Attributes

Reach new levels of predictive power.

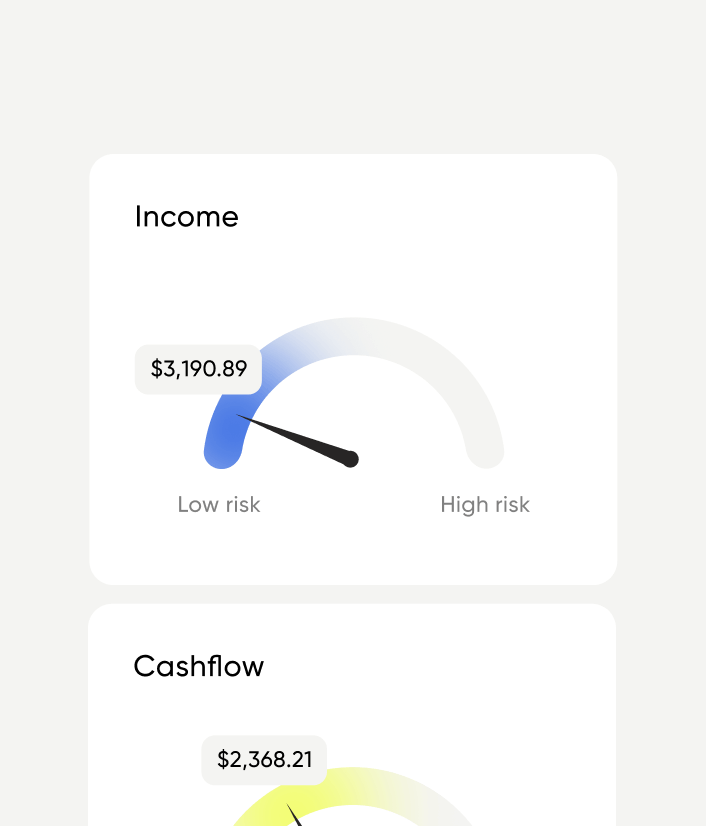

Enhance accuracy of your risk models using transaction data.

Predict default rates

in seconds.

Predict default rates in seconds.

data set

AI insights at scale.

Trained on over 20 million transactions covering a variety of consumer segments for a range of different risk outcomes.

See Truv

k-score

Unparalleled predictive power.

Understand your subprime, new-to-credit & under-served segments better.

See Truv

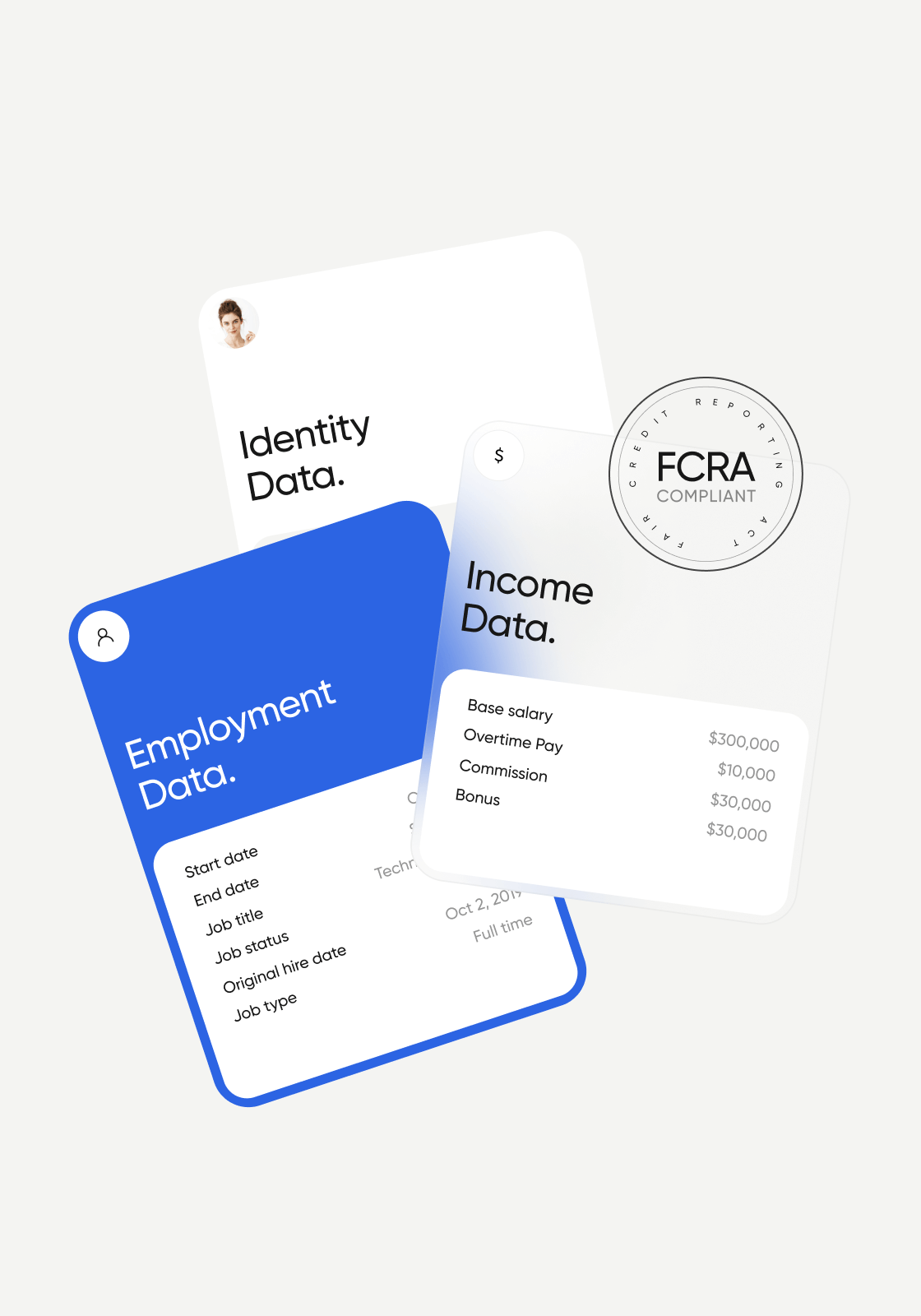

Quality

Fair Lending.

FCRA & ECOA compliant attributes which alleviate issue of disparate lending.

See Truv

Todd Rice

Founder & CEO at New Credit America