income and employment verification

Instant income and employment verification.

Automated online income verification in minutes.

Payroll VOIE.

Highest conversion rates in the industry and quality of data. Approved vendor by Fannie Mae D1C and Freddie Mac AIM.

Learn moreVerify using bank accounts.

With over 13K+ financial institutions & AI- driven deposit detection.

Learn more

Document upload.

Automated best-in-class OCR and AI-driven fraud detection. Income calculation approved by Freddie AIM.

Learn more

Waterfall.

Each request is analyzed and routed to the best verification method based on millions of historical transactions.

Learn moreTax Returns.

Unlock self-employed borrowers by collecting tax returns from tax prep software.

View docs

Justin Venhousen

COO at Compass Mortgage

“Truv has given us the ability to lower costs, all

while speeding up the verification process and

providing better employment data for our

operations team. Truv has been a great

partner for Compass Mortgage.”

“Truv has given us the ability to lower costs, all while speeding up the verification process and providing better employment data for our operations team. Truv has been a great partner for Compass Mortgage.”

Cost Savings

Proven ROI & cost savings.

Consistent, transparent pricing. Provide lower fees and interest rates to your customers.

Get StartedReduce Risk

Reduce risk & fraud.

Decreased fraud risk with data directly from the source. Lower risk of repurchases.

Get StartedIncreased Efficiency

Increase employee efficiency.

Customers who use Truv verifications suite have higher NPS, close faster and more often.

Get Started

Growth

Improve turnaround times.

Verify in less than 45-seconds to improve turnaround times and decrease time to close loans.

Get Started

All-in-one platform

for verifications.

All-in-one platform for verifications.

Mortgage Lending

Accelerate loan closing & reduce buy backs.

Home Equity Lending

Truv instantly verifies income, employment & insurance.

Consumer Lending

Approve more loans. Reduce repayment risk.

Auto Lending

Instantly waive income stipulations.

Tenant Screening

Avoid income fraud. Accelerate approvals.

Background Screening

Fast and affordable employment verifications.

Income & employment

verification FAQs.

Income & employment verification FAQs.

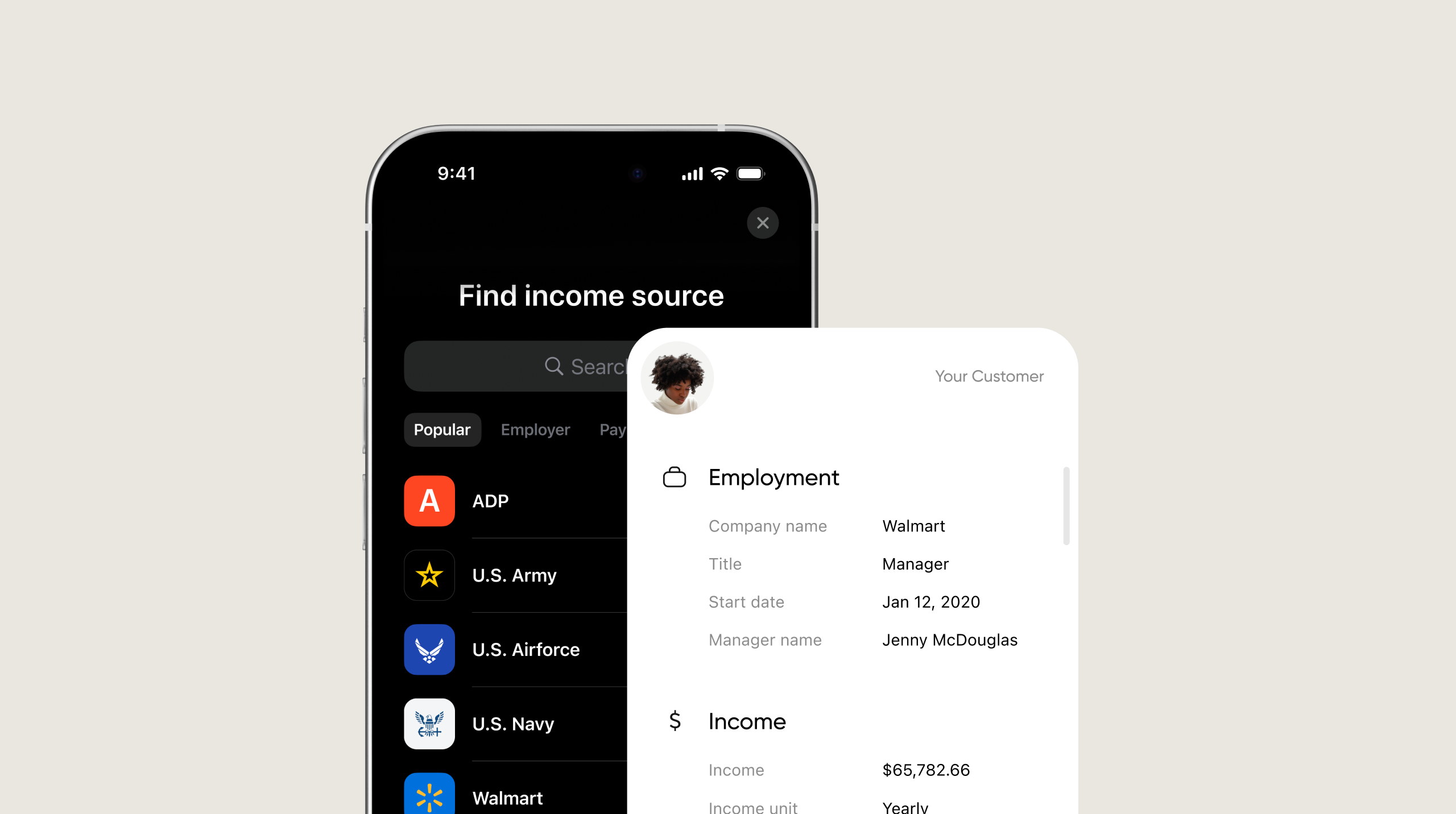

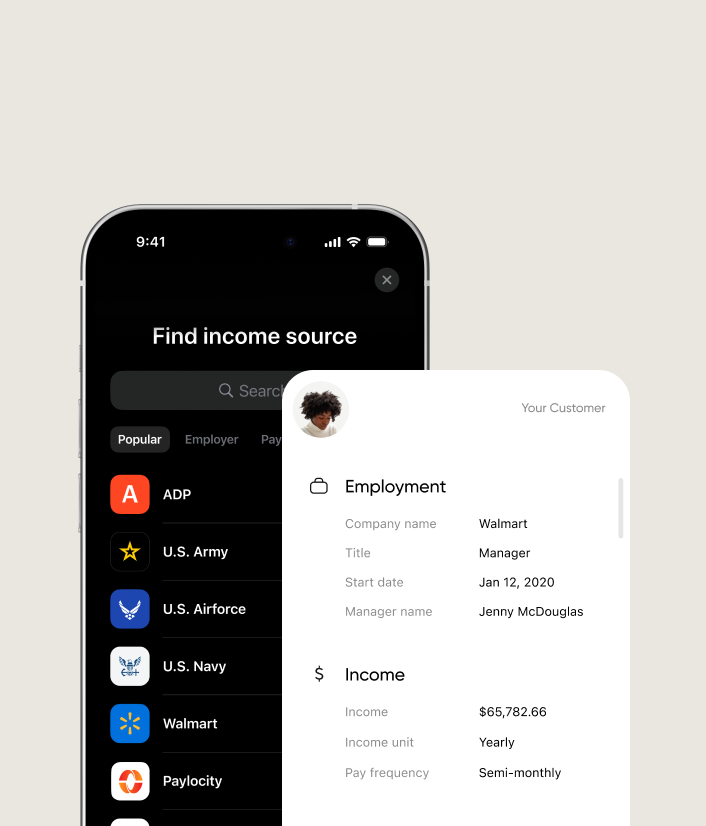

Truv’s consumer-permissioned data platform provides verification of income and verification of employment through direct-to-source payroll data, direct-to-source bank data, and AI-driven document upload. By Truv’s ability to connect consumers with their income and employment sources, they experience an easier VOIE process with less legwork and paperchase by powering a 30-second digital experience, while financial institutions and organizations save on costs, increase operational efficiencies, and deliver a consumer-centric customer experience.

Truv’s customizable waterfall solution integrates multiple data sources—payroll, banking, and documents—to boost application completion rates and conversion. By offering multiple verification options through a single vendor, Truv helps customers reduce costs, simplify vendor management, and achieve higher conversion rates.

Truv supports a wide range of lending and verification needs, including mortgage lending, home equity lending, consumer lending, auto lending, tenant screening, and background screening processes.

Mortgage lenders, banks, credit unions, auto lenders, consumer lenders, and screeners using Truv’s verification suite report higher conversion rates, faster closing times, reduced fraud risk, lower risk of repurchases, and improved operational efficiency.

Mortgage lenders save 60-80% on average with Truv compared to instant databases.

Yes, our payroll VOIE and Docs solutions. Truv is an authorized report supplier for Fannie Mae’s Desktop Underwriter® (DU®) validation service and an approved provider of Freddie Mac’s Loan Product Advisor®(LPASM) asset and income modeler (AIM). Offered as fallback solution to payroll VOIE, Truv offers an AI-driven Document Upload solution. As an integrated provider with Freddie Mac’s AIM Check API, Truv can deliver instant and automated assessment of paystub and W-2 data for lenders to use for their calculations of qualified income.

Paystubs, W2s, 1099s, and tax returns are typically documents that are required to verify income. Truv enables consumers to connect to payroll providers, employers, financial institutions, and tax providers, as well as provide documents through the same interface, to eliminate manual document collection and accelerate the verification process.

Yes, Truv is an all-in-one platform that offers a range of verification solutions that are designed to be used as standalone products or waterfalled to optimize conversion. The Truv team trailors recommendations specific to our client’s needs.