As we all make strides to finish out the first quarter of 2024 strong, Truv is ecstatic to showcase key product updates, features and enhancements that our product and engineering teams have been hard at work on to position our customers for an even stronger Q2. Let’s dive into the latest developments together!

New Product Announcement

Truv is now approved with Fannie Mae

We’ve teamed up with Fannie Mae to revolutionize borrower verifications! Truv is now a conditionally authorized report supplier for mortgage lenders using Fannie Mae’s Desktop Underwriter® (DU®) validation service. Truv’s consumer-permissioned platform will now be able to obtain and transmit income and employment data through the DU validation service.

Fannie Mae’s DU validation service uses third-party data vendors to independently validate borrower income, employment, and asset data, providing lenders with Day 1 Certainty® on validated loan components. By digitally validating secure third-party data through DU, lenders can help eliminate the paper chase and help get borrowers approved quickly.

As a designated report supplier for Fannie Mae’s DU validation service, Truv helps lenders:

- Minimize fraud and buyback risks with real-time data sourced directly from a borrower’s employer

- Reduce operational costs by re-verifying borrower data at no additional cost

- Accelerate loan processing, boost pull-through rates, and shorten closing times

- Improve productivity by streamlining data collection for underwriting

Gaining the approval of Fannie Mae confirms our commitment to providing lenders with comprehensive technology that streamlines origination processes, reduces costs, and enhances borrower experiences.

Truv Platform Updates

Encompass Improvements

Truv’s integration with Encompass is designed to seamlessly improve the workflow on the back end of your business so you can focus more on the front end of your business – building customer relationships and closing more loans.

Your experience with Truv’s integration in Encompass is always top of mind. That’s why we’re excited to unveil a few new enhancements:

- All-Encompassing Reports for Borrowers: We’ve made it easier for loan officers to gain necessary insight on the financial outlook of borrowers who have multiple employer sources, or additionally, in loan files that include a primary borrower and a co-borrower with multiple sources of income from more than one employer. Previously, the Reports were at the Employer Level and not permissible for GSE submission. Now however, with Fannie Mae D1C and Freddie Mac AIM approvals, you have access to:

- Borrower Reports (Use the report ID to submit for representations and warranties relief.)

- Employer Level Reports (This enables LOs and processors to make clearer decisions on whether the information retrieval from the borrower is sufficient to move the loan file forward.)

- 6 Paystubs

- 3 W-2s

- 1099s for hourly employees

- Current Employment Indication: In the list of a borrower’s employers, Truv has enhanced the visibility to show LOs, LOAs, and processors the borrower’s current employer, allowing easier verification of the VOIE that was completed by the borrower.

- Short Order Link: As we scale our customer base, we’ve taken note of some clients needing more ease of use than others. We have added a global setting for users to enable/disable the copy URL link function in the Truv UI within Encompass. Additionally, to enhance usability and improve the borrower experience, we’ve added the ability for you to copy the short URL for orders instead of the full URL.

- Enhanced Email Updates: Refreshed email templates have been designed to provide loan officers with more insight on the borrower, including updates to our Order emails sent to loan officers confirming borrower receipt, in addition to more detailed Status Update emails (with the loan number, originator and processor on the file, and status), that now include context on the change in status and recommended next steps for the loan officer to take.

SimpleNexus Improvements

Create All-in-One Orders: Our team of dedicated engineers has expanded Truv’s integration into SimpleNexus to include Verification of Assets product. Instead of creating two separate orders for borrowers (VOIE & VOA), Truv now sends a combined notification consisting of VOIE & VOA in the same order and notifies the borrower to complete their Income, Employment and Asset verification altogether. To increase borrower completions, Truv sends out reminder emails through the provided notification channels on all pending orders.

If you’re ready to see Truv in action or learn about how Truv could work for you, reach out to the team today.

Truv Dashboard and Order Updates

Ease of navigation within the Truv Dashboard to serve LOs, their support and borrowers with an optimal Truv Bridge experience is among our highest priorities. Discover noteworthy updates and enhancements we made in March.

- Customize Truv Bridge in Templates: Our newest customization feature has been implemented and configured for the product type, Paycheck Linked Loans (PLL). Previously, the Truv Bridge screen displayed “Confirm Auto Pay Distribution” for borrowers, so we’ve enhanced your customization ability to include changing the default value, “Auto Pay.” To change the name from Auto Pay, navigate to Templates then Branding and update the name in the paycheck linked loans (PLL) section.

- Resend Order Feature: Prior to our recent improvement, the option to Resend an order was not available for orders in a canceled or expired status, or orders with errors. By improving the re-send functionality, your LOs, LOAs, and processors working within the Truv Dashboard can now easily populate, edit, or update order details to (re)send to the borrower in one click. Unblocking your team’s path to a seamless user experience is our goal with every improvement.

- Short Order Link: Just as we did within the Truv integration with Encompass, we have enhanced user safety and improved the experience for your customers by building out the ability to copy the short version of order URLs directly from the dashboard. At Truv, we are delighted to hear about function gaps or areas of improvement because our ongoing commitment to our customers is to optimize the navigation and end-to-end experience for for LOs, LOAs and processors, as well as their borrowers.

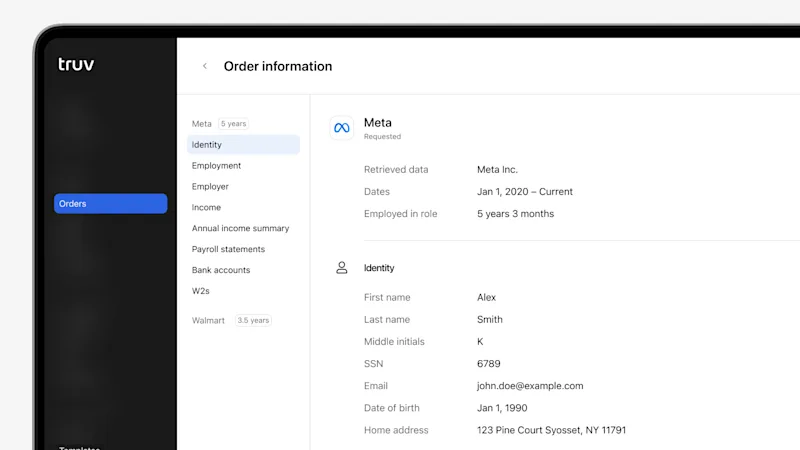

- Simplified Order Response Navigation: Truv introduced a few new experiences for our Dashboard users: First, we’ve simplified navigation to and readability of order responses, including order reports that require review of a customer with multiple employers. Second, we have introduced a sub-menu with clickable categories to improve the user experience. Third, our invoice functionality has been improved and enhanced across all clients who previously encountered less invoice functionality.

- Leveled Up Reports for Confident Decisions: Within the Truv Dashboard, we’ve upgraded your display of both Borrower Level Reports and with Employer Level Reports to provide more details to LOs, LOAs and processors as borrowers complete verifications to ensure confident decisions. Additionally, when Borrower Reports are generated following a completed order, the Borrower Level Reports are permissible for Freddie Mac and Fannie Mae submission, with Truv’s AIM and D1C approvals. As previously stated, we’ve upgraded our Encompass integration to include Reports that are accepted by GSEs as well.

Your Feedback Matters

These enhancements to our product are just the beginning of our commitment to you. We value your input and would love to hear about any additional improvements or integrations you envision for the future. Please don’t hesitate to share your thoughts and ideas with us.