Truv’s consumer-permissioned deposit-based VOE report streamlines 10-day pre-close requirements and reduces operational costs

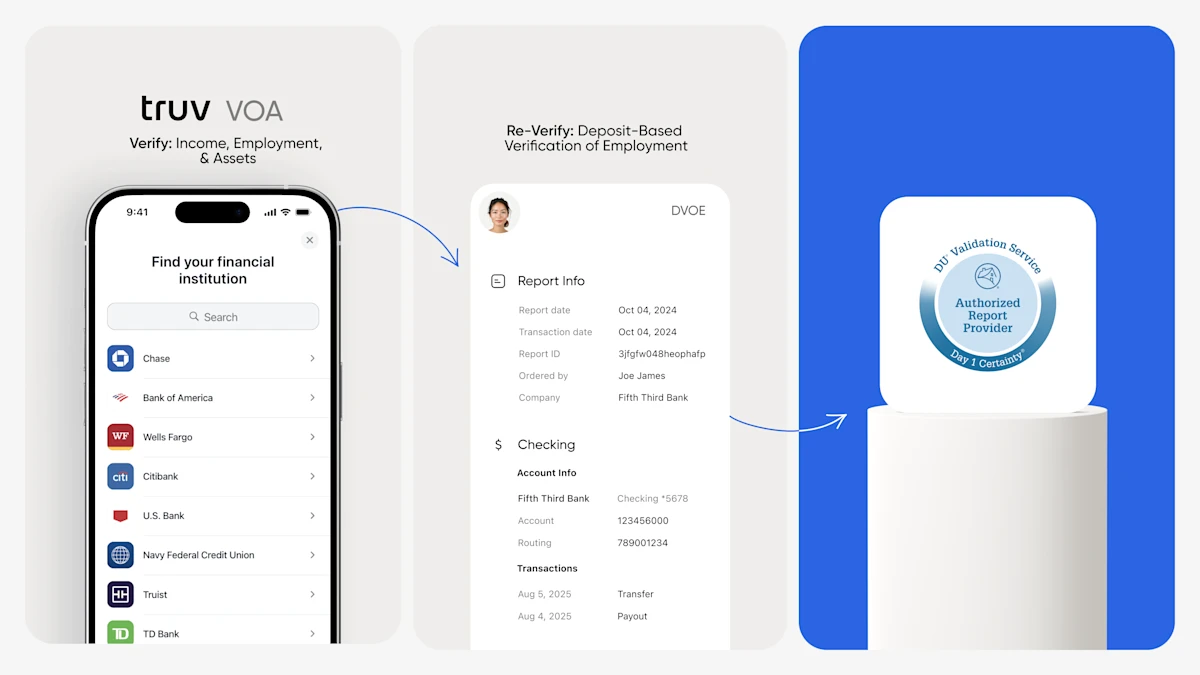

Truv, a leading provider of consumer-permissioned income, employment and asset verifications for mortgage lenders, banks, and credit unions, is an authorized supplier of supplemental asset reports for lenders using Fannie Mae’s Desktop Underwriter® (DU®) validation service. Now, lenders can leverage Truv Verification of Assets to obtain a VOA report for asset, income and employment verification and a Truv Deposit-based Verification of Employment (DVOE) report as a supplemental asset verification report for 10-day pre-closing employment re-verification.

Streamlining Pre-Close VOE Requirements

Truv’s deposit-based verification of employment solution addresses one of the most time-sensitive aspects of the mortgage process—the pre-close employment verification. Truv’s deposit-based VOE reports analyze transactions to verify employment status through consistent payroll deposits for loan files that received employment validation through Fannie Mae’s DU validation service using Truv’s VOA report.

Truv automatically identifies and analyzes recurring deposit patterns, matching them to employment information provided in the loan application to create comprehensive DVOE reports, displaying deposit transactions while omitting other bank data transactions, offering a more focused and efficient verification process to reduce verification methods and minimize potential delays in the mortgage process.

Benefits of Deposit-Based VOE

- Streamlined Process: Eliminate dependence on cumbersome traditional methods while accelerating loan processing timelines and reducing bottlenecks in the loan process

- Reduced Documentation Burden: Minimize extensive paperwork requirements and create a frictionless experience that reduces administrative burden for both borrowers and lending teams

- Operational Excellence: Leverage a single verification solution across multiple verification stages to eliminate redundant processes, reduce multi-vendor workflows, and reduce costs

- Enhanced Borrower Experience: The seamless, expedited verification process transforms the traditional loan experience, delivering faster approvals and streamlined pre-closing requirements

- Increased Loan Quality: Achieved Fannie Mae Day 1 Certainty® when income, employment and/or asset information is validated with Truv data

Lenders now have unprecedented opportunities to accelerate their worfklows and lend with greater confidence through Truv’s unified verification approach. At the start of the loan process, a single asset report from Truv covers income, employment, and asset verification, and at the pre-closing stage of the loan process, Truv’s 10-day DVOE report ensures lenders can meet closing timelines without manual intervention and without compromising on data quality.

Getting Started

Truv’s verification solutions are designed to integrate seamlessly with existing workflows and are available through Truv Dashboard and integrations with leading point-of-sale platforms, and loan origination systems.

Lenders must opt-in to use an asset verification report for income and employment validation, according to Fannie Mae.

Contact the Truv team today to learn more.