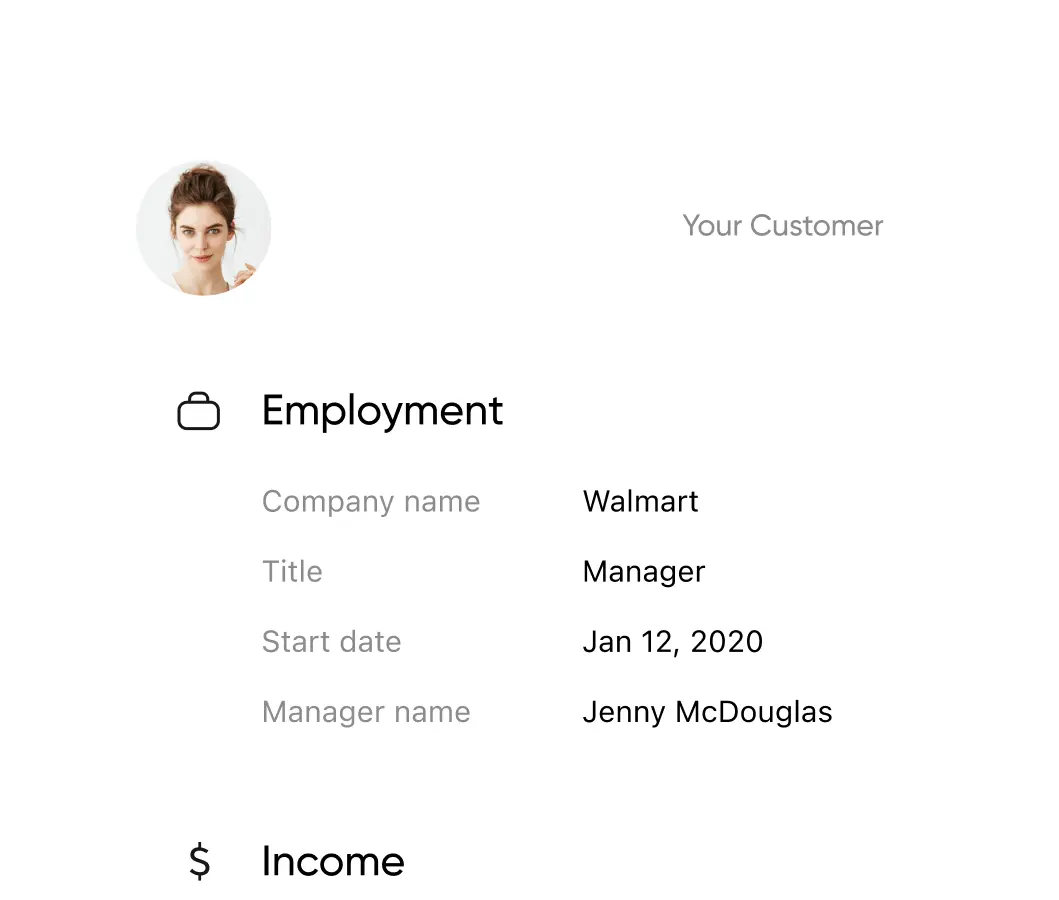

Truv makes it easy to verify income, employment, assets, insurance, and switch direct deposits.

Mortgage Lending.

Mortgage Lending.

Income & Employment. Assets. Home Insurance.

Learn more

Consumer Lending.

Consumer Lending.

Cash Flow. Income & Employment. Payroll Pay.

Learn more

Retail Banking.

Retail Banking.

Account Primacy. Direct Deposit Switch.

Learn more

Tenant Screening.

Tenant Screening.

Income & Employment. Rental Insurance.

Learn more

How It Works

One platform

Make confident decisions.

Make confident decisions.

The only unified platform purpose-built for organizations to make confident decisions.

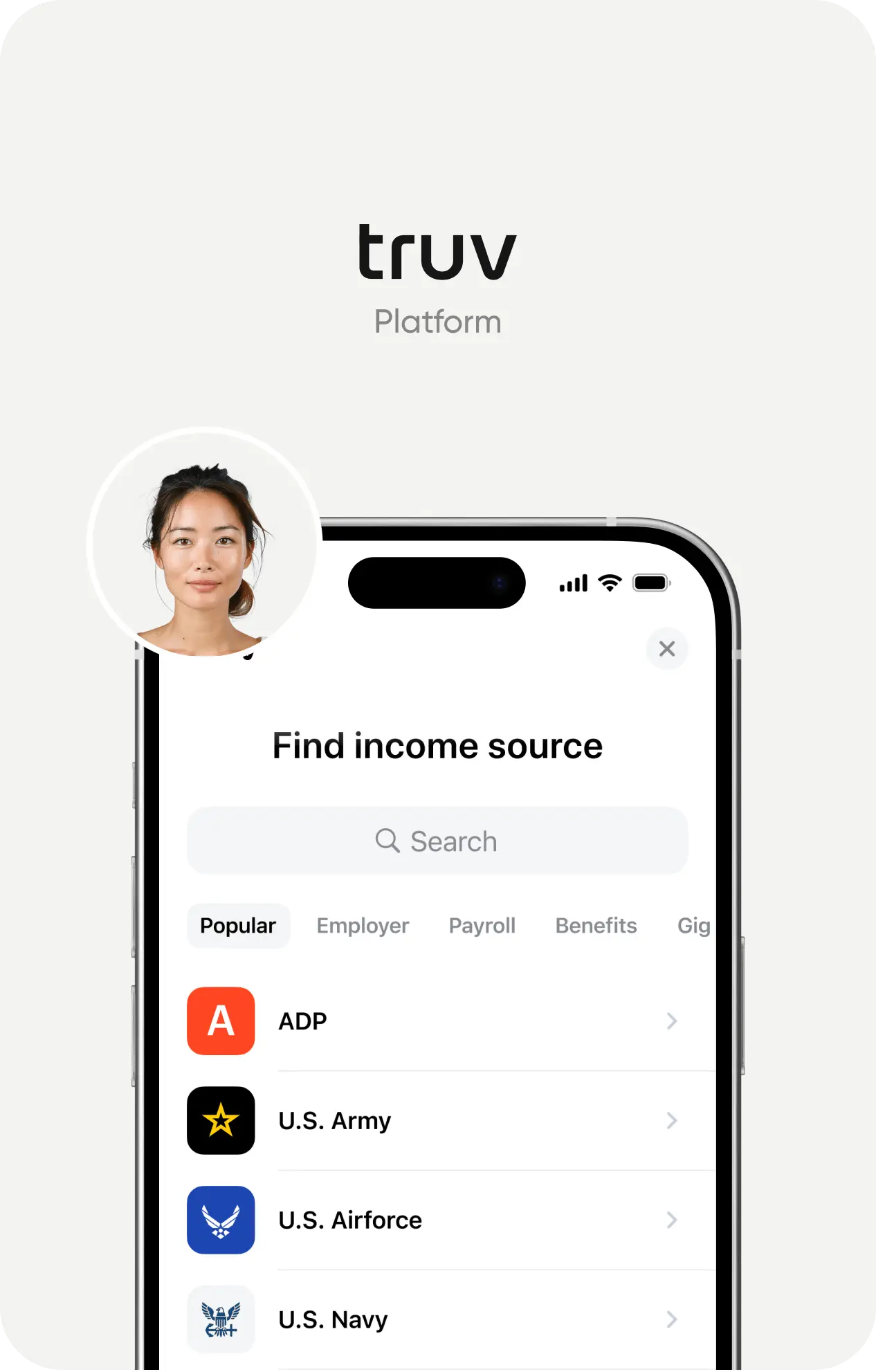

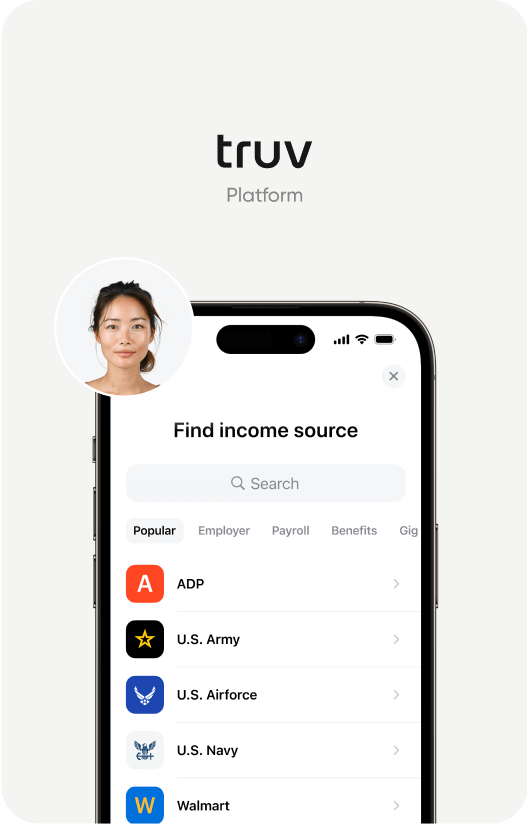

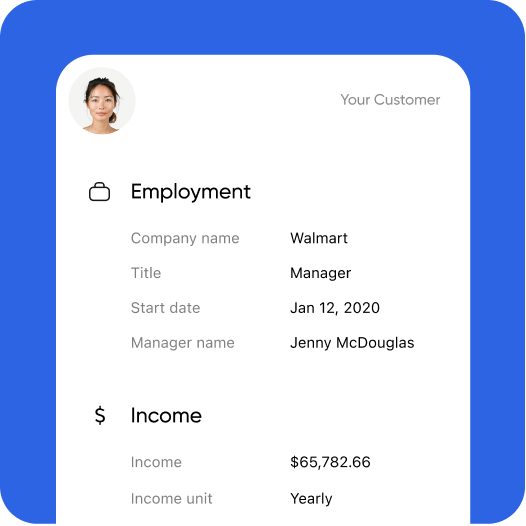

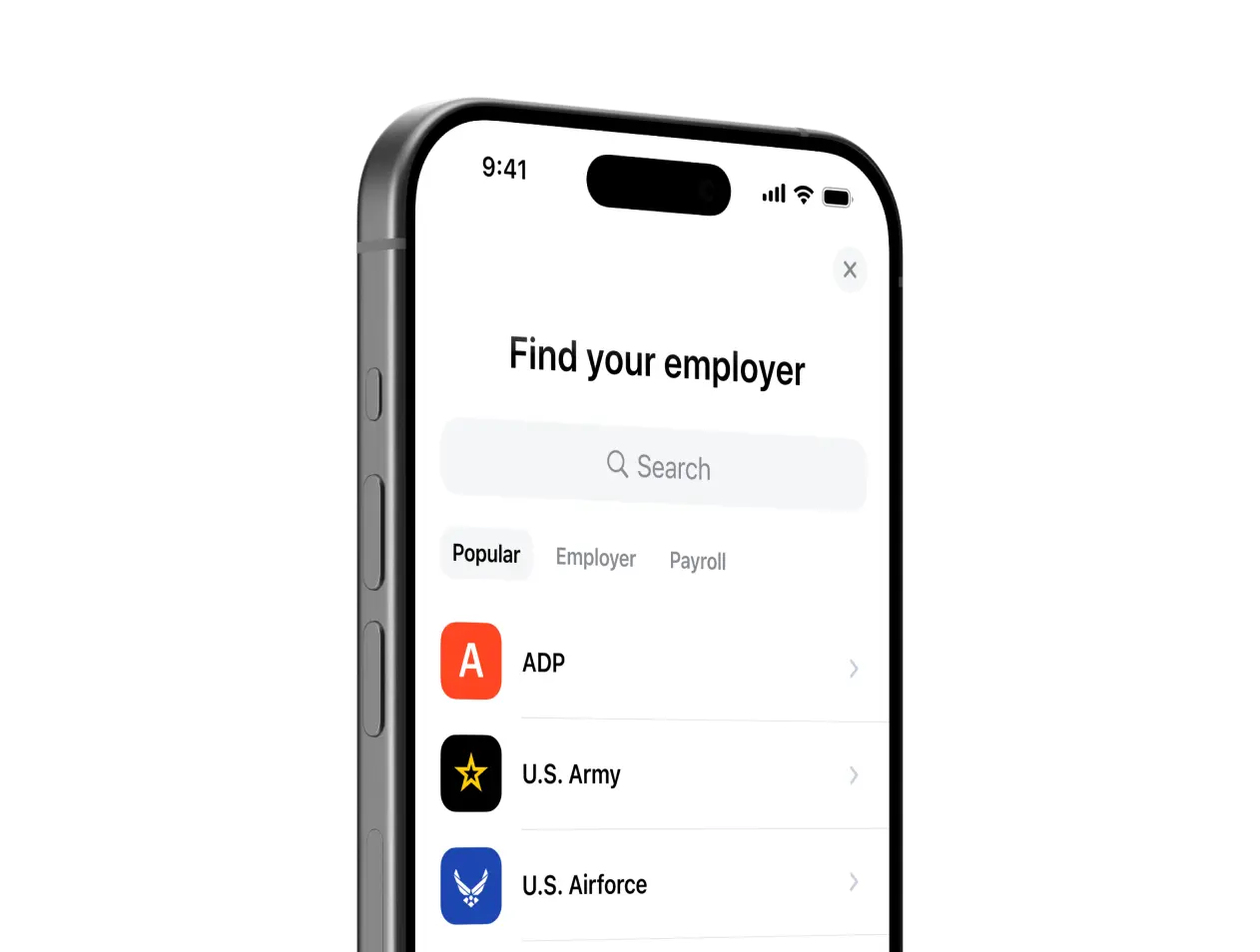

Truv Bridge

Industry-leading conversion rates.

Delight your users with a seamless user experience.

Learn more

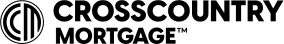

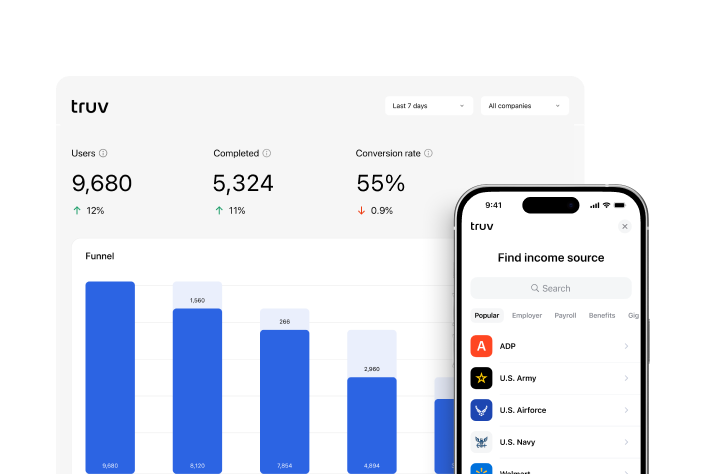

Truv Dashboard

Enterprise-ready tools.

Delight your developers and operations team with best-in-class dashboard.

Learn moreIntegrations

Quick implementation.

Integrations with top industry platforms including Encompass, nCino and more.

See IntegrationsWaterfall

Complete solution.

A fully integrated suite of products that play well together.

Learn more