Lenders use income verification to confirm you earn enough money to make your monthly mortgage payments. This makes determining who should be approved for a home loan easier.

Unfortunately, Fannie Mae reported a staggering increase in fraud tips received during the third quarter of 2022. Most of these tips are related to income fraud, which occurs when a borrower overstates their earnings to boost their approval odds.

Due to a high number of fraud tips, income verification remains an essential step in qualifying for a home loan. Whether you’re a renter or a prospective homebuyer, this article can help you better understand the verification process.

What Is Income Verification?

Income verification is a process used to confirm information in a mortgage application.

How Does Income Verification Work?

When you apply for a mortgage, the lender needs to know you earn enough money to make your monthly payments. During the verification process, a lender uses pay stubs, tax returns and other documents to calculate how much you earn, assess the consistency of your income and verify each source of income.

Performing income verification for mortgage approval helps lenders manage risk and spot income fraud before it hurts them. The results of income verification can make a big difference in the outcome of your mortgage application. If everything checks out, the lender may approve you.

However, if the lender identifies discrepancies, they may deny your application or report you for income fraud. The lender may even make an alternative offer, such as a lower principal amount or higher interest rate, based on what they find during the verification process.

Although income verification always has the same purpose, lenders use different methods to accomplish their goals.

Different Types of Income Verification

Depending on your lender, you may have to do manual, automated or consumer-permissioned income verification.

Manual Verification

Manual verification involves reviewing physical or digital copies of your W-2s, tax returns, pay stubs and other documents. Your lender may even contact employers or taxing authorities to verify the information you provide.

This type of verification is most beneficial for self-employed individuals, as it allows for a personal review of your documents and a direct resolution to any problems that arise. However, manual verification is time-consuming and susceptible to human error.

Instant Verification

Instant verification uses specialized software to analyze and verify income-related documents. Lenders use a variety of databases to cross-reference the information you submit with official records.

It’s much faster than manual verification, and it reduces the risk of error. Lenders also find it easier to spot signs of income fraud when using automated tools. However, automated verification isn’t the most efficient way to complete an income verification.

Consumer-Permissioned Income Verification

Consumer-permissioned income verification is the most reliable and accurate method. With this type of verification, you give a lender permission to access income and employment information directly from your employers and financial institutions. It’s efficient because it integrates with payroll providers for income and data sourcing, giving the most current and accurate data via application programming interfaces (APIs).

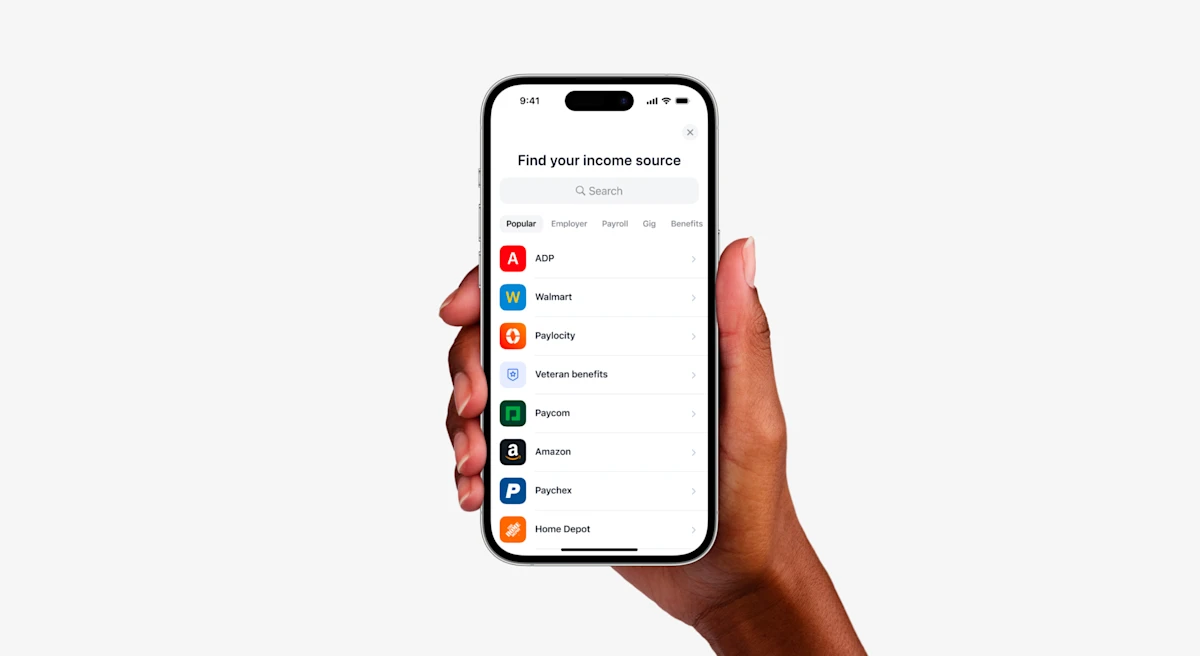

Truv offers comprehensive consumer-permissioned income and employment verifications, which allow borrowers to connect their employment records or financial accounts for seamless verification, taking under a minute to complete in an average of just a few clicks. Connecting your records makes income verification faster and more convenient and reduces the risk of fraud and errors.

Consumer-permissioned income verification is best for individuals with traditional forms of employment, as Truv maps employers to their payroll providers. However, Truv supports a range of income and employment sources, including the gig economy, self-employed individuals, the military, and those receiving benefits. When you use Truv, you may see your employer pre-populated in the Truv Bridge experience, eliminating the need to search for your income or employment source.

Truv’s payroll coverage spans 96% of the U.S. workforce, allowing nearly all employees to easily connect to their payroll providers. Truv also works with more than 2.3 million employers.

Best of all, Truv delivers a seamless verification experience. If Truv is unaware of your employer’s payroll company, you can quickly search and select your provider, ensuring a fast, smooth verification process.

Why Accurate Income Verification Is Key

Income verification helps a lender determine if you have stable and sufficient income to repay your home loan. Accurate verification also reduces the risk that a mortgage application is flagged for income fraud. A fraud flag triggers a thorough investigation, making the process more stressful and delaying your home purchase.

If there are significant inconsistencies or your application is deemed fraudulent, you may be denied a home loan. A denial can negatively impact your credit history and limit future borrowing opportunities.

In certain income verification examples, fraudulent statements can lead to criminal charges. Find out how to provide income verification to avoid these issues.

Why Are Lenders So Strict With Income Verification?

According to the CoreLogic 2022 Mortgage Fraud Report, mortgage fraud is one of the most common types of fraudulent activity. During the second quarter of 2022, one in 131 mortgage applications were estimated to have signs of fraud. The CoreLogic report indicates that income and property fraud are on the rise.

Lenders often suffer reputational harm when fraudulent activity occurs. If the fraud is intentional, the lender could face serious legal consequences. For example, a lender may have to pay steep fines for failing to verify the information provided by a borrower.

If no one notices discrepancies during the underwriting process, the lender could also suffer losses associated with mortgage defaults. Income verification helps lenders avoid these negative consequences.

FAQ About Truv’s Income Verification

Here are the answers to several frequently asked questions about Truv’s verification process.

Can Truv verify income for self-employed individuals?

In some cases, Truv can use tax returns and other documents to verify income for self-employed individuals.

What types of documents or information does Truv need for verification?

Truv doesn’t need you to provide documents for income verification. We verify your income and employment by connecting to payroll providers and employers via an online interface.

How long does it take to complete an income verification request?

In many cases, Truv completes a verification request within 45 seconds.