This May, Truv doubled down on innovation, launching game-changing features that transform how you interact with our platform. We’ve prioritized building tools that work smarter, not harder, giving you more control and flexibility in your daily operations. Explore what’s new in this month’s feature spotlight.

Truv Platform Updates

New Product Launch

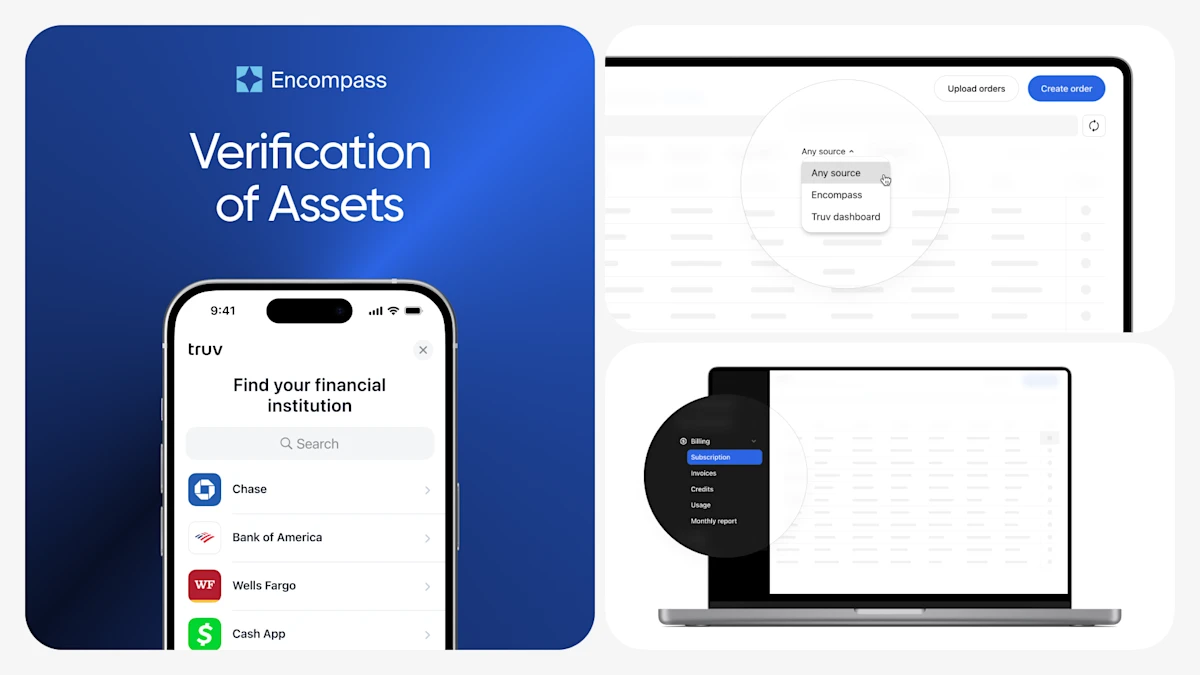

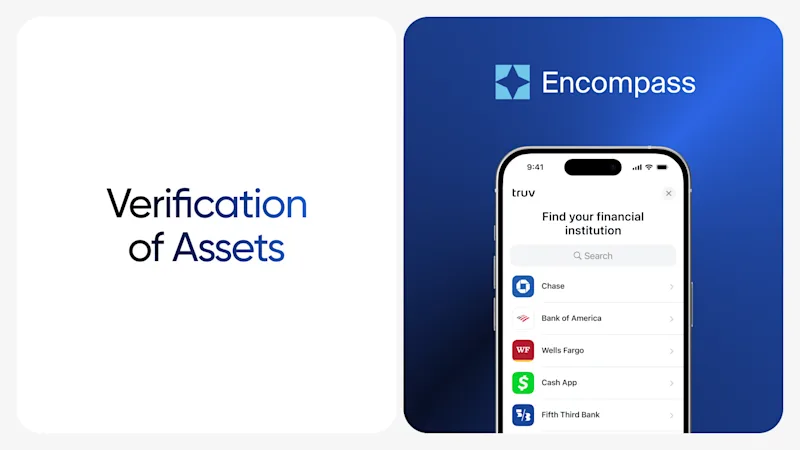

Introducing Verification of Assets

Truv’s asset verification solution is now available in Encompass, powering faster and easier real-time asset verifications for mortgage lenders and borrowers. Truv’s coverage includes 13,000+ financial institutions, enabling borrowers to connect their financial accounts in seconds.

- Customizable report data: Days requested and large deposits are customizable per order or at the lender and level via Truv templates.

- Financial institution and account selection for VOA refresh: For VOA refreshes in Encompass, financial institutions and/or accounts required for the verification are customizable per order. If accounts/institutions are excluded from the refresh, Truv will not include them in the refresh or report.

- Status update emails: Default roles receive notifications when the borrower completes the order.

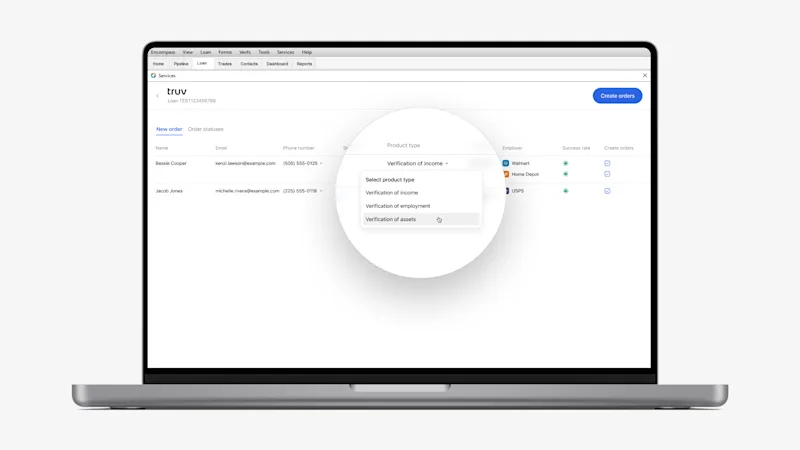

- Deposit-Based Verification of Employment (DVOE) refresh report: To re-verify employment for loans that initially verified employment via assets, ‘Deposit-based verification of employment (DVOE)’ can be selected under ‘Product type’ when refreshing a VOA order in Encompass. This report omits large deposits, asset summary, transactions, and account balances.

- Truv is an approved service provider supporting Freddie Mac’s Loan Product Advisor® (LPA®) asset and income modeler (AIM) and Authorized Report supplier of eligible verification reports for the DU validation service.

If you have VOA enabled in Encompass, create an order by selecting ‘Verification of Assets’ from the Product type dropdown menu in the ‘New Order’ tab. If you do not have VOA enabled, reach out to your Customer Success Manager to get started.

Truv Dashboard & Order Updates

For Truv Dashboard users, we’ve rolled out new features to enhance the experience and provide expanded end-to-end visibility.

- New Billing tab: We have introduced a new ‘Billing’ tab Truv Dashboard that includes: Subscription, Invoices, Credits, Usage, and Monthly Report to give more insight into billing details. ‘Usage’ in the Home tab has been updated to Monthly report.

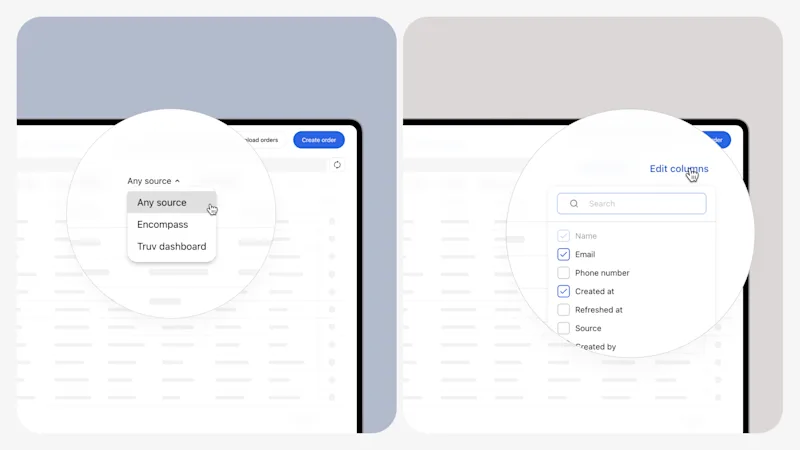

- Customizable columns in Dashboard Orders and Users tables: Clients can now customize Orders and Users tables by selecting which columns to display, resizing and reordering them, and exporting results to CSV. Settings are saved per user to maintain the preferred view.

- Add ‘Source’ filter for orders in Reporting and Orders tabs: Truv Dashboard now includes a ‘Source’ filter in the Reporting and Orders tabs, allowing clients to filter results by specific order sources, such as Truv Dashboard, Encompass, or nCino. The filter defaults to ‘Any source’ to show all orders and is customizable. This enhancement helps clients analyze reporting metrics and review orders from specific integration points more efficiently.

- Auto-approve new Truv Dashboard users: Truv clients can automatically approve new users who self-register via SSO, eliminating manual approval requirements. This streamlines onboarding for companies with hundreds or thousands of users. Enable by contacting Customer Success or support@truv.com.

- ‘End-user’ terminology aligned in order notifications: To ensure clarity across all industries and use cases, variable end-user terminology (such as client, applicant, borrower, consumer) has been removed from notification emails for a more consistent experience.

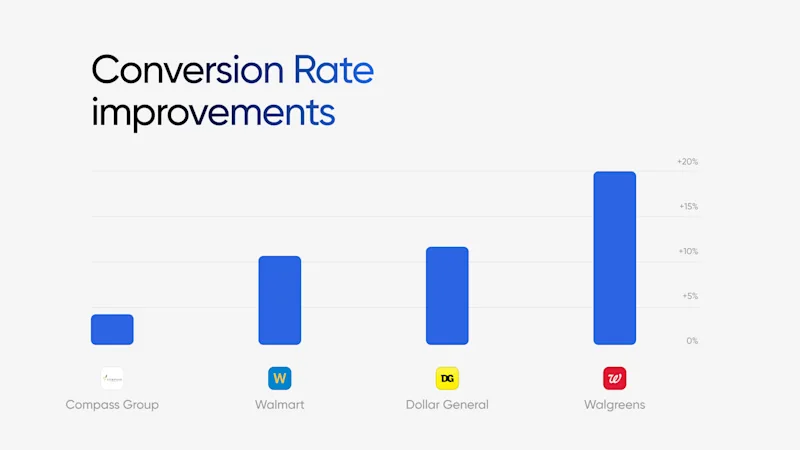

Conversion Improvements

Truv’s extensive monitoring framework continuously evaluates our network of payroll providers, employers and financial institutions, identifying and eliminating friction points that could slow down data retrieval and parsing. Review recent conversion improvements:

Verification of Income & Employment

| Company | Prior 30 days | Last 30 days | Improvement |

|---|---|---|---|

| Walmart | 80.45% | 92.08% | +11.63% |

| Dollar General | 33.07% | 45.58% | +12.52% |

Direct Deposit Switch

| Company | Prior 30 days | Last 30 days | Improvement |

|---|---|---|---|

| Walgreens | 28.03% | 45.45% | +17.43% |

| Compass Group | 43.65% | 47.77% | +4.12% |

Upcoming Events

Check out Truv’s on-demand event recordings and see where we’ll be next!

Strategies to Maximize The Power of Day 1 Certainty: Episode 2

Join us on June 12 at 2pm EST for the second event in a dynamic series featuring industry leaders from Fannie Mae, Lodasoft, Truv, and a guest Lender. This webinar will feature Josh Byrom, SVP of Technology & Innovation at Prosperity Home Mortgage.

Feedback for Truv

Since day one, Truv has built our success around our client success. Your partnership and feedback directly shape our product roadmap and drive the features that matter most. Continue telling us what we can build next to make your Truv experience even better!