Picture this: Your underwriter reviews a borrower’s income verification and spots commission variability that requires three more pay periods for validation. Another underwriter sees a verification report that indicates a recent pay raise or quarterly bonus. Now you’re back to emailing the borrower, waiting for uploads, and watching your clear-to-close timeline slip.

This back-and-forth over additional documentation is one of the most common friction points in mortgage lending—especially for borrowers with bonuses, commissions, overtime, or recent pay increases. It causes processing delays, frustrates borrowers, and increases the risk of abandoned applications.

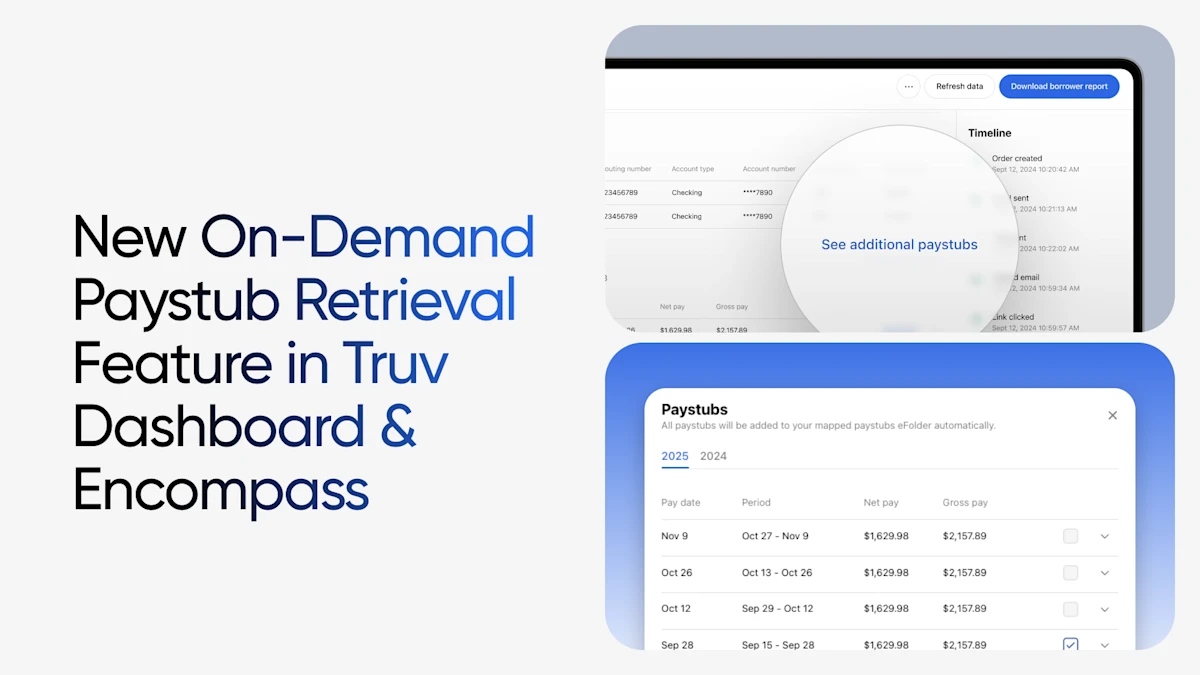

The Request Additional Paystubs Feature — Now Available Directly in Your Verification Workflow

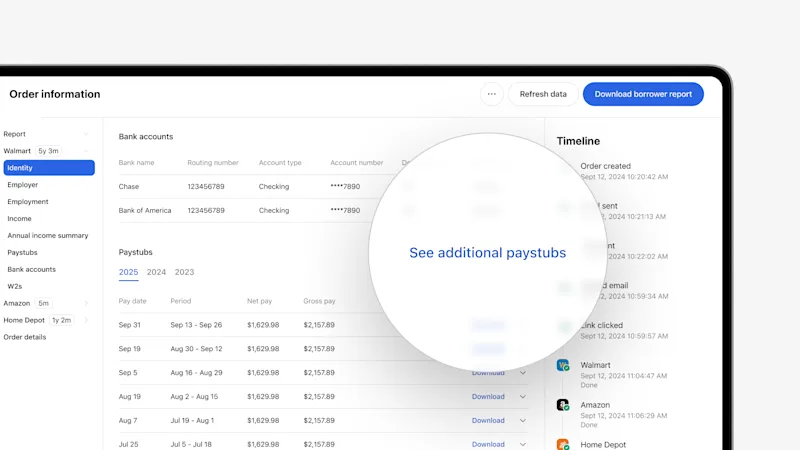

With this release in Encompass and Truv Dashboard, lenders can instantly access and download historical paystubs for any employer or payroll provider the borrower has successfully connected through Truv’s Income & Employment Verification, without having to reach out to the borrower again.

Why This Matters: Real Impact for Mortgage Teams

1. Remove borrower friction and eliminate the back-and-forth

No more sending emails or requests asking borrowers to upload specific paystubs. Once the borrower connects their employer through Truv, you now have the ability to retrieve the exact paystubs and income data you need—on demand.

2. Speed up underwriting with precise historical data

Commission-based earners, bonus recipients, and borrowers with recent raise activity often require additional pay periods to validate income consistency.

Now, you can verify:

- Recent pay increases

- Quarterly or annual bonuses

- Fluctuating commissions

- Variable income patterns

…without pulling borrowers back into the process.

3. Reduce processing delays and manual work

Your team gets immediate access to the right documents at the right time. That means fewer processing bottlenecks, fewer touches, and faster clear-to-close timelines.

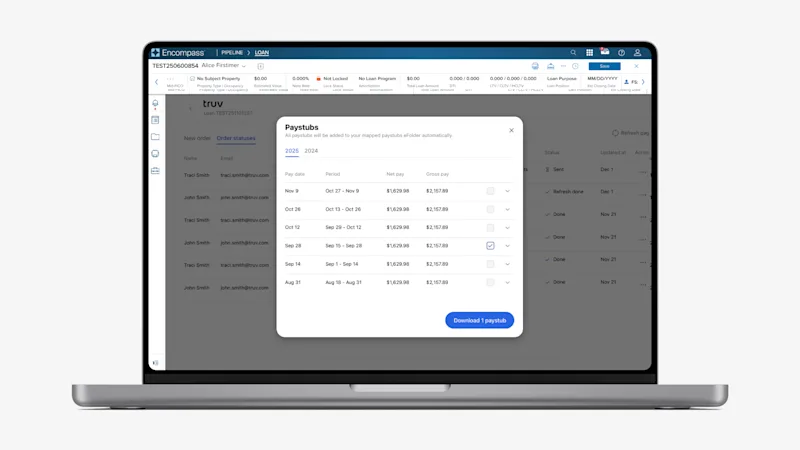

4. Fully integrated within your workflow

Everything stays in the system you’re working in already: Encompass or Truv Dashboard.

Simply select the available paystubs for the borrower’s connected employer and choose where you want them delivered:

- Directly into the eFolder, ready for underwriting

- Downloaded to your computer, if needed for review or secondary workflows

No new logins. No extra steps. Just a smoother process.

How It Works

- When a borrower connects their employer through Truv VOIE, you can view a list of available historical paystubs directly inside the order. No extra steps.

- Select the pay periods you want.

- View the documents—auto-mapped your Encompass Folder and available for download on your local machine.

- Use the paystub data to support income calculations and accelerate decisioning.

Enable the Feature Today

To turn on the feature for your organization, contact Truv Customer Success and our team will enable it.

Streamline Income Verification. Improve Borrower Satisfaction. Close Loans Faster.

Truv remains committed to simplifying the lending workflow and empowering mortgage teams with the data they need—instantly, reliably, and securely. The Request Additional Paystubs feature is another step toward a more automated, borrower-friendly mortgage experience.