Retail Banking

Accelerate primacy for high-potential customers.

Drive account primacy and deposit growth for your organization with Truv.

Drive deposit growth and personalize

your member experience.

Drive deposit growth and personalize your member experience.

Maximize primacy.

Go Live quickly.

Find best customers.

Why partner with Truv?

Why partner

with Truv?

Bridge

Instantly switch direct deposit.

User experience optimized for high conversion and minimum friction.

Learn more

Dashboard

Delight customers in branch.

Flexible and customizable experience to reach customers anywhere.

Get Started

Waterfall

Switch all customers.

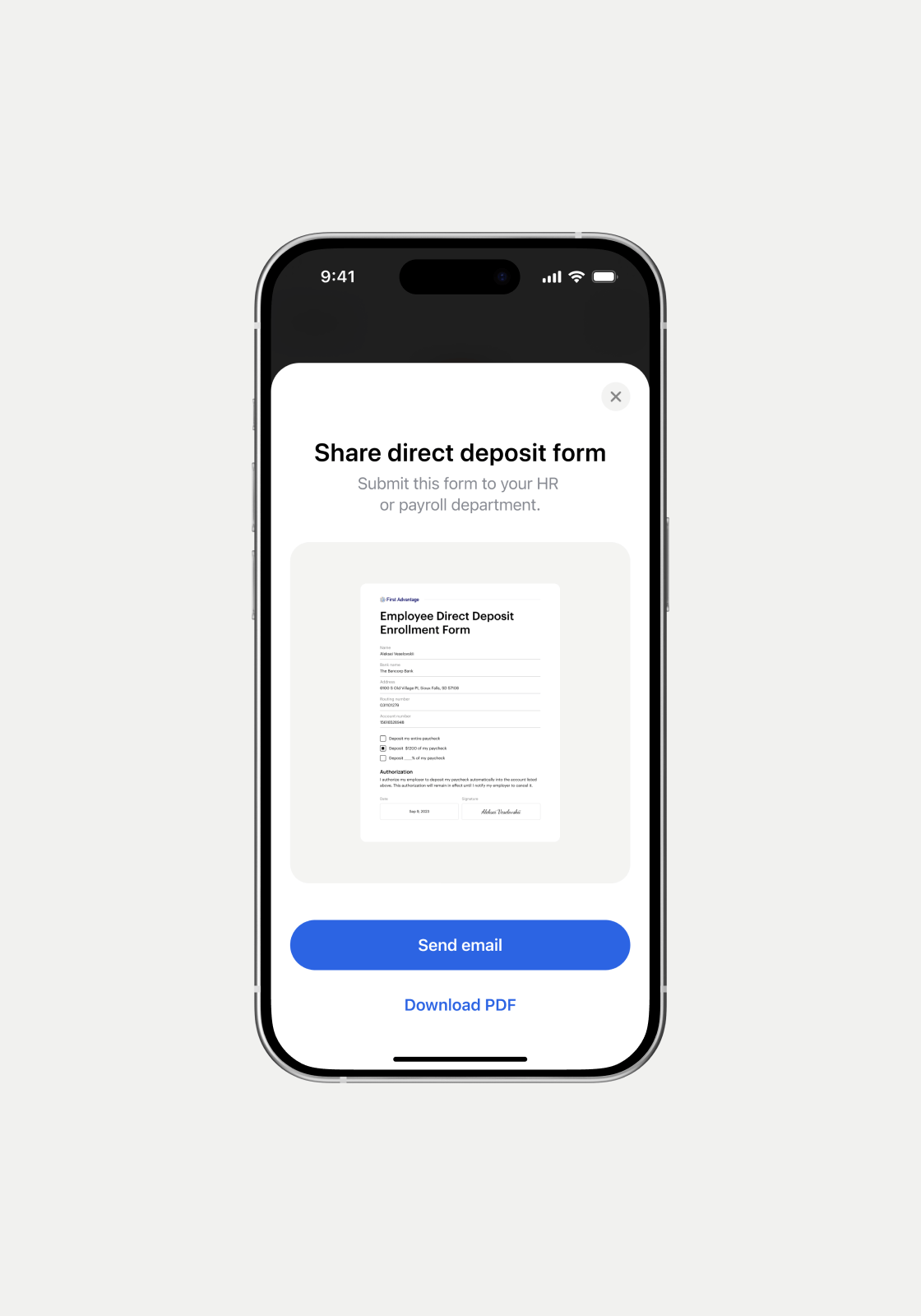

Switch direct deposit digitally or by sending HR a signed deposit form.

Learn more

Integrations

Implement Truv in days.

All DDS Platform integrations and dedicated success team.

Learn more

All-in-one platform

for verifications.

All-in-one platform for verifications.

Platform

Retail banking

verification FAQs.

Retail banking verification FAQs.

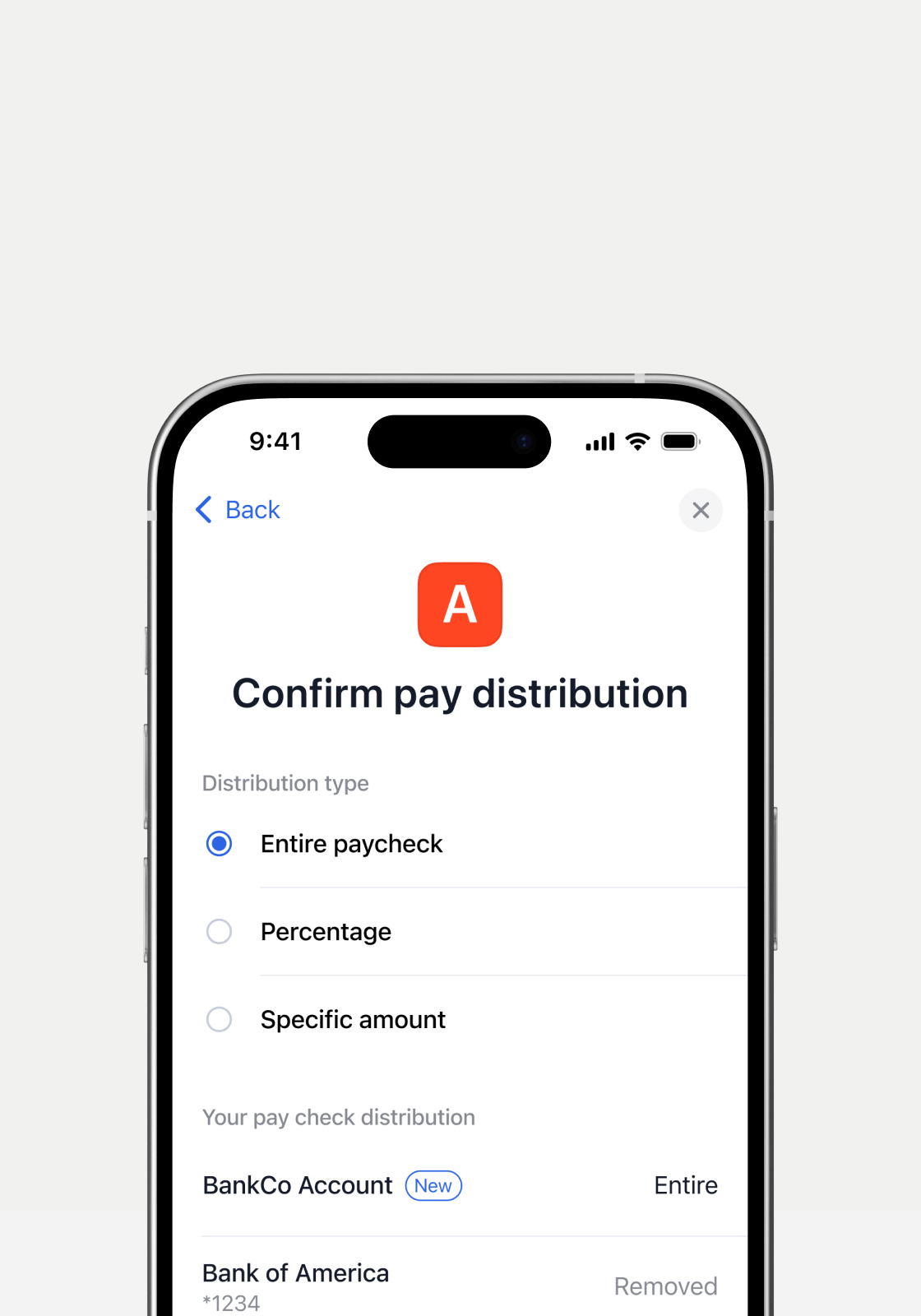

Retail banking encompasses several types of services designed to meet the financial needs of individual consumers, including checking accounts, saving accounts, digital banking services, credit cards, loans, and more. With direct deposit switching made easy by Truv, customers are enabled to allocate paycheck amounts to fund a new account or split a direct deposit in a fast, easy digital process.

Truv accelerates account primacy by streamlining the direct deposit switching process for new and existing customers. Our platform provides multiple ways to switch direct deposits, including digital automation via connections to payroll providers and an alternative HR form as a fallback solution, allowing banks to meet customers where they are. The system identifies high-potential customers through cash flow analysis and employer profiles, enabling targeted primacy campaigns that maximize conversion rates.

Truv offers seamless integration with major digital banking platforms, including Jack Henry Banno, Alkami, Clutch, Q2, Constellation, MX, and Candescent, allowing banks to implement direct deposit switching capabilities within days. Our platform maintains your institution's branding and user experience while providing powerful switching capabilities that can be accessed through your existing digital channels, mobile apps, and in-branch processes.

Financial institutions using Truv report significant improvements in direct deposit conversion rates and deposit growth. The system’s comprehensive approach to account primacy helps institutions identify and capitalize on opportunities for deposit growth while improving customer satisfaction. Truv’s customer, B9, realized +12% improvement in total funds deposited over a leading consumer-permissioned vendor.

Truv's platform is designed to support multiple deployment scenarios to serve existing customers and new customers. Our digital solutions enable customers to complete direct deposit switches through an embedded Truv experience for streamlined new account opening and online banking experiences, or through text, email, and QR codes for in-branch experiences. With mobile and desktop flexibility, Truv ensures banks can serve all customer segments effectively.

Our platform is designed for rapid implementation, with most institutions going live within days. We provide comprehensive integration support, dedicated training teams, and flexible deployment options to ensure quick time-to-value. The system includes pre-built integrations with major banking platforms and can be customized to match your institution’s specific requirements.

Truv transforms the traditional weeks-long direct deposit switching process into a seamless experience that takes just minutes. New customers can complete their entire account setup, including direct deposit switching, in a single session.

Our platform analyzes member income patterns, employment status, and direct deposit history to create actionable segments. This enables you to identify high-value members, spot opportunities for additional services, and proactively engage members who might be at risk of switching institutions. The system also helps identify members with split direct deposits who could be converted to primary relationships.

By automating the direct deposit switching process, Truv significantly reduces the operational costs associated with new account activation. Our platform eliminates manual form processing, reduces follow-up communications, and minimizes the need for branch staff intervention.

Sergio Terentev

Founder & CEO, B9