Truv’s momentum continued in October with a packed release: We expanded key integrations, launched new capabilities, and deployed features that give our customers deeper insights into consumer-permissioned data results and greater flexibility in delivering best-in-class experiences for their borrowers.

Truv Platform Updates

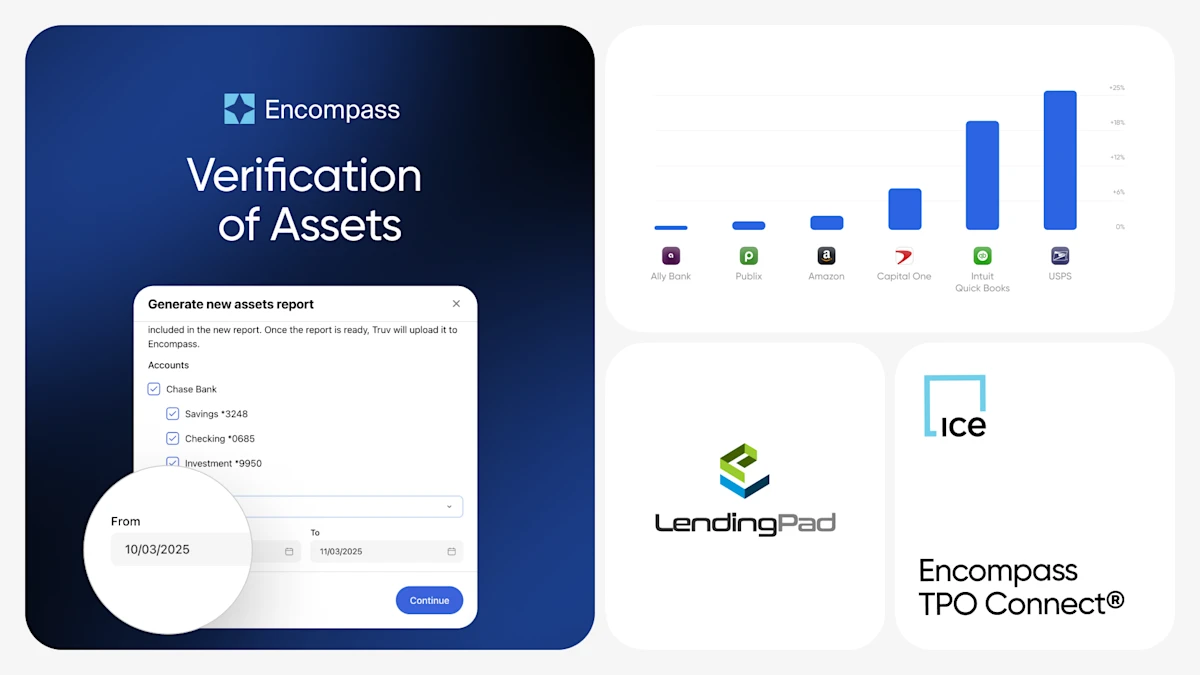

VOIE & VOA Available in Encompass TPO Connect

Truv’s integration with Encompass TPO Connect, a part of the Encompass ecosystem that gives lenders the ability to manage and receive loans from Third-Party Originators (TPO), enables real-time income, employment and asset verification.

To streamline the loan intake for wholesale lenders and reduce turnaround times to close faster, when loans are submitted to your LOS, all verification details, documents, and GSE Report IDs flow through automatically. One-click refresh report functionality is available inside the LOS directly. Review our setup guide to get started and reach out to your customer success manager to lean more.

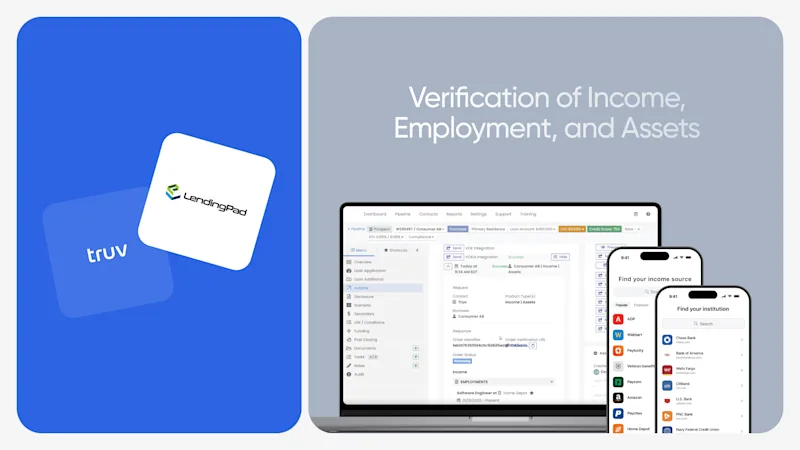

VOIE & VOA Available in LendingPad

Through Truv’s LendingPad integration, Lenders can now retrieve consumer-permissioned direct-to-source VOI/E and VOA reports instantly, reducing verification timelines from days to minutes while maintaining the highest quality data and GSE compliance standards required by the industry—enabling lenders to access critical borrower data without ever leaving their LOS environment. Reach out to the Truv Team to learn more.

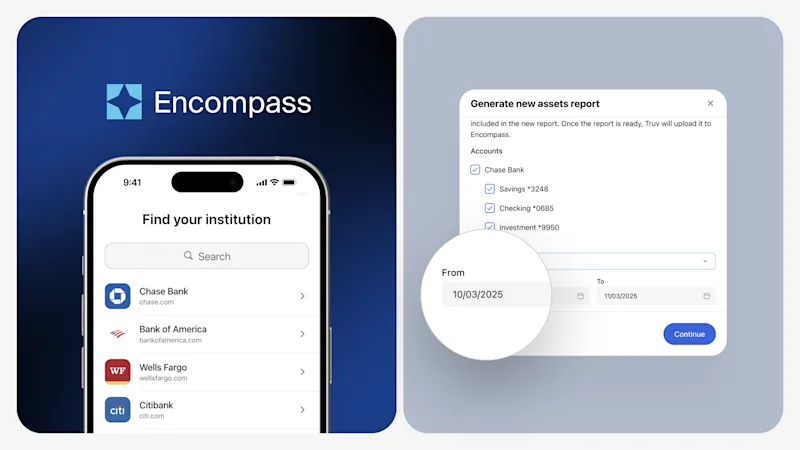

Encompass Improvements

Truv’s latest Encompass integration updates put efficiency first, introducing three pivotal features that improve visibility and accelerate the verification process:

- Generate VOE & DVOE Report with Specified Date Range: Now, lenders have the option to generate customized VOA/DVOE reports with data from specific date ranges—ideal for validating earnest money deposits, investigating recent large deposits flagged during underwriting, or confirming sufficient funds to close. Get the precise data you need without the full transaction history, streaming review process.

- Customize Truv Report Data Written Directly to Encompass: Update your Encompass loan files instantly with data returned on VOIE and VOE reports. Truv’s new side-by-side view lets you compare loan and report data, then select exactly which fields to update, giving you full control over what gets written to the file. Contact your customer success manager to enable this feature.

- Enhanced Truv Timeline Visibility for Orders: The order timeline in Encompass Order status tab shows when reminder email/sms notifications are sent, delivered, and opened by the end user, giving lenders actionable insights to streamline verifications with borrowers.

Truv Dashboard Updates

- Streamlined Sign-Up and Login Experiences: Truv’s system now automatically routes users to the correct login method or account creation flow for faster access. Plus, we’ve added one-time login links sent directly to your email for instant, password-less access to Truv Dashboard.

Truv Bridge & Order Updates

Self-Certification for Public Sector

Self-certification allows clients to review and confirm the accuracy of their income data immediately after connecting their sources through Truv Bridge. This client-facing verification step creates transparency in the data collection process while reducing back-and-forth between caseworkers and clients.

When applicants connect their income sources, they’re now presented with a clear “Success” screen that displays all connected data in real-time. They can review the information for accuracy and either certify it as correct or flag any discrepancies, all within the same seamless experience.

Recent Enhancements

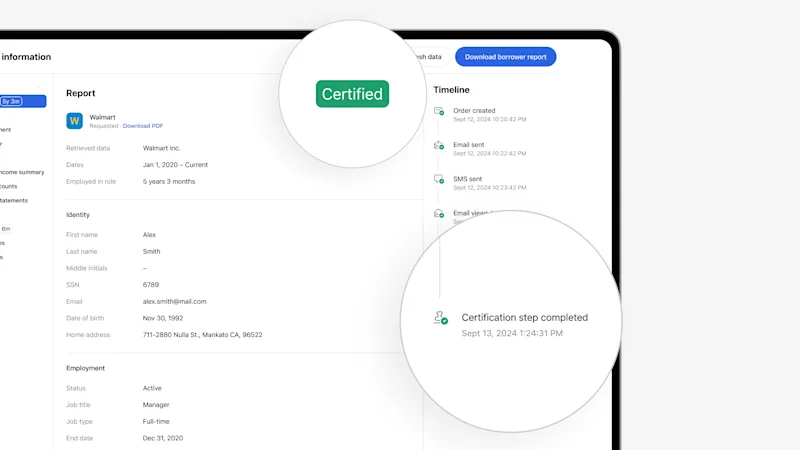

Building on our initial self-certification release for state agencies, we’ve added critical visibility features for caseworkers:

- Dashboard status indicators: Each verification now displays an at-a-glance status tag—either “Certified” or “Issue Reported,” so caseworkers can immediately identify which cases need attention

- PDF report integration: Certification outcomes are automatically included in downloaded reports, ensuring compliance documentation is complete

- Timeline tracking: A “Certification Step Completed” event now appears in the case timeline once applicants finish their review, providing a clear audit trail

These enhancements give caseworkers the context they need to process applications faster while maintaining data integrity and compliance standards.

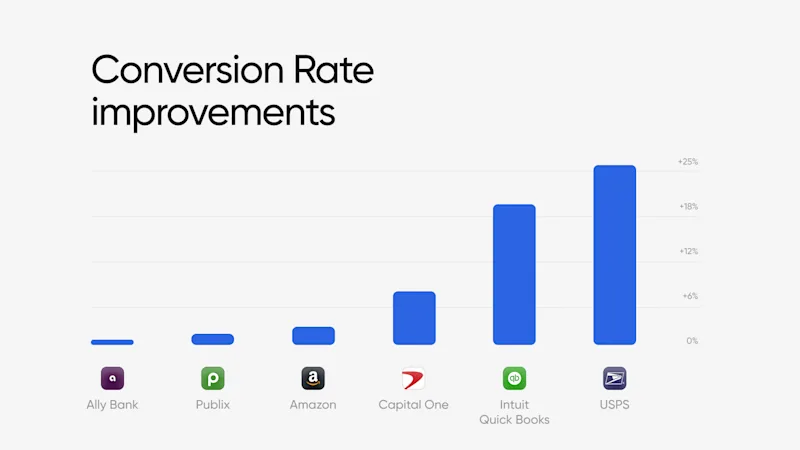

Conversion Improvements

Behind every data connection is Truv’s team of engineers actively monitoring performance, troubleshooting issues, and optimizing integrations. We work around the clock to keep the end users connections to payroll providers, employers, and financial institutions running smoothly.

Verification of Income & Employment

| Company | Prior 30 days | Last 30 days | Improvement |

|---|---|---|---|

| Intuit Quickbooks | 64.79% | 83.12% | +18.33% |

| Publix | 86.06% | 87.50% | +1.44% |

Verification of Assets

| Financial Institution | Prior 30 days | Last 30 days | Improvement |

|---|---|---|---|

| Regions Bank | 71.93% | 82.15% | +6.13% |

| Vanguard | 82.29% | 90% | +0.71% |

Direct Deposit Switch

| Company | Prior 30 days | Last 30 days | Improvement |

|---|---|---|---|

| Dept. of Veteran Affairs | 33.98% | 58.24% | +24.26% |

| MyPay DFAS | 73.6% | 77.26% | +3.66% |

Customers Come First

Your feedback isn’t just welcomed; it’s essential. We listen, we build, and we support you every step of the way. Each new feature we launch comes directly from understanding what you need to win. And when you need us? We’re there: real people, real solutions, no runarounds. Let us know what you want to see next!