At Truv, we believe verifications should be a painless process, not a pain point. That’s why Truv provides lender-aligned verification solutions with lender-aligned pricing.

Why It’s Time to Rethink Verification Costs

Traditional verification pricing models have one fatal flaw: they’re disconnected from your business outcomes.

You pay per pull.

You pay per borrower.

You pay for refreshes.

You even pay for loans that never close.

It’s a model that profits from your activity, not your success. Every verification attempt, every refresh, every abandoned application adds to your cost — even if the loan never makes it to funding. That’s the “cost bomb” hidden in most verification programs.

The Flawed Model: Paying for Activity, Not Outcomes

In a transactional pricing model, lenders are charged for each verification pull. While volume discounts may exist, the fundamental issue remains — you’re paying for attempts, not outcomes.

- Per verification: Each borrower verification adds to your bill.

- Per borrower: You pay even if that borrower drops off mid-process.

- Per refresh: Need updated data? That’s another fee.

This outdated approach rewards vendor usage, not lender success. The result? Ballooning operational costs that don’t correlate with revenue.

A Smarter Approach: Pay Per Funded Loan

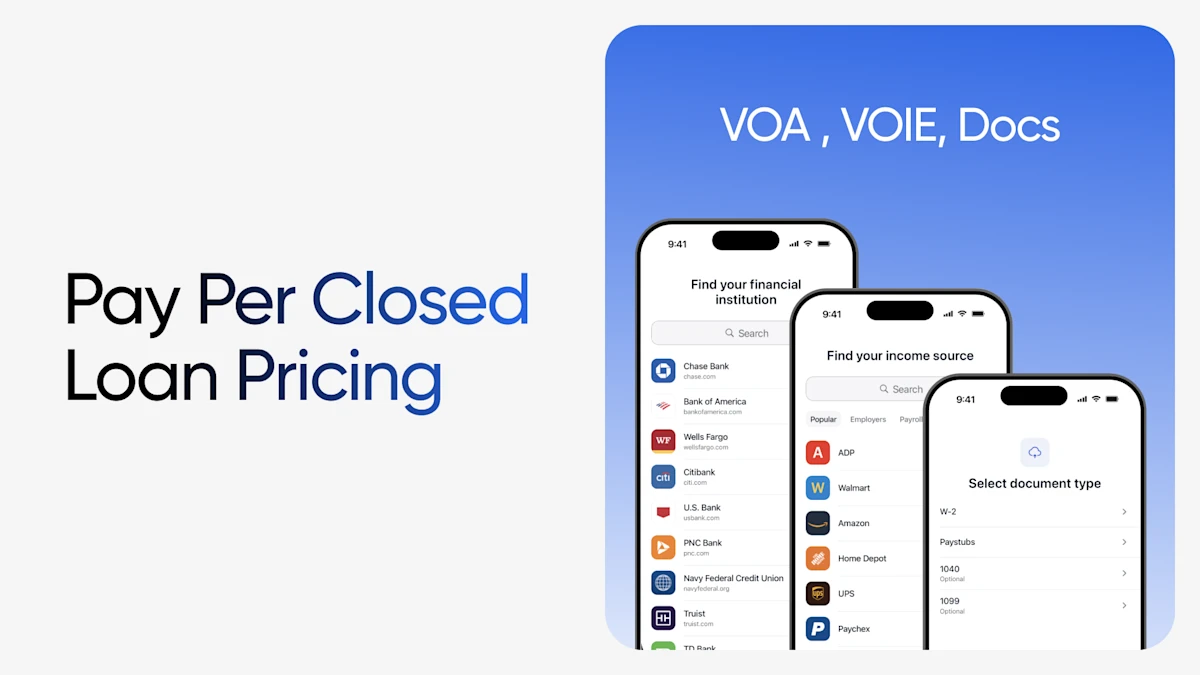

Truv’s Pay Per Closed Loan model changes that.

Instead of paying for every verification event, you only pay when a loan funds — and only if Truv was used on that loan.

That means your costs are directly tied to business performance. You’re no longer penalized for doing your job thoroughly; you’re rewarded for running an efficient, successful lending operation.

Two flexible options for modern lenders:

- Transactional pricing: Pay per verification, discounted by volume.

- Pay per funded loan: Pay only when a loan closes.

You choose what fits your business best — and adjust as you grow.

The Playbook to Defuse the Cost Bomb

1. Audit Your Invoices

Take a close look at last month’s verifications. How many were tied to loans that never funded. The answer will likely surprise you — and highlight how much waste traditional models create.

2. Align Cost With Outcomes

The smartest lenders are shifting toward pricing models that tie cost to performance. When you only pay for loans that close, your vendor becomes your partner in profitability.

3. Unleash Your Loan Officers

When cost isn’t tied to every pull, your loan officers can verify early and often — leading to faster approvals, better borrower experiences, and smarter lending decisions without fear of “wasting” budget.

Predictable, Performance-Based Pricing

Verification should empower your lending team — not punish them for being proactive.

With Truv’s Pay Per Closed Loan pricing:

- Costs become predictable and manageable — no more billing surprises.

- Spend aligns directly with revenue-generating outcomes — every dollar goes toward successful loans.

- Your tech stack becomes an enabler, not a penalty — enabling better borrower experiences.

- Predictable costs allow lenders to include verification fees upfront in loan disclosures — simplifying compliance and improving borrower transparency.

Stop Paying for Activity. Start Paying for Success.

It’s time to move beyond transactional pricing and adopt a model that reflects your business reality. With Truv, you can finally ensure your verification costs scale with performance — not paperwork.

- Predictable pricing

- Aligned incentives

- Shared success

Ready to align your verification costs with your results?

Talk to Truv and see how our Pay Per Closed Loan pricing model can transform your bottom line.