Using Tax Data to Expand Income Verification Coverage

Truv is focused on our mission of putting data back in the hands of consumers. To this end, Truv’s flagship product unlocked access to consumer data hosted in payroll and HRIS systems to verify income and employment more efficiently for our customers. Today, we are excited to announce that we’ve expanded our coverage by offering Tax Data as an additional verification source.

Complete payroll coverage provides financial verification representation for 90% of the U.S. workforce. 90% isn’t enough. Truv is relentlessly expanding coverage to 100% of consumers. This is why we’re proud to announce our new Tax verification product, which will allow us to expand our consumer permissioned financial data support to the self-employed segment of the U.S. population.

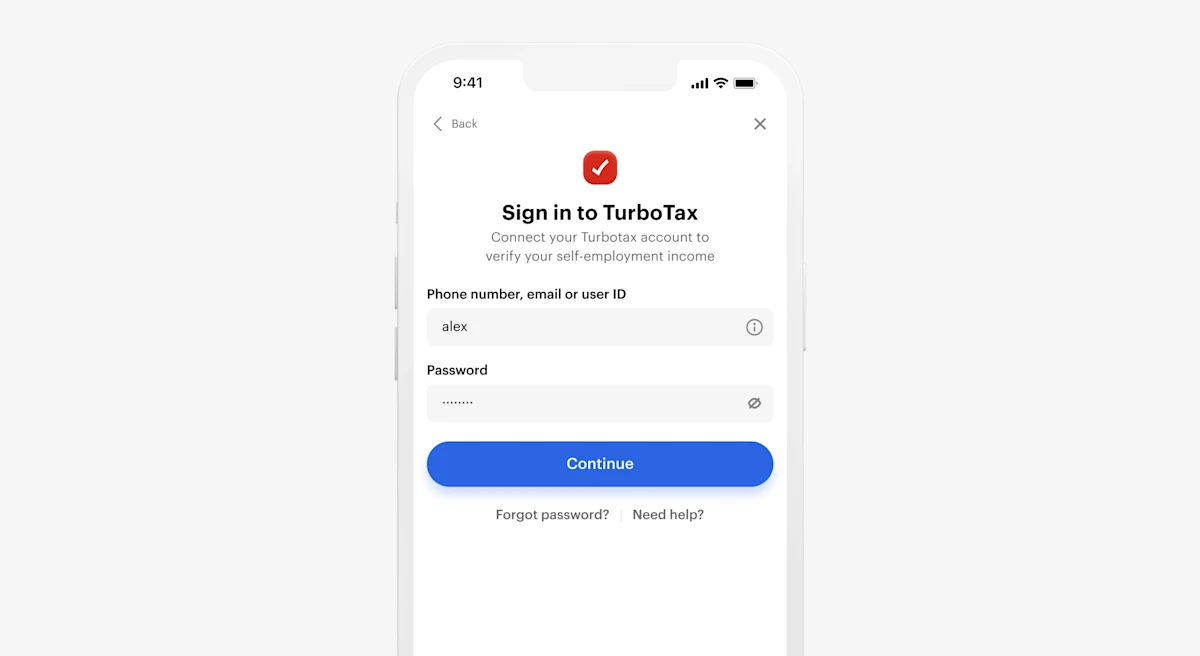

Individuals who are self-employed or earn their income through alternative sources don’t have traditional paystubs. They don’t have traditional payroll deposits. They don’t have large companies to rely on for credibility. These individuals are extremely challenging for lenders to approve as the data that’s available to underwrite them is limited. Truv’s verification of income through tax data removes that burden from lenders. We allow consumers to log into their tax prep software (e.g., TurboTax, H&R Block, etc.) which gives lenders access to their tax form that was approved by the IRS. We’re unlocking seamless loan applications and financial data control for a traditionally underserved population.

How Truv’s Income Verification through Tax Data Works…

…For Consumers

During the loan application process, applicants are asked to provide Income and Employment data to verify their eligibility for a loan. During this verification process, an applicant can elect to verify their income and employment through tax documents (e.g., W2s, 1099s, etc.). To retrieve this information, applicants are asked to login to the tool they used to submit their last tax return (e.g., TurboTax). From there, the lender receives the information from the applicant’s W2 form to be used for loan verification.

…For Lenders

Once an applicant has permissioned their Tax data, lenders get access to their IRS accepted tax returns. This means no falsified documents, and data that can be directly integrated into an LOS. This data can be used in combination with other pieces of the verification waterfall to paint a complete picture of the loan applicant.

Conclusion

Truv’s mission is to put data back in the hands of consumers. By adding tax as a data source for our Verification of Income and Employment solution, we can offer coverage to a greater portion of the population. We will continue to add data sources and integrations as we relentlessly pursue our goal of 100% coverage. We are currently working to add 4506C form to our tax integration and working to directly integrate with the IRS.