Auto Lending

Instantly waive income stipulations.

Minimize risk, close more loans.

Easily verify income, employment and

auto insurance in minutes.

Easily verify income, employment and auto insurance in minutes.

Maximize conversion.

Accelerate approvals.

Reduce risks.

Why partner with Truv?

Why partner

with Truv?

Bridge

Verify borrowers instantly.

User experience optimized for high conversion and minimum friction.

Learn more

Quality

Use real-time, accurate data.

Direct to source data. Approved by Freddie Mac and Fannie Mae.

Learn more

Assets

Verify using bank accounts.

With over 13K+ financial institutions & AI- driven deposit detection.

Learn more

All-in-one platform

for verifications.

All-in-one platform for verifications.

Auto lending

verification FAQs.

Auto lending verification FAQs

Direct auto lending involves obtaining a loan directly from a financial institution before visiting a dealership. Indirect auto lending involves when a dealership arranges financing through multiple lenders. Truv's income and employment verification solutions, as well as auto insurance verification solution, are designed to improve the workflows for both direct and indirect auto lenders.

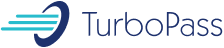

Truv offers comprehensive verification services for auto lenders and dealers, including income verification, employment verification, document processing, scoring attributes, paycheck pay, auto insurance verification. Our all-in-one platform is designed to optimize conversion and streamline the verification process for auto lenders and dealers.

Truv accelerates auto loan decisions through instant income and employment verification, allowing you to waive income stipulations immediately. Our platform combines employment verification, income validation, and auto insurance verification in one seamless process, enabling dealers and lenders to complete verifications while the customer is still on the lot. This comprehensive approach has helped lenders like OpenRoad Lending save their customers an average of $100 monthly through efficient refinancing.

Truv SmartRouting is designed to handle the unique challenges of auto lending, where quick decisions are crucial for closing deals. The system automatically selects and presents the most efficient verification path to each applicant, either payroll provider or bank account, resulting in a seamless, conversion-optimized flow. This flexibility and speed-driven product ensures you can serve more applicants with a faster experience, maximizing your ability to close more loans while applicants are still engaged.

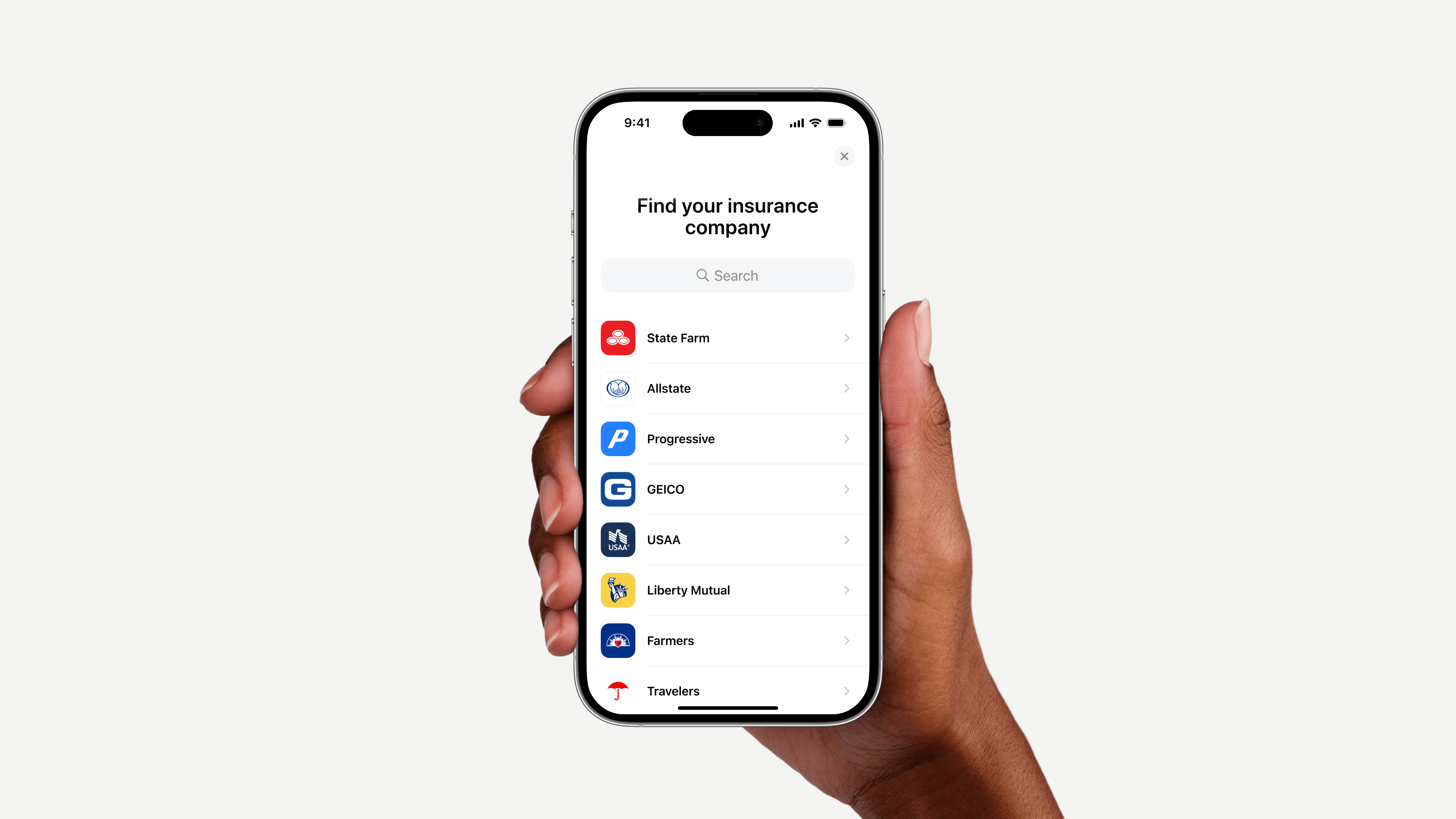

Truv’s all-in-one platform provides access to income verification and employment verification with instant auto insurance verification, streamlining two critical components of auto lending from one vendor. Our solution verifies insurance coverage in real-time, helping you meet compliance requirements and close loans faster. This integrated approach eliminates the traditional delays associated with insurance verification, significantly reducing time-to-close for auto loans.

Auto lenders using our platform report significant improvements in key metrics: dramatically reduced verification times, higher application completion rates, and increased closing ratios. The ability to instantly verify income, employment, and insurance means dealers can complete more deals while customers are still on the lot. Our automated verification process has helped lenders like OpenRoad Lending modernize their refinancing operations and improve customer satisfaction. Review TurboPass case study

Our platform provides multiple layers of risk mitigation specifically designed for auto lending. Beyond standard income and employment verification, we offer real-time insurance verification and direct paycheck-based loan repayment options. Our system analyzes transaction data to verify income stability and provides insights into debt-to-income ratios, helping you make informed lending decisions while maintaining strong risk management practices.

We maintain the highest level of security standards, protecting sensitive borrower information with industry-leading encryption protocols. Our platform is built to comply with auto lending regulations, helping you maintain regulatory requirements while streamlining the lending process. Truv’s encrypted platform delivers safe connections to payroll providers & banks. The combination of the Advanced Encryption Standard (AES-256) & Transport Layer Security (TLS) keep personal information safe.

Jeff Austin

CFO at OpenRoad Lending