MortgageRight Reduces Dependency on The Incumbent by 40%

About

MortgageRight is one of the Southeast's premier independent mortgage lenders, delivering personalized home financing solutions since 2005. Headquartered in Birmingham, Alabama, and operating across 47 states, the company bridges modern digital convenience with human guidance. As a direct lender, MortgageRight manages the entire lending process in-house from application to closing, offering conventional mortgages, FHA, VA, and USDA loans, and refinancing programs.

Problem

Prior to partnering with Truv, MortgageRight’s verification process relied heavily on legacy verification solutions, with costs reaching up to $360 for loan files with multiple borrowers. In addition to rising costs, the verification reports lacked comprehensive income categorizations and often returned incomplete data, which became particularly problematic as rising interest rates led to an uptick in borrowers who required all available income sources to qualify for a loan.

The income and employment process became time-consuming and cumbersome, leading to operational inefficiencies and high-friction customer experiences.

Truv Solution

Verification of Income & Employment; Encompass Integration

The Story

MortgageRight initiated a comprehensive search for alternatives to their existing verification providers to solve for a range of loan origination process improvements. Their vendor evaluation process was thorough, focusing on several critical factors: integration capabilities, granularity of income and employment data, cost savings, and a partner-centric vendor relationship.

Tanner Allen, Partner, MortgageRight

“We prefer having a Truv report over other verification providers because the data is more granular, comprehensive, broken down by income source, and includes paystubs & W-2s.”

The limitations of traditional verification services became particularly apparent to MortgageRight as the market shifted towards a high-rate environment. As Tanner from MortgageRight explains, "When rates were at three and a half percent, many of our clients simply needed base pay to qualify. When it's a seven percent rate, many clients need every bit of income they have."

As rates climbed to steady highs, MortgageRight strategically implemented consumer-permissioned verifications that would not only improve underwriting decisioning and processing turn times, but also streamline the process for a broader client set, where every income source can make the difference in loan qualification.

Tanner Allen, Partner, MortgageRight

“We’re saving an estimated 80% on 40% of our borrowers by executing Truv and avoiding instant databases.”

Truv’s ability to break down income into specific categories:

base pay, commission, additional pay, and multiple jobs - all in one comprehensive report - empowered MortgageRight’s loan officers and underwriters by equipping them with granular data in real time, eliminating the need for multiple document requests from clients and multiple pulls from legacy verification solutions. With clear visibility and all-encompassing view into unique income scenarios, including clients with overtime, shift differential, and bonus pay, MortgageRight has reduced reliance on legacy verification solutions by more than 40% while realizing 80% cost savings.

Tanner Allen, Partner, MortgageRight

“If you're getting W-2s and paystubs from a borrower, they're already going to their payroll system to get them. Why not have them connect that same info with Truv? It’s one-time access, no paperwork, no doubling back.”

As dependency on databases decreased and cost savings increased,

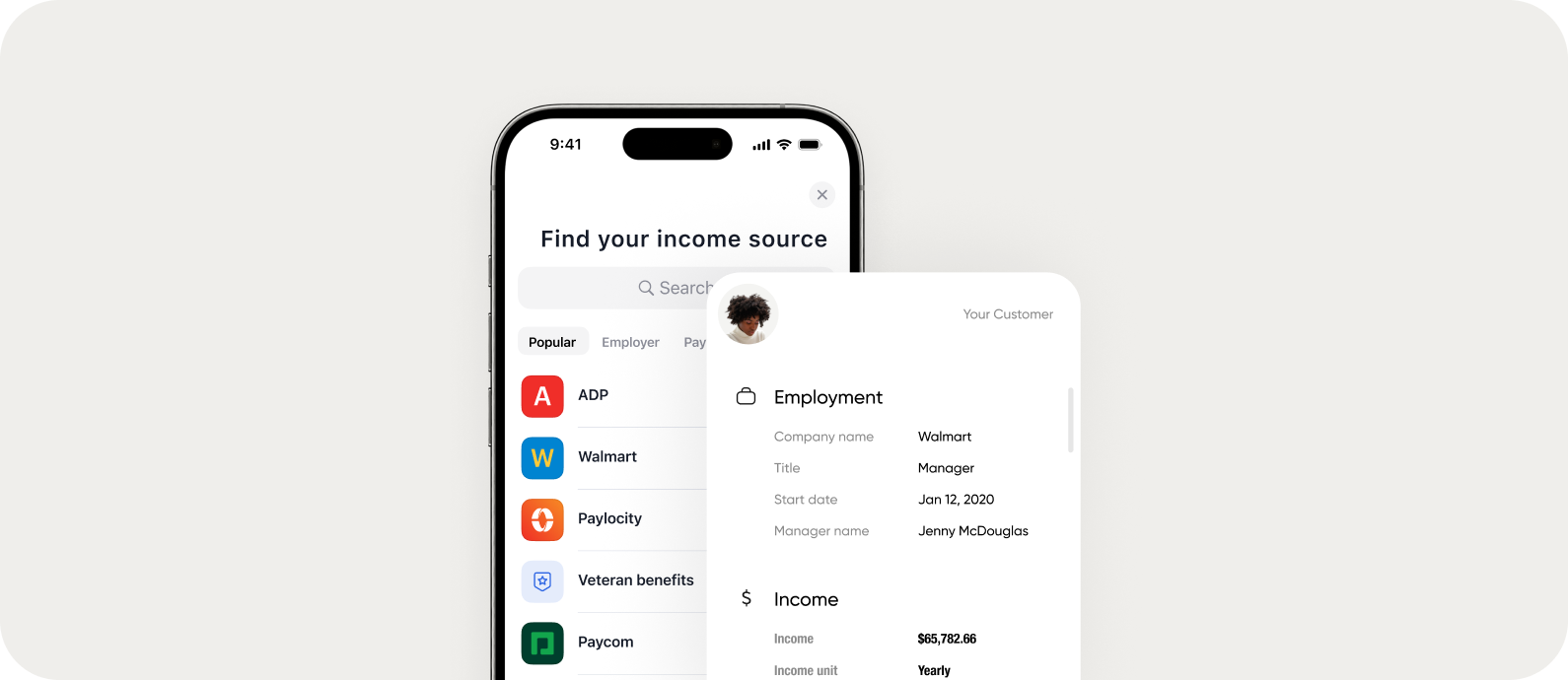

MortgageRight also recognized the transformative impact consumer-permissioned verifications had on the customer experience. The manual approach—requesting paystubs or W-2s and waiting days for customers to retrieve, download, and submit documents—had been replaced by fully digital, fast alternative. Now, MortgageRight loan officers guide clients through Truv’s one-time login process, enabling instant retrieval of income and employment data directly from payroll providers in real time. The paperless solution has eliminated processing delays and accelerating loan approvals.

Tanner Allen, Partner, MortgageRight

“By linking their payroll provider through Truv, borrowers become invested, which creates a sense of commitment, making them more 'sticky' and more likely to follow through with us.”

Once customers authenticate access to their payroll provider through Truv, the secure connection remains active throughout the loan process. With the ability to auto-refresh data in the loan origination system, MortgageRight has eliminated manual 10-day pre-closing verifications. The streamlined approach ensures all necessary employment and income details remain automatically synced with their LOS system, preventing HR outreach delays and additional re-verification costs charged by The Incumbent.

Tanner Allen, Partner, MortgageRight

“Truv’s integration flexibility has allowed us to customize when and how we request VOIEs. We can do manual orders during the application and auto-trigger orders when a loan hits processing.”

Looking ahead at the next phase of the partnership, Tanner shared, “We’re exploring the expansion of our partnership with Truv to put income, employment, and asset verifications directly in our point-of-sale. Not only will this align with our client experience goals by making the income and employment verification faster and easier with Truv’s few-click process inside the loan application, but it will also further enhance decisioning speed and accuracy by empowering our loan officers to capture real-time verifications upfront.”