AFCU Achieves 65% Conversion and Saves 80% on Verifications

mortgage division

home equity division

About

America First Credit Union (AFCU), founded in 1939 and headquartered in Riverdale, Utah, is one of the nation's fifth-largest credit union by membership and seventh largest by total assets as of 2023. Currently licensed to operate in six states—Utah, Idaho, Nevada, Arizona, California, and New Mexico—America First Credit Union continues its long-standing history of delivering exceptional member service while maintaining its commitment to financial excellence.

Problem

At the core of America First Credit Union is their member experience. Having successfully implemented Truv's verification services in their consumer lending division, AFCU recognized an opportunity to expand this solution into other lending verticals. The mortgage division, which includes mortgage and home equity loans, sought to increase operational efficiencies and reduce origination costs by minimizing reliance on traditional verification processes, including document reviews, manual methods, and The Incumbent.

Austin Coleman, SVP of Mortgage Lending, AFCU

“We have borrowers try Truv first because it has proven most reliable. We now rely less on manual VOEs and instant databases, saving us 80% on verifications and hours in processing.”

Truv Solution

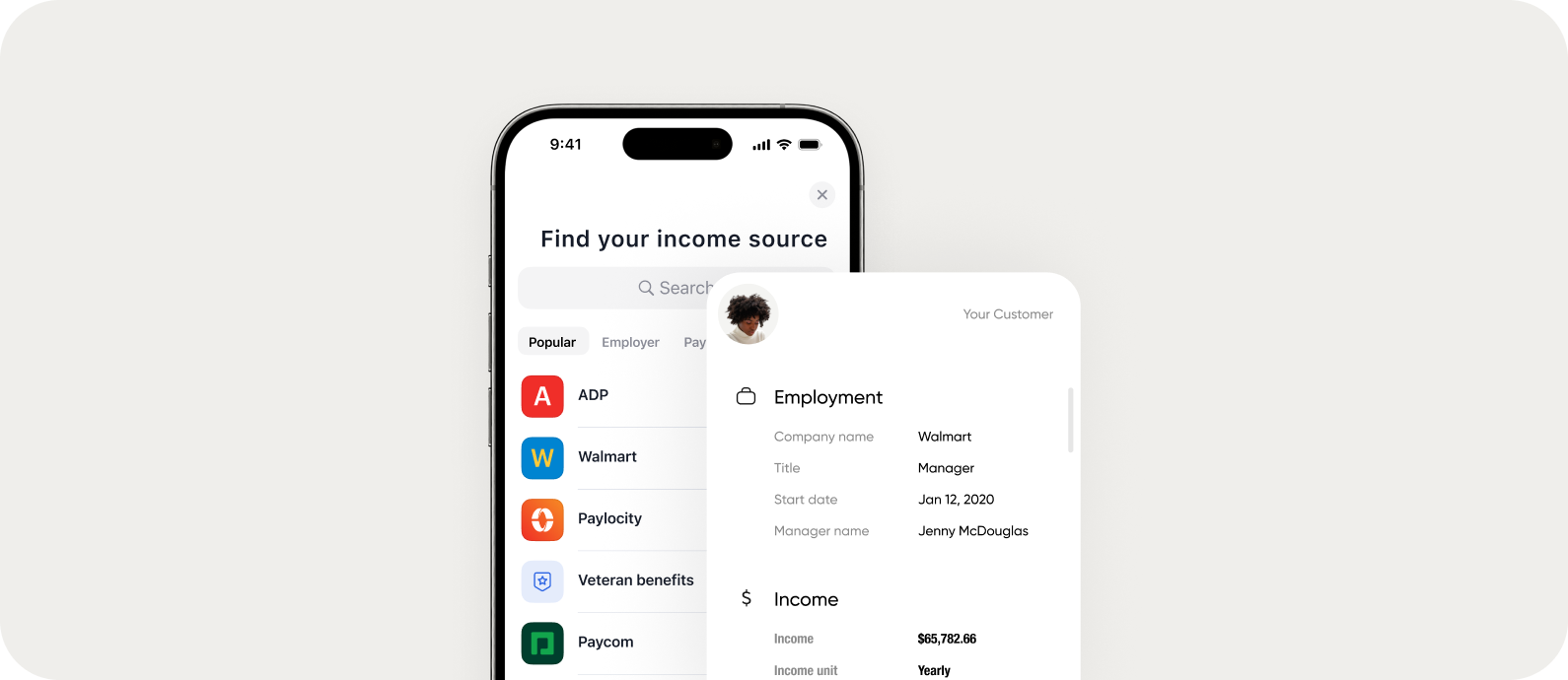

Verification of Income Employment

The Story

As a pioneer for technology and automation, America First Credit Union (AFCU) initiated a plan to enhance their member experience, with a particular focus on accelerating loan decisions and closing times. Their search for innovation led them to a partnership with Truv, whose data access capabilities surpassed other potential partners in the market.

The partnership began with AFCU's consumer lending division,

where Truv's verification services demonstrated consistently high conversion rates and higher member satisfaction.

This success led the credit union to expand the solution across their home equity and mortgage lending divisions, resulting in significant improvements in both loan origination efficiency and member experience.

Austin Coleman, SVP of Mortgage Lending, AFCU

“Truv’s data quality has transformed the speed and confidence of our loan approvals.”

Truv's flexible products proved instrumental in its seamless implementation across multiple workflows.

The mortgage team incorporated Truv verifications directly into their loan origination system, Encompass® while the home equity team launched Truv with Truv’s web-based Dashboard. The platform’s adaptability enabled both departments to optimize their independent lending processes, improving processing turn times, underwriting loans with reliable data retrieved in seconds, and enhancing the member experience by reducing the paper chase.

Austin Coleman, SVP of Mortgage Lending, AFCU

“We attribute our successful rollout and widespread adoption to assigning junior processors to the management of Truv orders as a task. This removes a step in the process for LOs and processors.”

AFCU took a methodical approach to implementing Truv,

recognizing that effective change management would be critical for success. The credit union developed a comprehensive educational strategy to drive adoption of the new solution among loan officers, underwriters, and processors.

Loan officers learned about the benefits that consumer-permissioned verifications bring to lending process, including reduced turn times, easier experience for members, and less legwork during origination. Junior processors were assigned to manage the verification orders, streamlining the rollout by:

- Centralizing responsibility for the verification process

- Leveraging existing borrower communication channel

- Reducing loan officer workload

- Enabling clear process explanation to borrowers

Austin Coleman, SVP of Mortgage Lending, AFCU

“Our conversion reached 65%, and we’re saving 80% on verifications.”

Quickly thereafter, the credit union achieved 65%+ conversion on mortgage loans and 30%+ conversion on home equity loans. AFCU attributed the success of the new verification process to internal education efforts driving adoption across both divisions.

Austin Coleman, SVP of Mortgage Lending, AFCU

“Truv makes it easier to collect the data required for underwriting across all types of employment. Commissioned income is no longer a high-friction experience for us or borrowers.”

As a result of consistently high conversion rates and exceptional member experiences, AFCU’s mortgage division restructured their verification waterfall, positioning Truv's consumer-permissioned solution at the top, followed by traditional and/or manual methods second, and instant database solutions third. The new waterfall was defined based on key performance metrics: data quality, cost-effectiveness, and processing speed.