Home Equity Lending

Close more loans, faster.

Truv verifies income, employment, and insurance in minutes – all-in-one platform.

All-in-one platform for verification of

income, employment and insurance.

All-in-one platform for verification of income, employment and insurance.

Maximize savings.

Accelerate approvals.

Verify all borrowers.

Why partner with Truv?

Why partner

with Truv?

Bridge

Verify borrowers instantly.

User experience optimized for high conversion and minimum friction.

Learn more

Quality

Use real-time,

accurate data.

Direct to source data. Approved by Freddie Mac and Fannie Mae.

Learn more

Assets

Verify using bank accounts.

With over 11K financial institutions & AI- driven deposit detection.

Learn moreWaterfall

Use one platform

for all verifications.

Every method you need to verify 100% of borrowers.

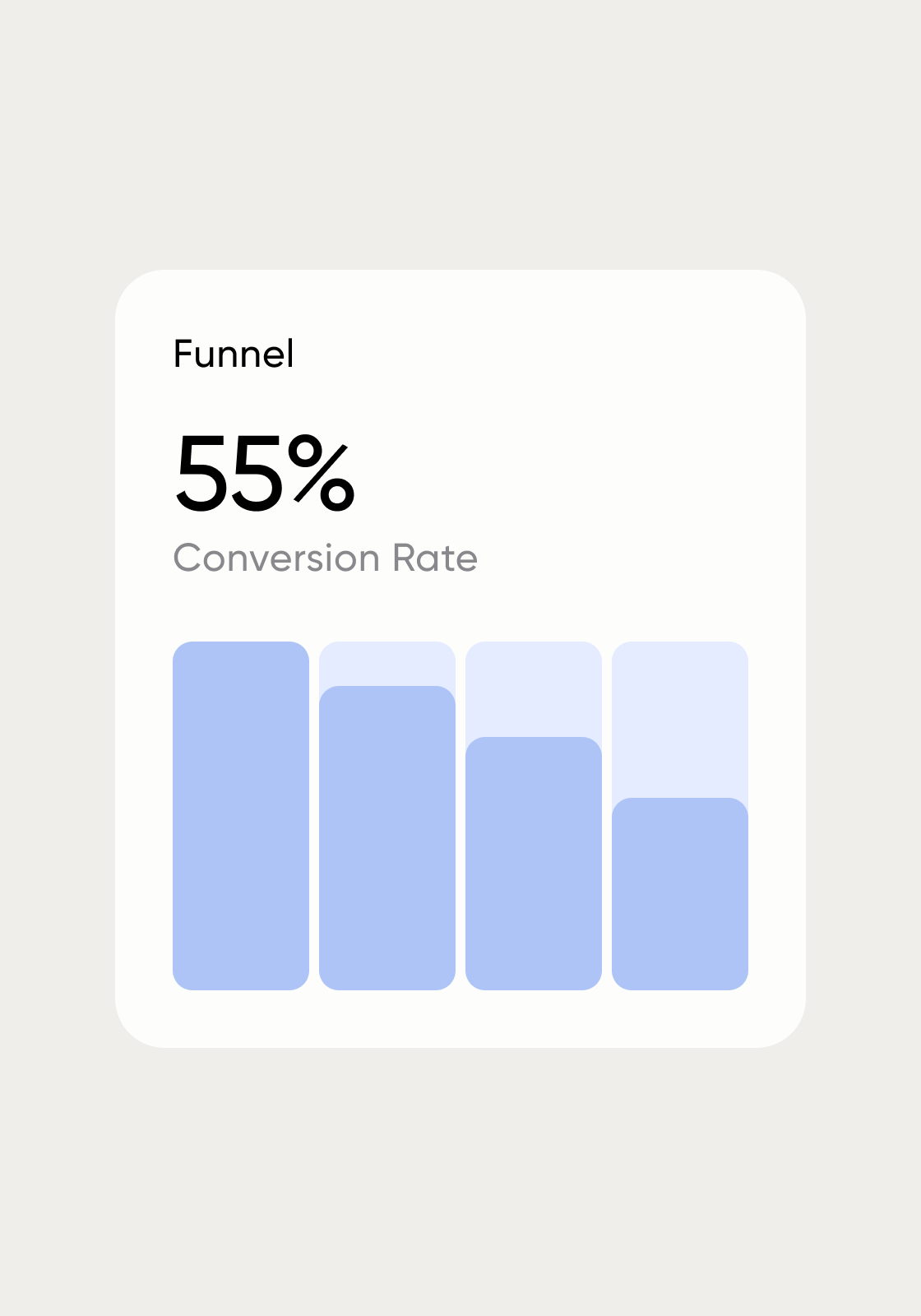

Learn moreGrowth

Accelerate funded loans.

Best conversion rate in the industry. Higher NPS for customers who used Truv.

See Truv

Trusted Data

Reduce risk of income fraud.

Trusted data and documents directly from the source.

See TruvCost Savings

Maximize your savings.

Increase margins for every closed loan. Keep data access for up to 120 days.

See TruvIncreased Efficiency

Reduce manual verifications.

Less dependency on manual labor and fixed expenses.

See Truv

All-in-one platform

for verifications.

All-in-one platform for verifications.

Income & Employment Verification

Payroll Income & Employment

Highest conversion rate and data fill rates in the industry.

Bank Income

Highest oAuth rate and insights into transactions.

Paystubs & W-2s

Best-in-class OCR and fraud detection for pay documents.

Outreach (Q2 24)

AI-driven outreach to HR teams for written and verbal VOIE.

Insurance Verification

Home Insurance

Instant verification of home insurance.

Platform

Jonathan Spinetto

COO & Co-Founder at NFTYDoor