Evaluating payroll API providers, much like other aspects of your business, can be a complicated and confusing process. Yet getting it right is mission-critical to safely and seamlessly enabling income, employment, and insurance verification while consumers benefit from quicker approvals and a better overall experience.

In this overview of choosing a payroll API provider, you’ll learn how to:

- Determine the coverage you need

- Assess the caliber of the payroll API integration

- Evaluate the data quality

- Calculate ownership cost and prices

- Ensure enterprise-grade security and privacy practices

- Implement the solution successfully

The Changing Landscape of Customer Data

Before we dive into evaluating different providers, it’s important to understand the way consumer data, and its usage, is evolving. The easiest way to explain some of the changes is thinking back to when financial institutions used to make two micro deposits into a bank account to verify it for another institution (and you may even still be doing this). However, now, there’s a simpler process and a more secure solution — payroll API providers. This technology allows your data to flow freely and safely between two permissioned sources.

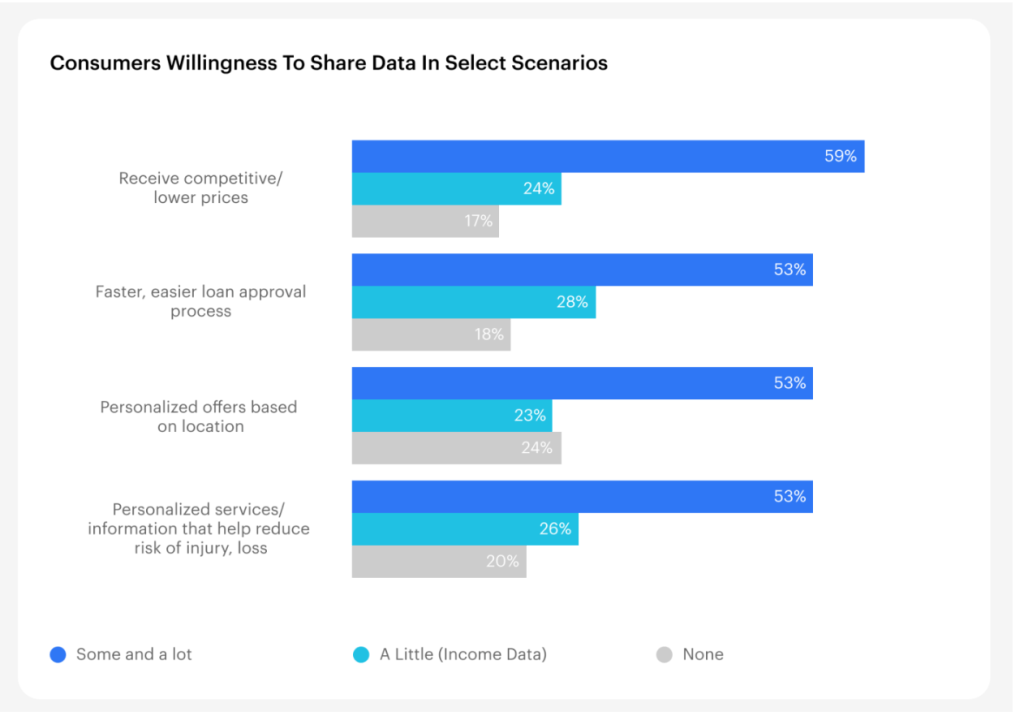

Financial institutions like JP Morgan, Capital One, and more are only recently embracing data-sharing and digital-first experiences because customer expectations are demanding a change in the way they do business. There are now more agreements between banks and financial data networks like Plaid and MX than ever before. And while consumers have been hesitant to share personal information in many areas of their lives, they’ve been more willing to do so with financial services due to the benefits.

But it’s not just about connecting bank accounts; universal access to payroll data holds promise for lenders, neobanks, employers, tenant screeners, and B2B fintech companies in distinct and interesting ways.

Selecting a Provider: Overview

Selecting a payroll API-based income, employment, and insurance verification solution for your business can be an overwhelming process. When choosing, consider your:

Return:

What’s the success rate that you’ll get when end users try to connect to each payroll provider?

Investment:

The amount of time and money you’ll have to invest in the implementation of the solution and how much you’ll pay per transaction.

Risk:

The provider’s data and security governance procedures.

This blog will be your single resource for evaluating payroll API-based providers for income, employment, and insurance verification. We’ll explain step-by-step what you need to know and the questions you need to ask to ensure you find the very best solution for your unique business.

Selecting a Provider: Determine the Coverage You Need

There are several payroll API providers in the marketplace today, but to evaluate which one is right for you, you must first assess the coverage your business needs. You can start by asking yourself important questions like: Which industry segments are most important to me? What type of companies does this vendor cover? Which companies do I need to be able to verify?

Truv defines coverage as the number of end-users who can access their data via our platform, which is only limited by the number of payroll systems that Truv is integrated with. It’s easiest to identify what you need based purely on whether a vendor covers a specific category of companies you need such as: public companies, NASDAQ, private companies, gig economy, retirement, disability, etc. Be sure to check out each vendor’s coverage page. Below is Truv’s:

Once you have answers to those questions you can properly evaluate vendors based on coverage and conversion rates against those industries and companies. Ultimately, trying to figure out which payroll API provides the best coverage depends on what’s important to you.

Selecting a Provider: Assess the Caliber of the Payroll API Integration

Next, you’ll want to calculate what success rate, otherwise known as the conversion rate or pull through rate, you’ll get when end users try to connect to each payroll provider. At Truv, we define success rate as the ratio of successful connections to the number of times Truv Bridge was requested to be presented to users.

- Success rate = # of successful connections / # of unique users

Then, we suggest running a Proof-of-Concept (POC) test with a minimum acceptable conversion rate guarantee to ensure the vendor can actually achieve the benchmarks it promised. Benchmarking is a tool for comparing the performance of multiple vendors and understanding how an existing vendor is continuously improving to meet your goals.

Below, you’ll see an objective analysis we conducted featuring Truv and three other providers in the space. The results show why Truv has won 90% of A/B tests that have been conducted with competitors.

Selecting a Provider: Evaluate the Data Quality

All integrations are not created equal. It’s important to know after connecting with the payroll provider, how many fields the provider is able to fill. Fields can be related to user identity, employer, employment history, income, bank account information, pay stubs, and more. There can be hundreds of them available from the payroll provider for a single applicant, so you need to know the fill rate.

- Fill rate percentage = # of times the vendor successfully retrieves data for the field / Total # of times the vendor tries to retrieve data for the field

Ask vendors questions such as: What is your fill rate for [your target segment]? What is your rate for [fields that matter to you]? This will help determine the quality of the integration and if you’ll receive the data you need to sufficiently verify income, employment, and insurance for your use case.

It’s also a good idea to request that the vendor provide a list of your top 1,000 employers that you see from your customers, so you can review the adjusted success rate and connection duration/speed to ensure the vendor can actually achieve the rates it promised.

But it’s not just about fill rates — the quality of the integrations and the simplicity of the user experience as well as coverage also determines how likely you’ll receive the data you need to make informed decisions.

For instance, Truv’s best-in-class coverage successfully connects to payroll accounts and employers covering over 85% of working Americans, with 96% coverage of Fortune 1000 companies, 50+ supported payroll providers, and 12.8K+ direct employer integrations with 2.3M employers. In addition, we have 50 unique single sign on providers (SSO), a method to securely authenticate with multiple applications and websites by using just one set of credentials, which is critical to creating a frictionless user experience.

When evaluating a payroll API provider, it’s important to consider fill rates, number of integrations, coverage, and SSO to determine the quality of data you’ll receive by using a specific vendor.

Selecting a Provider: Calculate Cost and Prices

When looking at total cost of ownership, you should include both the initial investment and the ongoing costs of running the solution. Depending on your use case, payroll APIs may charge significantly different fees, and the total cost of ownership may vary.

The best method is to compare the cost per 1000 transactions over a 12-month period. This way, you’ll account for implementation costs, transaction costs, minimums, and ongoing monitoring fees.

We recommend requesting pricing broken down by category:

- Implementation cost (if any)

- Sum of minimum payments made over a 12-month period

- Total number of expected connections over the next 12 months multiplied by the cost per connection

- Total expected number of active connections over a 12-month period multiplied by the cost per connection

Selecting a Provider: Ensure Enterprise-Grade Security and Privacy Practices

When it comes to payroll API risk, it is critical that personal data is encrypted in transit and at rest. This means that even if a data breach occurs, no one will be able to access the data in its raw, unencrypted form.

In general, there are two ways to access data from a payroll system. Historically, this data has been accessed via screen scraping in which credentials are shared, the user is impersonated by a computer, and information is pulled from the user’s profile to be given back to the organization. However, now, there’s a much more reliable and secure method in which data is securely requested and accessed via an API from a payroll provider.

Here at Truv, 95% of our connections are made via direct APIs which enables us to ensure that these credentials are secure and can’t be stolen or lost. Additionally, after the connection is successfully established, organizations can request that Truv’s purges our system of all user credentials and information to ensure that your customers’ credentials are safe.

Instead of assessing all of the security and privacy risks yourself, it’s a good idea to rely on security certifications such as SOC 2 Type II and review the reports associated with such certifications. Once you verify that the vendor is following certain necessary protocols to protect the confidentiality, integrity, and availability of the data, you can truly evaluate your options and make the right choice for your business.

Selecting a Provider: Implementing a Solution Successfully

Adopting a new feature to a hectic roadmap can be difficult for many organizations, so having an easy-to-implement payroll API is critical. To get a good effort estimate, ask your developers to go through the quickstart apps and getting started guides provided by a payroll API in their online documentation. Quality APIs should maintain up-to-date documentation and provide a testing environment for your developers.

When it comes to implementation, you’ll want to work with a team that can create prototypes or show you how other similar companies have implemented payroll API solutions. Request a quick session with an existing client or review available case studies to evaluate what a post-launch experience would look like.

If you’re an enterprise customer, ask whether you will be assigned a dedicated engineer to assist you through the implementation process. Ideally, you’ll want to find a partner who can provide post-launch marketing, engineering, and analytics support. It’s important that the vendor is committed to improving their conversion rates and optimizing their product based on traffic. After the solution is successfully implemented, you’ll continue to collaborate with your partner’s team on an ongoing basis.

Final Thoughts

There have been exciting and revolutionary developments in this space that can help modernize your business processes, but it’s critical that you carefully evaluate options before settling on a solution.

Remember to concentrate on:

- Coverage for the area you’ll be focusing on

- Costs, both for implementation and ongoing

- Quality of the payroll integration and data

- Security certifications and implementation processes

If you want to dive deeper, check out our Choosing a Payroll API Provider Guide!

Truv unlocks the power of consumer-permissioned data to empower organizations to make confident decisions. We provide the safest and most reliable API connections to payroll accounts to enable income, employment, and insurance verification for lenders while consumers benefit from quicker approvals and a better overall experience. Our consumer-permissioned instant verification covers over 145 million people and 85% of the U.S. workforce.

Let’s partner together to accomplish your business objectives today.